ROE Reporting and Taxation of Retroactive Pay Adjustments and Corrections

ROE Reporting and Taxation of Retroactive Pay Adjustments and Corrections

This feature enables the system to now distinguish between retroactive pay adjustments and corrections, so that they are correctly taxed and reported on the Record of Employment (ROE), Block 15C. Adjustments are changes to an employee’s pay, such as a retroactive pay increase or rate change. Corrections are errors that are fixed, such as hours that were missed in a previous period. The following now applies for retroactive scenarios:

- Pay adjustments are reported in the pay period in which they are paid (DATE PAID) and taxed as non-periodic earnings.

- Pay corrections are reported in the pay period(s) they are earned (DATE EARNED) and taxed as regular earnings.

Note: Absence discretionary and final disbursement retroactive payments are always taxed as nonperiodic earnings.

The following outlines how retroactive changes are handled in each scenario:

- Retroactive changes to hours are allocated to the pay periods based on the date earned.

- Retro earnings are taxed as regular earnings.

- Retroactive changes to earnings are allocated to the pay period in which they are paid.

- Retro earnings are taxed as nonperiodic earnings.

- Retroactive changes to both hours and earnings are allocated to the pay periods based on the date earned.

- Retro earnings are taxed as regular earnings.

- Retroactive changes for vacation payouts are allocated to the pay period in which it is paid.

- Retro earnings are taxed as nonperiodic earnings.

- Retroactive changes for RRSP taxable benefits are allocated to the pay period in which it is paid.

- Retro earnings are taxed as nonperiodic earnings.

This feature ensures retroactive adjustments and corrections to an employee’s pay reported on the ROE are compliant with Service Canada legislative requirements, as noted on the page Employers: How to complete the record of employment (ROE) form (Annex 1: Summary chart – Type of earnings, insurable/non-insurable earnings and hours, and pay-period allocation). It also ensures they are taxed correctly, as required by CRA (see the Employers’ Guide – Payroll Deductions and Remittances > Chapter 6 – Special payments > Bonuses, retroactive pay increases, or irregular amounts).

Steps to Enable

To enable this feature for absence elements, you must manually update the existing absence retroactive element formulas. Absence elements created from 25A March Maintenance Pack onward do not require these changes. To update the formulas:

- Navigate to My Client Group - > Fast Formulas.

- Enter a Canadian LDG.

- Search for the formula, %Canadian Absence Retroactive Pay.

- Click the formula name.

- Select Edit > Correct.

- Make the changes below to the formula code.

Note: You must apply these steps to all absence retroactive formulas containing the following line in the formula text:

IF (l_ei_allocation = 'DATE_PAID') THEN

-

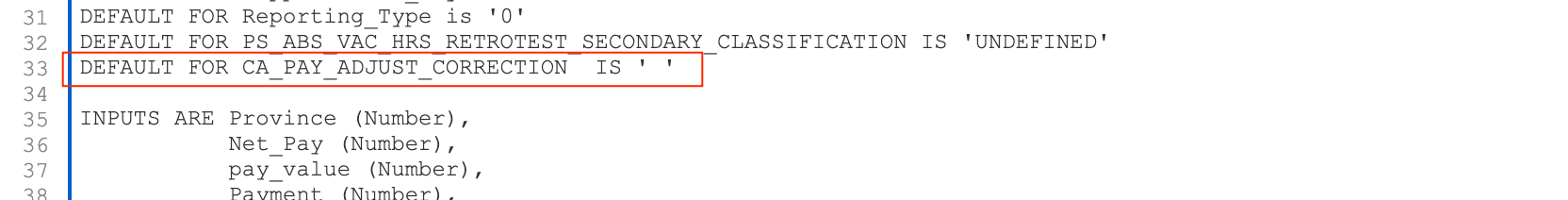

- Revision 1

Add

DEFAULT FOR CA_PAY_ADJUST_CORRECTION IS ' '

Above the line

INPUTS ARE Province (Number)

-

- Revision 2

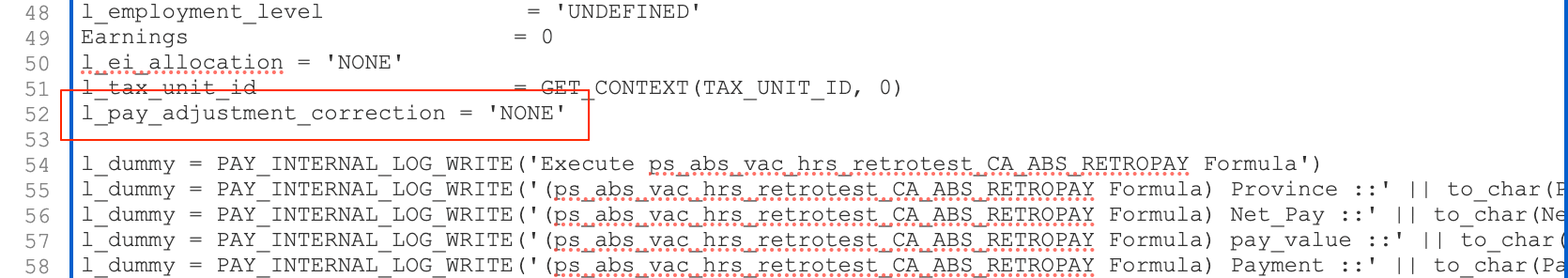

Add

l_pay_adjustment_correction = 'NONE'

Above the line

l_dummy = PAY_INTERNAL_LOG_WRITE('Executeps_abs_vac_hrs_retrotest_CA_ABS_RETROPAY Formula')

-

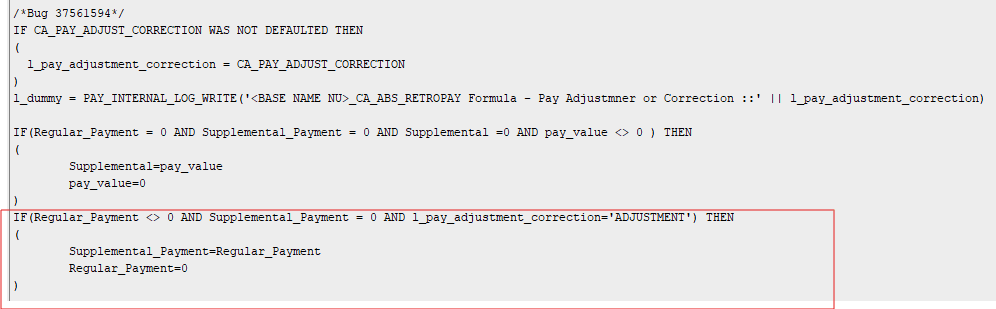

- Revision 3

To tax the pay correction case with regular taxation we need to do the following changes.

If the following code is present in the formula and it is commented out, uncomment the code and add “AND l_pay_adjustment_correction='ADJUSTMENT” condition to the IF statement below

/*IF(Regular_Payment <> 0 AND Supplemental_Payment = 0) THEN

(

Supplemental_Payment=Regular_Payment

Regular_Payment=0

)*/

If the commented code is not present then add the below code:

IF(Regular_Payment <> 0 AND Supplemental_Payment = 0 AND l_pay_adjustment_correction='ADJUSTMENT') THEN

(

Supplemental_Payment=Regular_Payment

Regular_Payment=0

)

The code snippet below illustrates the formula after changes are complete.

- Revision 3

d. Revision 4

Replace line:

IF (l_ei_allocation = 'DATE_PAID') THEN

With:

IF CA_PAY_ADJUST_CORRECTION WAS NOT DEFAULTED THEN

(

l_pay_adjustment_correction = CA_PAY_ADJUST_CORRECTION

)

l_dummy = PAY_INTERNAL_LOG_WRITE('<Enter element name>_CA_ABS_RETROPAY Formula - Pay Adjustment or Correction ::' || l_pay_adjustment_correction)

IF(l_pay_adjustment_correction = 'ADJUSTMENT') THEN

-

- Revision 5

Replace <Enter element name> with the actual element name from any PAY_INTERNAL_LOG_WRITE function

- Compile the formula.

Tips And Considerations

Note the following tips and considerations of this feature:

- This feature applies to Absence, Timecard, and Standard Earnings elements. It also applies to Supplemental and Taxable Benefits elements whose Tax Processing Type is Regular.

- This feature applies to both the original and amended ROEs.

- To use this feature for existing absence elements, you must manually update the existing absence retroactive element formula, as noted in the Steps to Enable section.

- This feature is available by default (no manual updates are required for these elements) for absence elements created from 25A March Maintenance Pack onward.

- This feature is not enabled for any earnings elements created prior to Update 21A. You must create new elements.

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > Product Documentation > Technical Briefs > Record of Employment Processing

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature