Support for the TD1-IN (Determination of Exemption of an Indian's Employment Income)

This feature provides additional functionality to support the TD1-IN (Determination of Exemption of an Indian's Employment Income). You can already designate an employee as Indian Exempt Status to exempt them from federal and provincial tax, but we are now providing additional functionality to support the TD1-IN. These enhancements include the following items and are discussed in more detail in each section below.

- Ability to Exempt a Percentage of Income for Duties Performed on an Indian Reserve

- Ability to Stop CPP/QPP Deductions on Indian Exempt Wages

- Indian Wages elements and New Input Values for Year-End Reporting

Ability to Exempt a Percentage of Income for Duties Performed on an Indian Reserve

We are now providing the ability to exempt a portion of the employee's income for duties performed on a reserve.

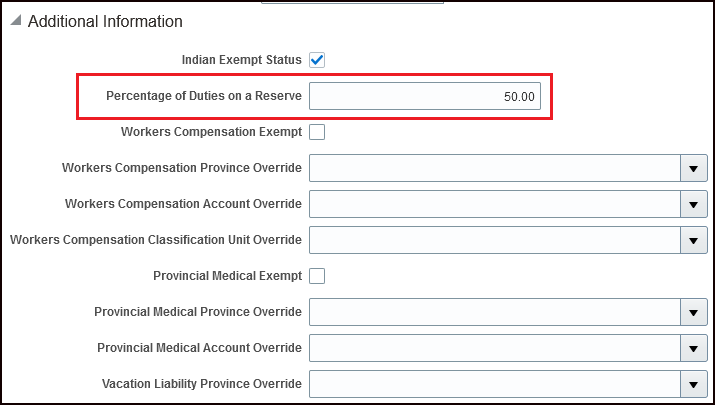

Use the new Percentage of Duties on a Reserve field to capture the percentage of employment duties while working on an Indian reserve. This field appears in Payroll Assignment Details on the Payroll Relationships page where the Indian Exempt Status field is located. This new field is only applicable if the Indian Exempt Status field is checked, and applies to all earnings associated with the payroll assignment in question.

To summarize the functionality:

- If no percentage is entered, all wages are considered as Indian exempt wages.

- If a percentage is entered, only that percentage of earnings are Indian exempt, and taxes are calculated only on the remaining earnings.

This illustration shows the new field used to capture the percentage for this assignment.

