Third-Party Payment Enhancements

You can now process direct deposits for payments to third-party payees for the following types of deductions:

- Involuntary

- Pretax

- Voluntary

Additionally, you can now process third-party cheques for these types of deductions:

- Pretax

- Voluntary

Note: The ability to process third-party cheques for involuntary deductions is already supported.

Enhancements include the following items and are discussed in more detail in each section below.

- New Element Template Question for Pretax and Voluntary Deductions

- Enhanced Direct Deposit Verification Report

- Enhanced Direct Deposit Interface File

- Third-Party Cheques for Pretax and Voluntary Deductions

New Element Template Question for Pretax and Voluntary Deductions

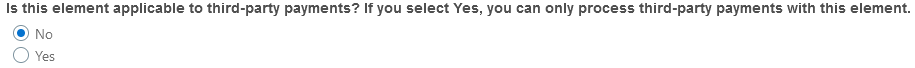

A new question was added to the pretax and voluntary deduction element template that allows you to specify during element creation if the element is applicable to third-party payments (note that this template question is not needed for involuntary deduction elements). You can only use this element for third-party payments once you specify that this element is used for third-party payments. This illustration shows the new question displayed during element creation for pretax and voluntary deductions.

Element Template Question

Enhanced Direct Deposit Verification Report

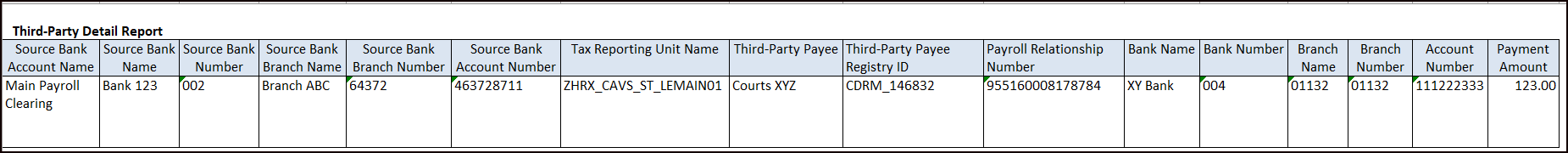

The Direct Deposit Verification Report was enhanced to report the third-party details of the direct deposit file, using a new tab called Third-Party Detail. If there are no third-party payments, this new tab is not displayed. This illustration shows the attributes reported in the new tab, which allows the user to validate direct deposit payment details for a third-party payee.

Third-Party Detail Report

Enhanced Direct Deposit Interface File

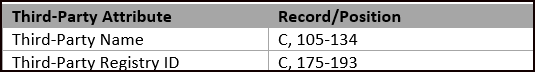

The Direct Deposit Interface File was enhanced to include the third-party details. For third-party direct deposits, we now report the following third-party payment data elements.

Third-Party Attributes

Use the Generate Direct Deposit Payments process to initiate third-party direct deposits.

Third-Party Cheques for Pretax and Voluntary Deductions

You can now process third-party cheques for an employee’s pretax and voluntary deductions. The ability to process third-party cheques was already available for involuntary deductions. Use the Generate Cheque Payments for Employees and Third-Parties process to initiate third-party payments. This process generates the following as output:

- Third-Party Cheque Payment

- Third-Party Cheque Payments Audit Report

Third-Party Cheque Payment

The third-party cheque payment displays the payment details on the cheque stub, along with the physical cheque payable to the third-party.

The maximum number of payment detail lines included on the cheque stub is 17. If more than 17 are present in the payment, a message is displayed to refer to the audit report for details and no detail lines are displayed on the cheque stub.

Third-Party Cheque Payments Audit Report

The third-party cheque payment audit report displays the employee payment details of each third-party cheque generated. This report is produced automatically as part of the process.

Third-Party Payment Rollup

The Third-Party Payment Rollup process allows you to consolidate multiple employee payments to the same third-party payee into a single payment. This process is optional and can be used when you want to avoid making multiple individual payments to the same payee. The rollup process applies to both cheque and direct deposit payments.

For example, if several employees are members of the same union, or if an employee has multiple deductions payable to the same third-party (e.g., multiple maintenance and support orders), you can consolidate these into one payment. To initiate this process, use the Submit a Flow task to run the Run Third-Party Payment Rollup.

Generating Third-Party Direct Deposits and Cheques

Steps to generate a third-party cheque or direct deposit file are:

- Create the pretax or voluntary deduction element (and answer ‘Yes’ to the question ‘Is the element applicable to third-party payments?’)

- Create the organization payment method (this must be unique for third-party payments)

- Create the third-party payee (person or organization)

- Add the payment method to a payroll definition

- Attach a payroll to the employee

- Attach element entries to the employee, enter amount and payee

- Run payroll, prepayments and periodic payroll archiver

- Run the Third-Party Payment Rollup process, if applicable

- Run these processes, as per your requirements

- Run Generate Cheque Payments for Employees and Third-Parties

- Run Generate Direct Deposit Payments

This feature benefits your business by providing the ability to process direct deposits for payments to third-party payees and generate third-party cheque payments in Oracle Cloud.

Note the following tips and considerations of this feature:

- For information on creating third parties and organization payment methods, refer to the Administering Payroll for Canada Involuntary Deductions guide on the Oracle Help Center.

- You may exclude third-party payments from the rollup process by selecting the Exclude from Third-Party Rollup Process when setting up the Third-Party Payment Method in the Payment Method page. When running the rollup process prior to either the Generate Cheque Payments for Employees and Third-parties or the Generate Direct Deposit Payments process, each payment to the third-party marked for exclusion will not be included in the rollup and will be paid separately. For more information on third-party payment rollup, refer to the Implementing Global Payroll guide on the Oracle Help Center.

- The ability to capture a correspondence language for the third-party payee and process cheques to third-party payees in that language is existing functionality. It now extends to the third-party cheques for pretax and voluntary deductions. For more information on creating a third-party payee correspondence language, refer to the Administering Payroll for Canada Involuntary Deductions on the Oracle Help Center.

- You must create new pretax and voluntary elements to use the third-party direct deposit feature. It is not available for existing elements.

- Your organization payment method must be unique for third-party payments (not the same payment method used to pay employees).

Steps to Enable

You don't need to do anything to enable this feature.

Tips And Considerations

Note the following tips and considerations of this feature:

- For information on creating third parties and organization payment methods, refer to the Administering Payroll for Canada Involuntary Deductions guide on the Oracle Help Center.

- You may exclude third-party payments from the rollup process by selecting the Exclude from Third-Party Rollup Process when setting up the Third-Party Payment Method in the Payment Method page. When running the rollup process prior to either the Generate Cheque Payments for Employees and Third-parties or the Generate Direct Deposit Payments process, each payment to the third-party marked for exclusion will not be included in the rollup and will be paid separately. For more information on third-party payment rollup, refer to the Implementing Global Payroll guide on the Oracle Help Center.

- The ability to capture a correspondence language for the third-party payee and process cheques to third-party payees in that language is existing functionality. It now extends to the third-party cheques for pretax and voluntary deductions. For more information on creating a third-party payee correspondence language, refer to the Administering Payroll for Canada Involuntary Deductions on the Oracle Help Center.

- You must create new pretax and voluntary elements to use the third-party direct deposit feature. It is not available for existing elements.

- Your organization payment method must be unique for third-party payments (not the same payment method used to pay employees).

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > Product Documentation > Payroll Guides > Implementing Payroll for Canada

- CA – Payroll tab > Product Documentation > Payroll Guides > Administering Payroll for Canada

- CA – Payroll tab > Product Documentation > Payroll Guides > Administering Payroll for Canada Involuntary Deductions

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature