Update Investment Declaration Data for Employees

You can now run the payroll flow Update Investment Declaration Data for Employees to update the investment declaration data for employees at the start of the year. All the approved or declared investment declaration data from the previous financial year is copied into the current financial year.

This is one of the start of the year processes performed by the Payroll Administrator.

The investment declaration data in these sections can be copied into the current financial year:

- House rent details

- House Property and House Loan Information

- Chapter VIA Deductions which include the contributions in

- Section 80C, 80CCC Pension Fund Contributions

- 80E Interest on Higher Education Loan, 80EEB Interest on Electric Vehicle Loan,

- 80GGA Donation for Research and Rural Development, 80GGC Donation to Political Party

- 80GG Deduction for Rent Paid

- 80U Permanent Physical Disability

- 80DDB, 80CCD1 and 80CCD (1B)

- 80DD Medical Treatment for Disabled dependents, 80D Medical Insurance Premium

To migrate the investment declaration data from previous financial year:

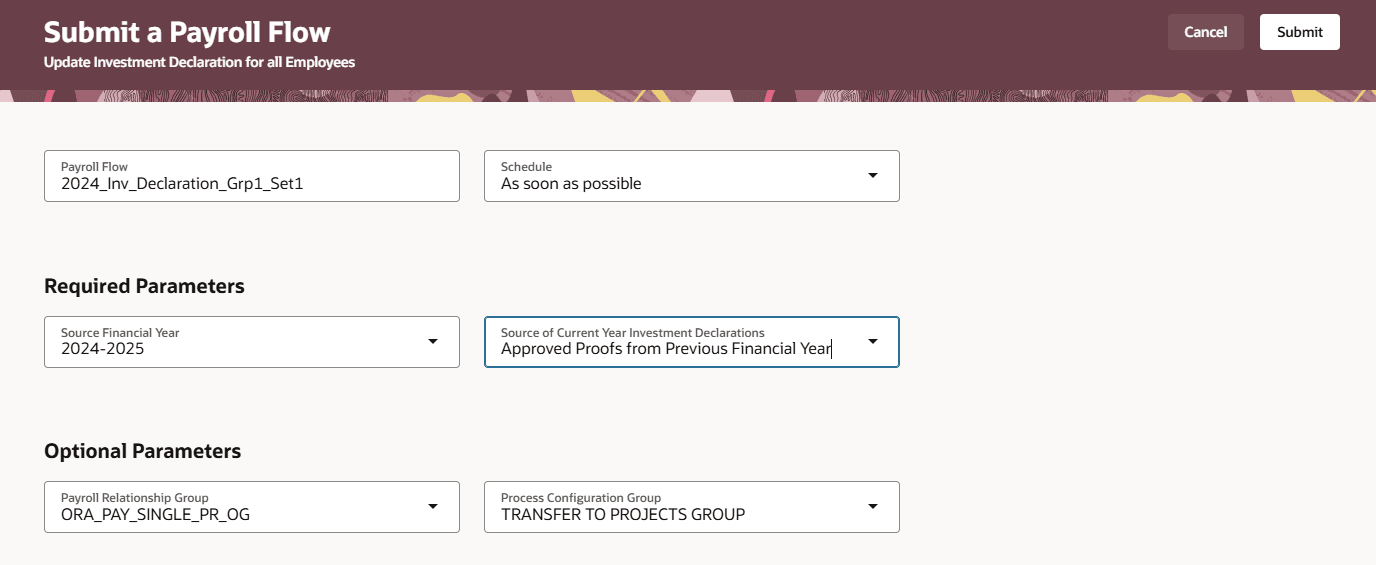

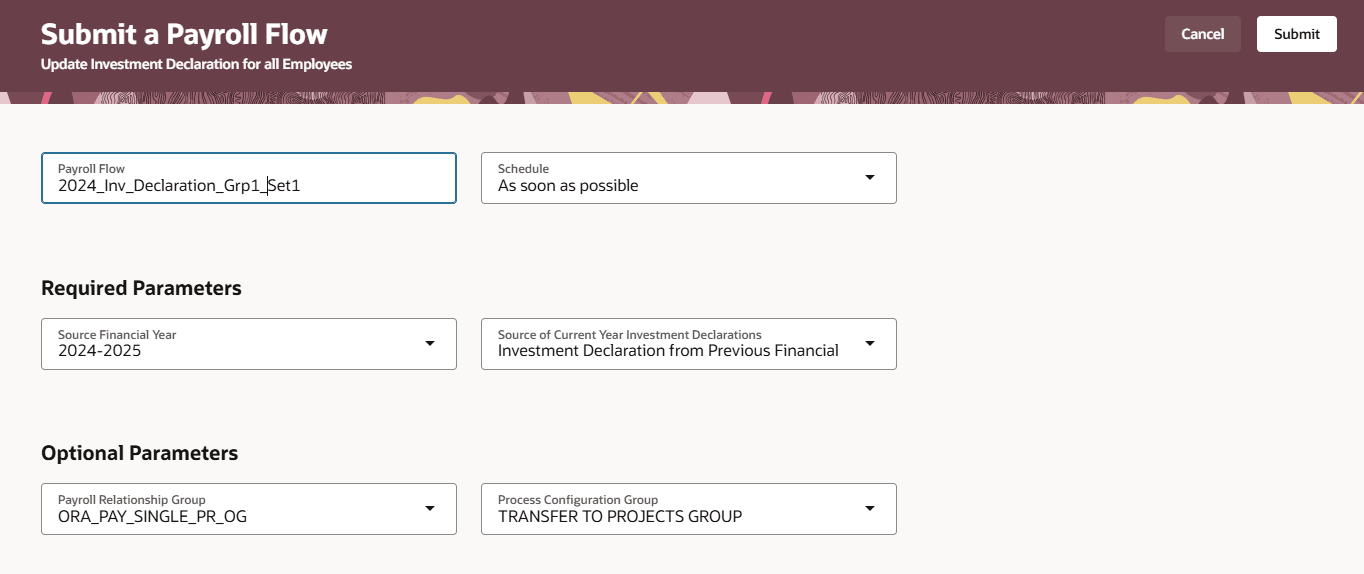

- Navigate to My Client Groups > Payroll > Submit a Payroll Flow and select the flow Update Investment Declarations of all employees.

- Select the schedule and the financial year.

- In the Source of Current Year Investment Declaration:

- Use the Approved Data from Previous Financial Year option to update the approve data from previous year.

Update Investment Declaration - Approved Proofs

- Use the Declared Data from Previous Financial Year option to update the declared data from the previous year.

Upload Previous Financial Year Investment Declaration

Choose a suitable option based on your company policy.

Employees can update the readily available investment declaration data instead of entering the same data every year.

Steps to Enable

You don't need to do anything to enable this feature.