Percentage of Duties on a Reserve Field

Ability to Stop CPP/QPP Deductions on Indian Exempt Wages

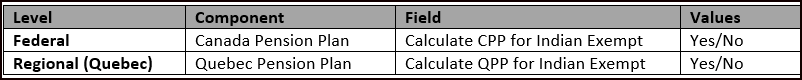

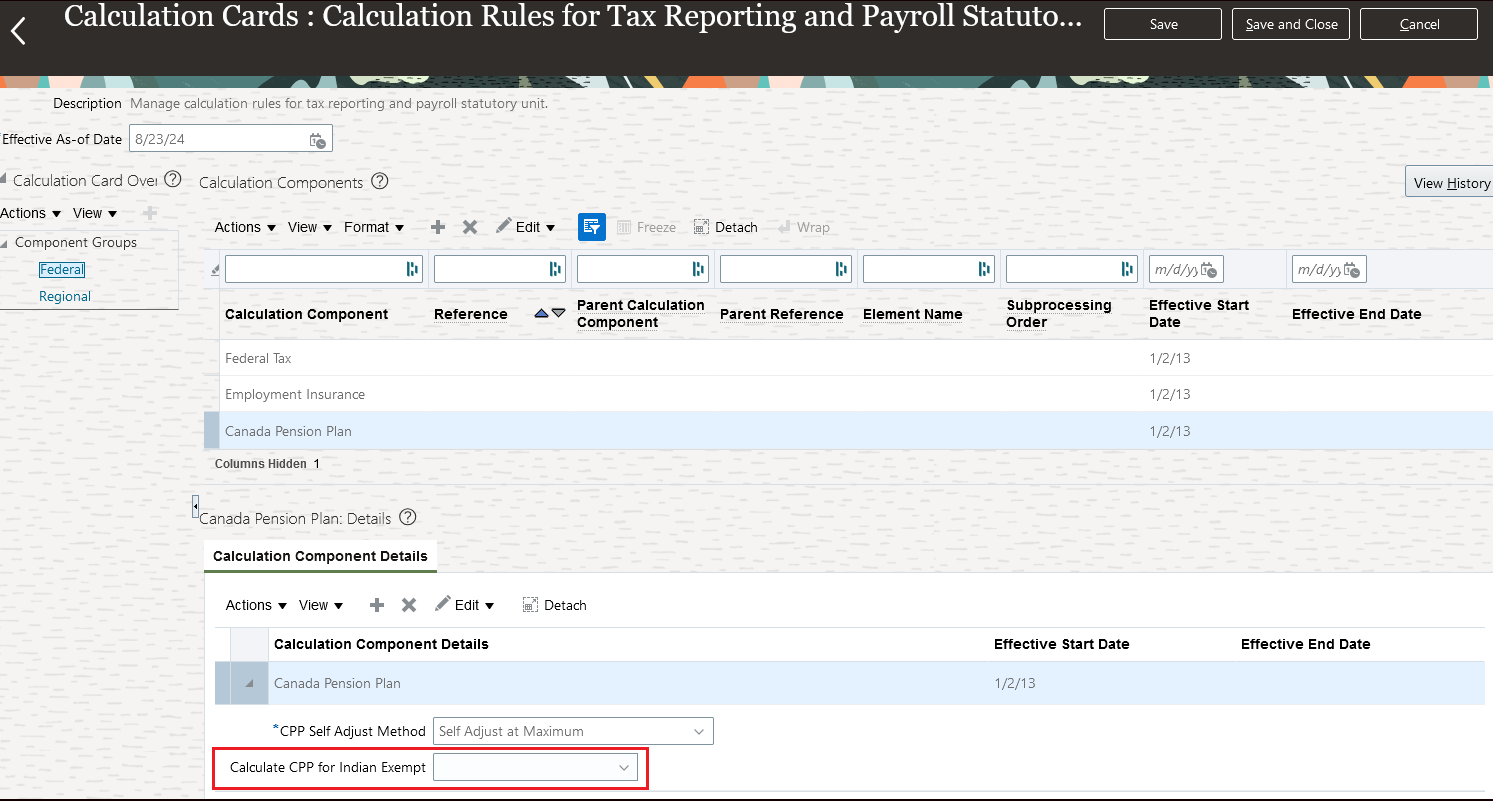

Currently, CPP and QPP taxes are withheld even if the payroll assignment is designated as Indian exempt. We have introduced options that can stop those deductions from occurring at the Payroll Statutory Unit (PSU) and Tax Reporting Unit (TRU) levels. Note that any settings at the TRU levels supersede the setting at the PSU level. Use the new fields below at either the PSU and/or TRU levels to designate whether CPP/QPP is calculated or not for Indian exempt wages. The default behavior (value is blank) is to have CPP/QPP deducted on the Indian exempt earnings.

Indian Exempt Field Locations

This illustration shows the new Calculate CPP for Indian Exempt field at the PSU level.

Calculate CPP for Indian Exempt Field

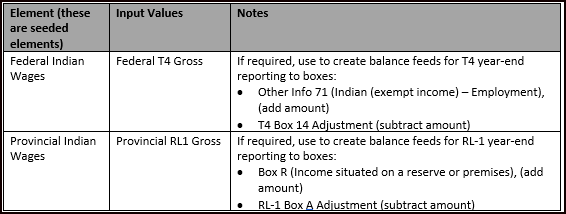

Indian Wages Elements and New Input Values for Year-End Reporting

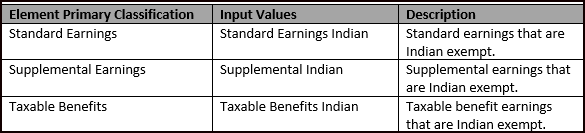

When payroll is processed for a person designated as Indian Exempt, the following new input values are populated with the value of Indian exempt earnings. These input values have been added to existing seeded elements. If required, use the input values to create balance feeds for year-end reporting.

Indian Wages Elements Input Values

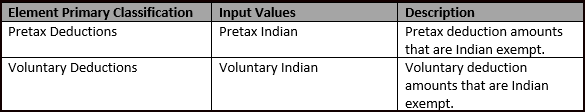

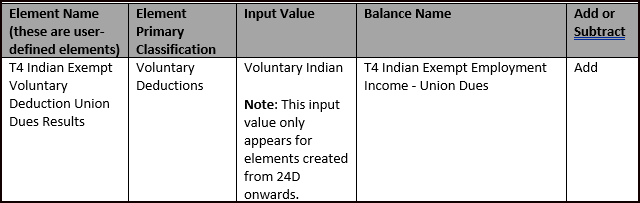

Additionally, the following new input values were created and are populated for Pretax and Voluntary deduction user-defined elements. When payroll is processed for a person designated as Indian Exempt Status, these new input values are populated with the value of the deduction amounts. If required, use the input values to create balance feeds for year-end reporting.

Note: These input values only appear for elements created from 24D onward.

Pretax and Voluntary Deductions Input Values

You can now use the following existing earnings elements input values for Indian Exempt year-end reporting, if required.

Earnings Elements Input Values

PMED Calculations for Manitoba Indian Exempt Wages

Indian exempt wages in Manitoba are not subject to Provincial Medical liability. It’s possible to satisfy this requirement by creating separate Indian Exempt earnings elements with their own wage basis rules.

Since we can exempt a percentage of the employee's earnings from federal and provincial income tax, for duties performed on a reserve, this same percentage of wages in Manitoba now also needs to be exempted from Provincial Medical liability. This is delivered in 24D.

This feature works for new earnings elements created in 24D, and all existing earnings elements other than the ones below. Please contact Oracle Support for assistance in modifying existing elements from this list.

