Form 12BAA Statutory Report

You can now capture the Tax Deducted at Source(TDS) and Tax Collected at Source (TCS) outside the payroll, adjust the income tax calculation, and report the same on the statutory report, Form12BAA.

Ensures compliance with Indian income tax regulations.

Steps to enable and configure

You don't need to do anything to enable this feature.

Tips and considerations

To view the Form 12BAA report:

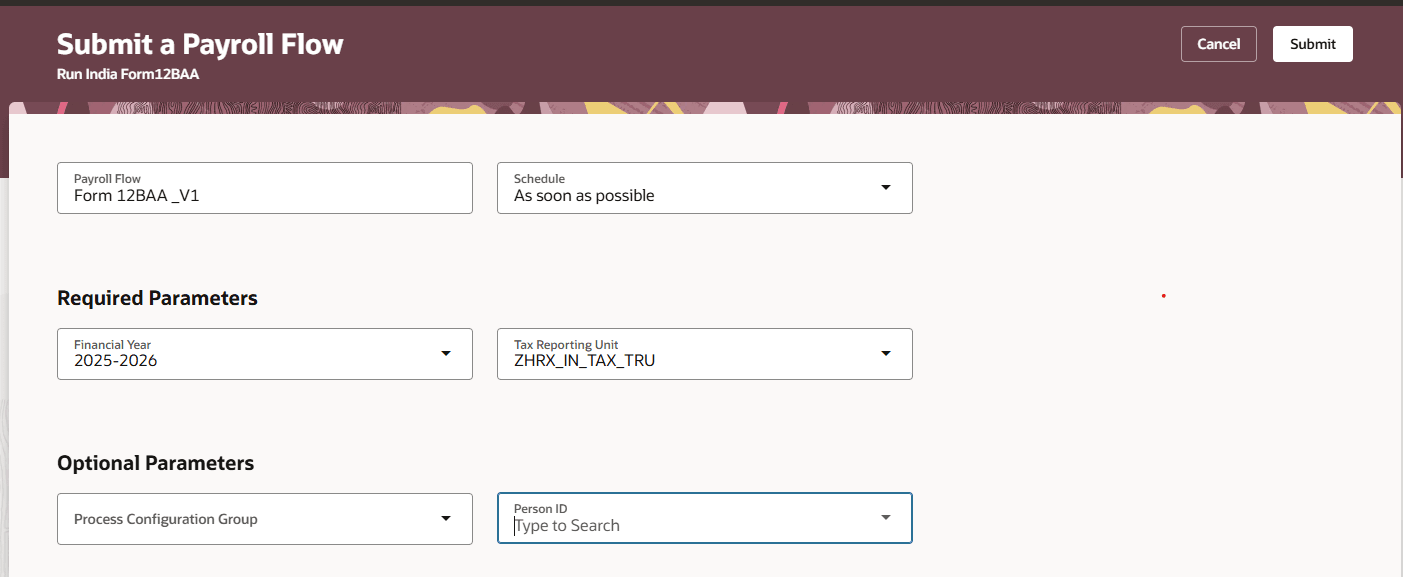

Generate Form 12BAA

- From the home page, navigate to My Client Groups > Payroll > Submit a Flow.

- Select the legislative data group.

- Search and select the flow Run India Form 12BAA.

- Add the flow name and select the schedule.

- Enter the financial year.

- Enter the tax reporting unit.

- Enter the optional parameters and submit the flow.