Lump Sum Self-Adjust Tax Method

Federal lump sum withholding tax rates are based on an employee’s cumulative total lump sum earnings for the year. We have provided a new option called Lump Sum Self Adjust Method to specify how to handle those lump sum earnings, more specifically to apply a self-adjust method or not to those earnings.

With this new feature, employees who receive multiple lump-sum payments are taxed appropriately using the following logic:

- Current lump sum is added to the YTD lump sum earnings for a cumulative total of all lump-sum payments made during the year

- Appropriate tax rate is applied to the cumulative total to calculate the annual withholding

- Withholding for the current payment is then calculated by subtracting the taxes already withheld from previous payments

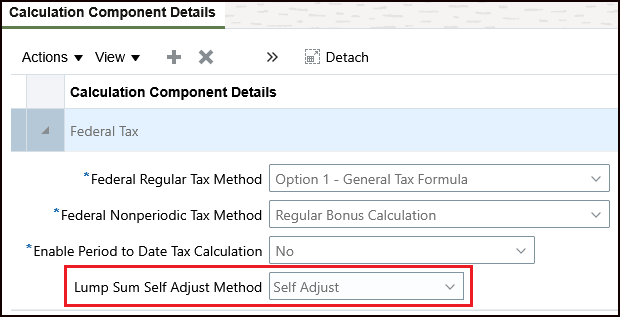

This image illustrates the new option that was added to the Federal component of the Calculation Rules for Tax Reporting and Payroll Statutory Unit card. This setting can be configured at the PSU and the TRU levels.

Lump Sum Self Adjust Method

The values for the new field are:

- Blank (default)

- Self Adjust

- No Self Adjust

When processing, the system will consider lump sum settings in this order:

- Federal Lump Sum Rate (tax card override for employee)

- TRU Lump Sum Method

- PSU Lump Sum Method

Without this feature, employees who receive multiple lump-sum payments may be under-taxed, but now with this new feature, employees who receive multiple lump-sum payments will be taxed appropriately.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

Note the following tips and considerations of this feature:

- This feature only impacts employers who pay their employees multiple lump sum payments in the year.

- Adjustments are done within the context of the TRU.

- The Lump Sum Self-Adjust method does not apply to Quebec because, unlike the Federal Government, Quebec treats each lump-sum payment as a single, distinct payment that is taxed independently.

- Blank and No Self Adjust represent the same behavior, which is the system default, meaning the system will perform as it does today, with no self-adjust on lump sum earnings.

- Self-adjustment for the federal lump sum tax amount and rate for non-Quebec residents applies only to lump sum payments earned in Canadian provinces and territories outside of Quebec.

- Self-adjustment for the federal lump sum tax amount and rate for Quebec residents applies only to lump sum payments earned within Quebec.

- Lump sum payments paid to non-residents of Canada are handled separately by the Lump Sum Self Adjust method, but since there is currently only one rate available for non-residents, there is no impact on tax calculations.

- Important: Results may not be accurate if you enable this feature in the middle of tax year and lump sum earnings were previously processed.

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > Product Documentation > Payroll Guides > Implementing Payroll for Canada

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature