Eligibility Criteria for Run Mexico Annual Tax Adjustment

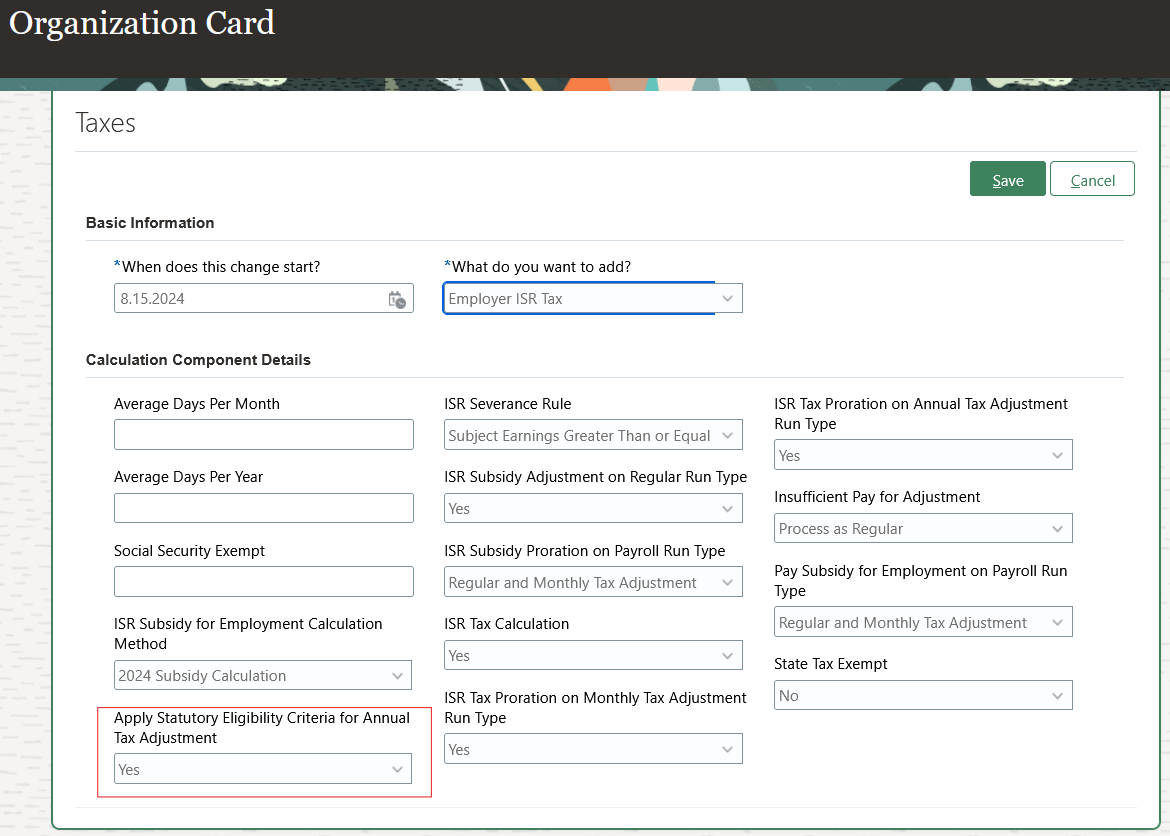

You can now choose whether to apply the statutory eligibility criteria for the employees being processed in the Run Mexico Annual Tax Adjustment task flow.

The Apply Statutory Eligibility Criteria for Annual Tax Adjustment was previously only used for the Annual Tax Adjustment run type. Now, it's also used for the Run Mexico Annual Tax Adjustment task flow.

If this override is set to Yes, which is the default value, the tax will be adjusted only for those employees who meet these eligibility criteria:

- Earnings are less than $400,000.00 pesos in the fiscal year (FY).

- Works from 01 January 01 December in the FY.

- Employee hasn't been explicitly excluded from the annual tax adjustment process.

If you select No, tax will be adjusted for all the employees regardless of eligibility.

Organization Card

You have the flexibility to apply the statutory eligibility criteria for selecting the employees who are eligible for the annual tax adjustment (ATA).

Steps to Enable

You don't need to do anything to enable this feature.