Processing Negative Earnings

Processing Negative Earnings

This feature is effective January 1, 2026, onward.

Currently, Fusion Cloud Payroll for Canada does not support processing negative earnings, unless they are processed with positive earnings that are equal to or greater than the negative earnings. In most cases, processing negative earnings causes the payroll run to fail. However, in these 2 scenarios, the payroll process is successful, but produces incorrect results:

- Negative taxable benefits processed alone

- Negative earnings (subject to tax) that are processed with positive earnings of equal or greater value (NOT subject to tax)

These two scenarios are now supported in Canada Payroll. During the payroll process, the following now occurs:

- Wage balances used for year-end reporting are now reduced by the negative amount

- Wage balances used for tax calculations are now reduced by the negative amount

Note: Employee withheld balances are not impacted by the negative amount.

In these situations, processing negative earnings may be necessary:

- Overpayment of insurance benefits to employees that are no longer active. This is processed as a negative taxable benefit for employees.

- Terminated employees paid a negative vacation pay amount (that is subject to tax) together with a positive severance pay amount (that is not subject to tax)

- Employees initially paid regular earnings that are subsequently adjusted to a type of leave (such as maternity) that have different wage basis rules.

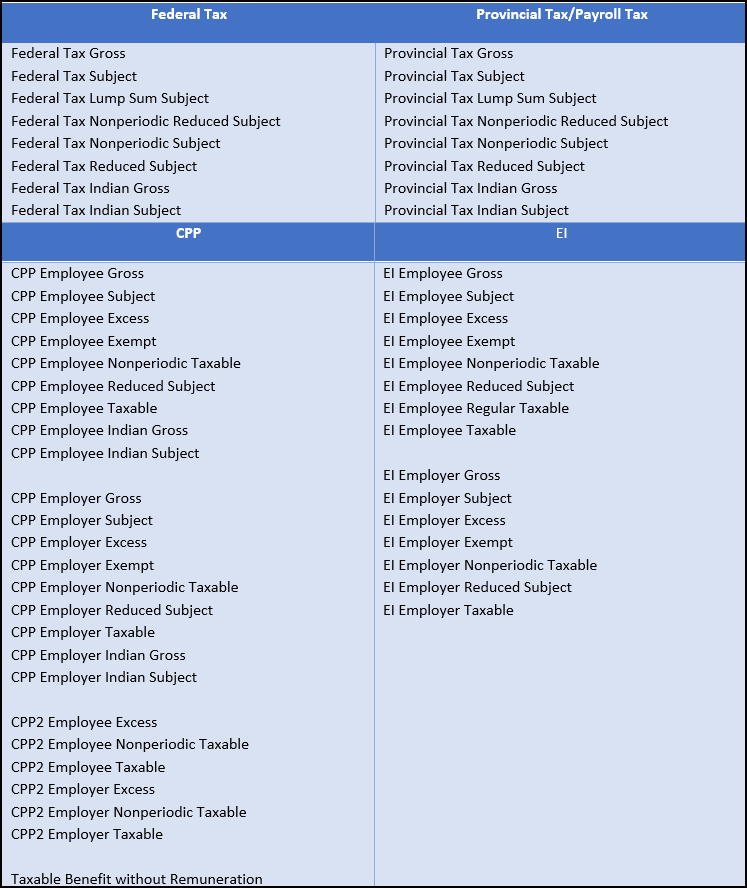

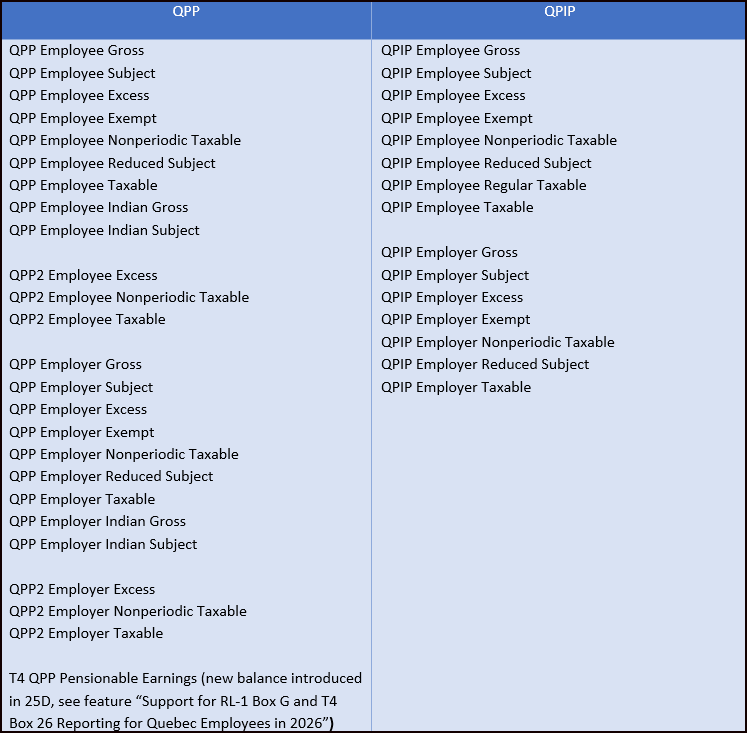

Balances Impacted by Negative Earnings

The following balances are impacted by this feature:

Balances Impacted

Balances Impacted

This feature supports the ability to process negative earnings.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

Note the following tips and considerations of this feature:

- This feature is effective January 1, 2026, onward.

- Effective January 1, 2026, Taxable Benefits in Kind will now be subject to federal income tax. They will no longer be subject to QPP deductions.

- Employee withheld balances are not impacted by the negative reduction amount.

- Negative year-to-date balances are not created by the payroll process, as they are not permitted.

Key Resources

Refer to these documents on the Canada Information Center for additional information.

Canada Information Center: https://support.oracle.com/rs?type=doc&id=2102586.2

- CA – Payroll tab > Product Documentation > Payroll Guides > Administering Payroll for Canada

Hot Topics Email (To Receive Critical Statutory Legislative Product News)

To receive important Fusion Canada Legislative Product News, you must subscribe to the Hot Topics Email feature available in My Oracle Support. Refer to the document below on the Canada Information Center for additional information.

https://support.oracle.com/rs?type=doc&id=2102586.2

- Welcome tab > Other Documents > How To Use My Oracle Support Hot Topics Email Subscription Feature