- Absences (and Absences Retro)

- Vacation Payout (and Vacation Payout Retro)

- Taxable Benefits (and Taxable Benefits Retro)

- PreTax RRSP Employer Match Taxable Benefits

- PreTax RRSP Employer Match Taxable Benefits Retro

Note: This ONLY applies if you process Provincial Medical liability for employees in Manitoba, who are designated as Indian exempt.

Examples: Year-End Reporting of Indian Exempt Wages

These examples illustrate different scenarios for year-end reporting of Indian Exempt balances. These are examples and may not meet your business requirements. You must feed all balances that meet your business requirements.

Note: For proper reporting at year-end, you must create separate elements for Indian exempt and non-Indian exempt cases. This enables you to create the necessary balance feeds to the year-end box balances reported on year-end slips.

Note: For proper retroactive processing and reporting, you must also create the balance feed for the related retroactive element when the element is:

- User-defined

- Processed in a payroll

- Enabled for retroactive processing

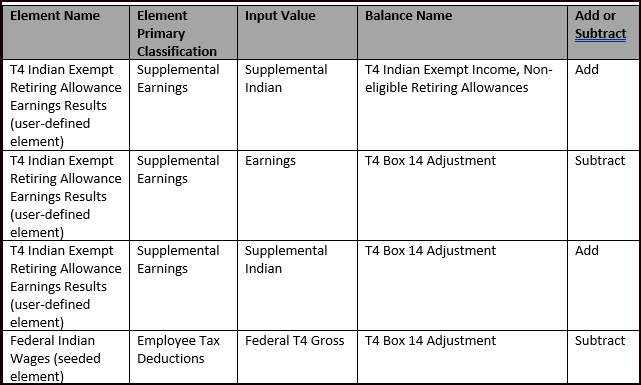

Example 1: Balance Feed to "T4 Code 69 - Indian Exempt Income, Non-eligible Retiring Allowances" and “T4 Box 14 Adjustment”

In this example, the feed is required from a supplemental earnings element to report Indian Exempt wages in the T4, Code 69, and adjust T4 Box 14 (for an Indian exempt percentage based employee, 100% of Retiring Allowance payment must be reduced from Box 14 and not just the Indian exempt portion).

Note: You must use the Results element for the user-defined elements.

Example 1 Balance Feeds

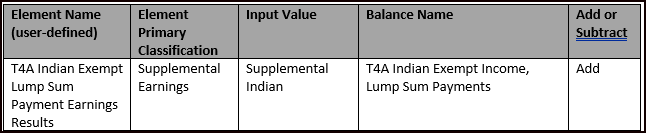

Example 2: Balance Feed to "T4A Code 148 - Indian Exempt Income, Lump Sum Payments"

In this example, the feed is required from a supplemental earnings element to report Indian Exempt wages in the T4A, Code 148.

Note: You must use the Results element.

Example 2 Balance Feeds

Example 3: Balance Feed to “T4 Code 95 - Indian Exempt Employment Income - Union Dues”

In this example, the feed is required from a voluntary deduction element to report the union dues related to Indian Exempt income in the T4, Code 95 (note this is a new code introduced for year-end 2024).

Note: You must use the Results element. This input value is populated only if the voluntary deduction element is processed at the assignment level.

Example 3 Balance Feeds

This feature supports the TD1-IN (Determination of Exemption of an Indian's Employment Income).

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Note the following tips and considerations of this feature:

- If multiple assignments exist for the employee, you can configure different percentages based on the assignment. Note that an employee may have assignments which are Indian Exempt and some which are not.

- For proper reporting at year-end, you must create separate elements for Indian exempt and non-Indian exempt cases. This enables you to create the necessary balance feeds to the year-end box balances reported on year-end slips.

- If you are pointing a particular element result to a year-end box for Indian Exempt Status, you cannot use the same element for non-Indian exempt employees. For example, you could not point an element to T4 Other Information Code 94 (Indian RPP contributions) and use this same element for non-Indian exempt employees.

- The Federal Indian Wages and Provincial Indian Wages elements are only populated for persons with Indian Exempt Status during payroll processing.

- The End-of-Year Exception Report will be enhanced to report an Indian Exempt exception. The exception message will be added at a later date to the Administering Payroll for Canada End-of-Year Processing guide.

- For additional information on balance feeds and year-end reporting, see the Administering Payroll for Canada End-of-Year Processing guide in the Oracle Help Center.

- The input values Pretax Indian and Voluntary Indian only appear for pretax and voluntary deduction elements created from 24D onward.

- To use the new input values Pretax Indian and Voluntary Indian for year-end reporting, the pretax and voluntary elements must be processed at the assignment level.

- For proper retroactive processing and reporting, you must also create the balance feed for the related retroactive element when the element is:

- User-defined

- Processed in a payroll

- Enabled for retroactive processing

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > Product Documentation > Payroll Guides > Implementing Payroll for Canada

- CA – Payroll tab > Product Documentation > Payroll Guides > Administering Payroll for Canada

- CA – Payroll tab > Product Documentation > Payroll Guides > Administering Payroll for Canada End-of-Year Processing

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature