Support for RL-1 Box G and T4 Box 26 Reporting for Quebec Employees in 2026

This feature is effective January 1, 2026, onward. There is no impact on year-end reporting for 2025.

RL-1 Box G Reporting

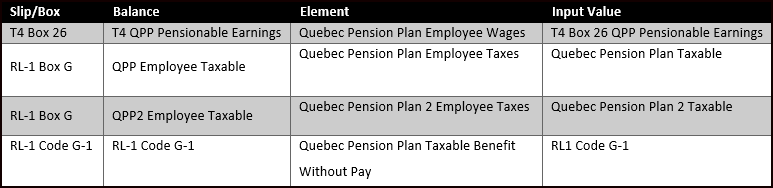

This feature supports the legislative requirement to report the pensionable salary or wages under the Quebec Pension Plan on the RL-1 slip (Employment and Other Income). To satisfy this requirement, we will use the sum of the following balances to populate Box G (pensionable salary or wages under the Quebec Pension Plan (QPP)) on the RL-1 slip and interface file:

- QPP Employee Taxable

- QPP2 Employee Taxable

Taxable benefits in kind are not included in the QPP and QPP2 employee taxable balances. The payroll process automatically populates these balances, and they are archived for year-end reporting.

T4 Box 26 Reporting

This feature supports the legislative requirement to report the pensionable salary or wages under the Quebec Pension Plan on the T4 slip (Statement of Remuneration Paid). To satisfy this requirement, we will use the following new balance to populate Box 26 (CPP/QPP pensionable earnings) on the T4 slip and interface file:

- T4 QPP Pensionable Earnings

This represents the sum of the QPP/QPP2 employee taxable balances and taxable benefits in kind. The payroll process automatically populates this balance for year-end reporting.

Additionally, the following report was enhanced to display the new T4 Box 26 balance:

- Employee Active Payroll Balance Report

Balance Adjustments

If manual adjustments are required to the T4 Box 26 balance (T4 QPP Pensionable Earnings) or the RL-1 Box G or Code G-1 balances (QPP Employee Taxable and QPP2 Employee Taxable), use the following based on your requirements.

Balance Adjustment Details

Note the following tips and considerations for balance adjustments:

- You must adjust each balance separately. Related balances are not automatically adjusted.

- The T4 Box 26 balance (T4 QPP Pensionable Earnings) equals the sum of the following balances:

- QPP Employee Taxable

- QPP2 Employee Taxable

- Taxable Benefits in Kind

- If taxable benefits in kind have not been processed, and if the T4 QPP Pensionable Earnings balance does not equal the sum of the QPP Employee Taxable and QPP2 Employee Taxable balances, you must adjust the Box 26 balance (T4 QPP Pensionable Earnings).

- If either the QPP Employee Taxable or QPP2 Employee Taxable balances are adjusted, you must also adjust the T4 QPP Pensionable Earnings balance with a similar value.

This feature supports statutory requirements, as published by CRA here and Revenu Quebec here.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

This feature is effective January 1, 2026, onward. There is no impact on year-end reporting for 2025.

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > End-of-Year Processing > End-of-Year Processing Guide

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature