Canadian Provincial Rail Carbon Tax Calculation and Settlement

Canadian Provincial Rail Carbon Tax Calculation and Settlement

This feature provides you with the ability to configure OTM to support the calculation and settlement activities related to the Provincial mileage based Canadian Rail Carbon Tax. Once configured, the newly provided capabilities will calculate and capture (using PC*MIler Rail) the province specific distances involved in your Canadian Rail shipments and allow for the calculation of each Province's specific Carbon Tax charges. The calculated charges can then be processed using OTM's standard freight payment capabilities.

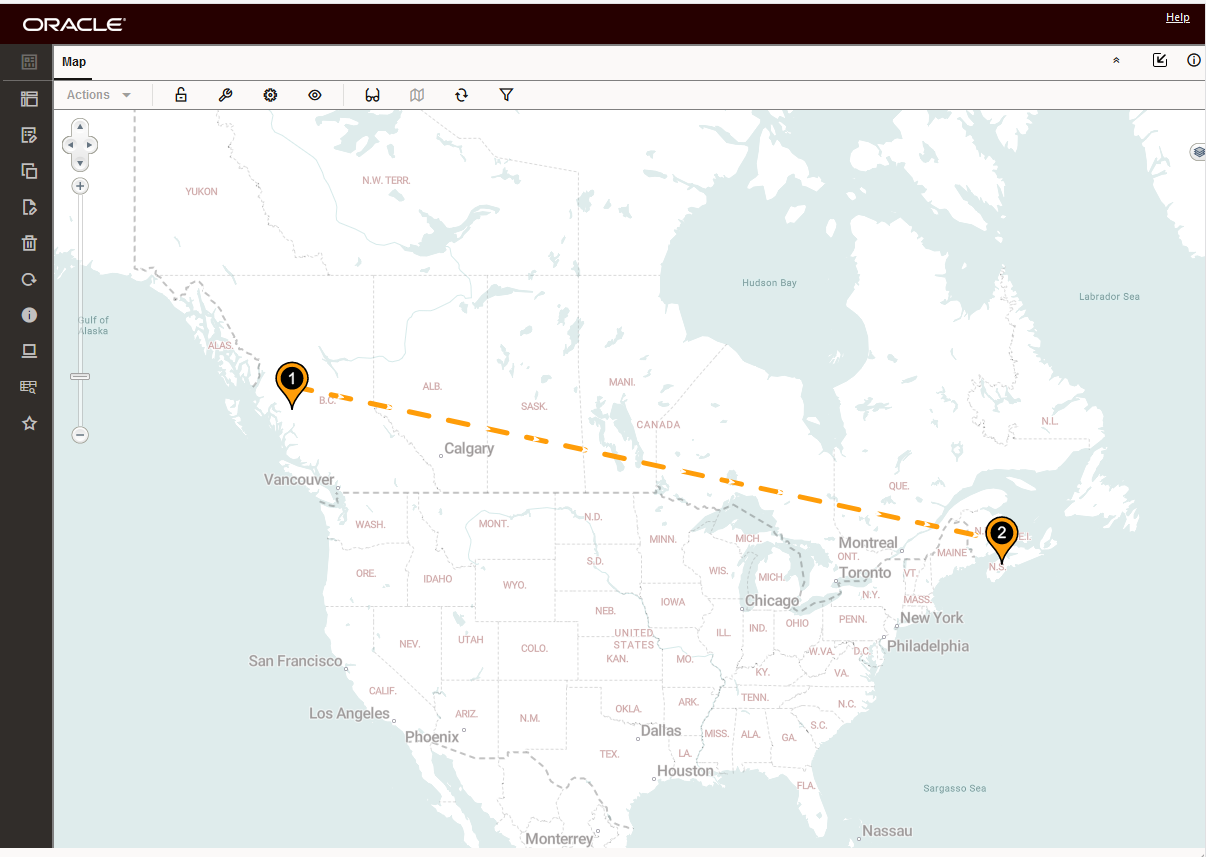

In the example below, the rail shipment going from Smithers BC V0J 2N0 to Moncton, NB E1H 2S8 passes through all of the following Provinces - AB - Alberta, BC – British Columbia, , MB - Manitoba, NB - New Brunswick, ON – Ontario, , PQ - Québec and SK- Saskatchewan. Each of the seven provinces has a distance based Carbon Tax that must be calculated based on the distance traveled within the specific province. This feature supports capturing the Province specific distances and the calculation of the Carbon Tax charged by each Province for the miles travelled through/in each Province.

Example Rail Shipment

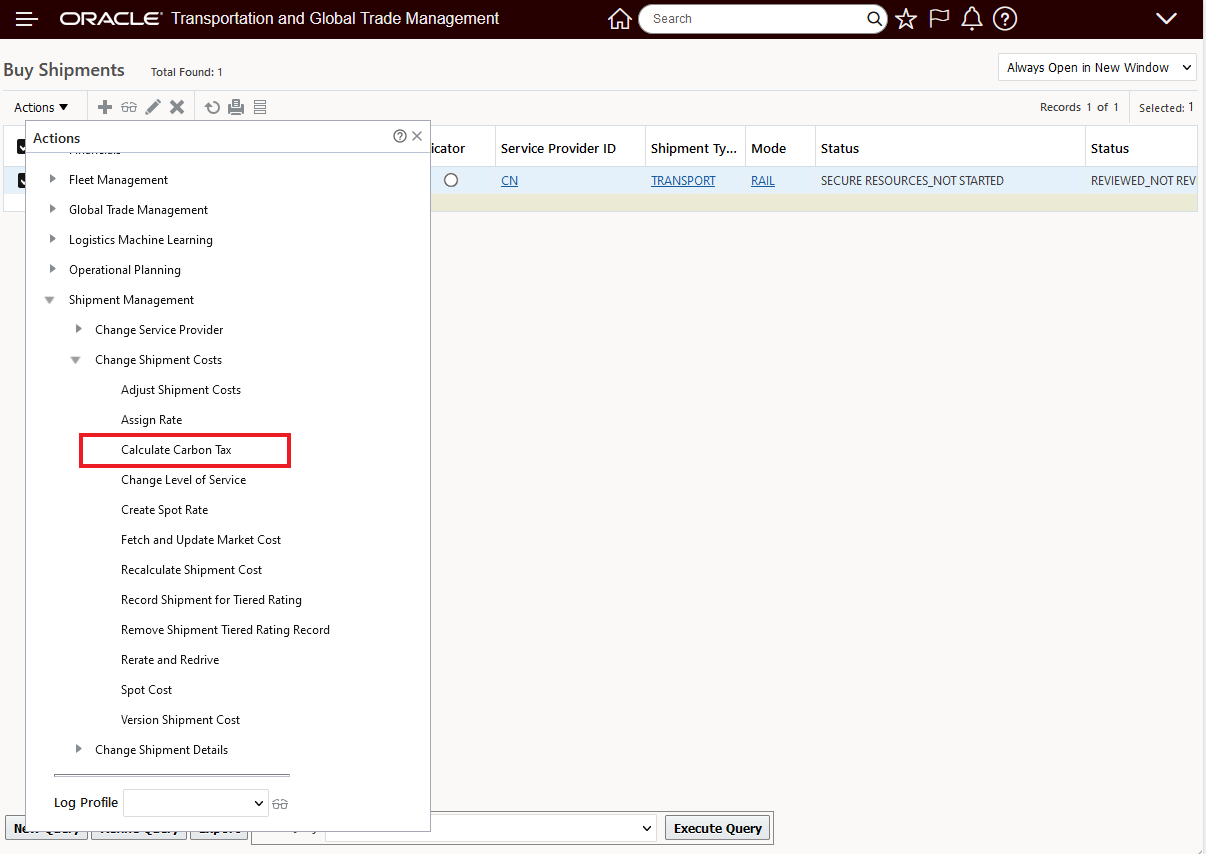

Given the shipment above, running the Shipment action Calculate Carbon Tax (Shipment Management > Shipment Management > Buy Shipments > Actions > Shipment Management > Change Shipment Costs > Calculate Carbon Tax) will calculate the Carbon Tax for each of the Provinces involved in this shipment. The Calculate Carbon Tax action can be initiated either by running the Shipment Action Calculate Carbon Tax or by running the agent action Calculate Carbon Tax.

Action Calculate Carbon Tax

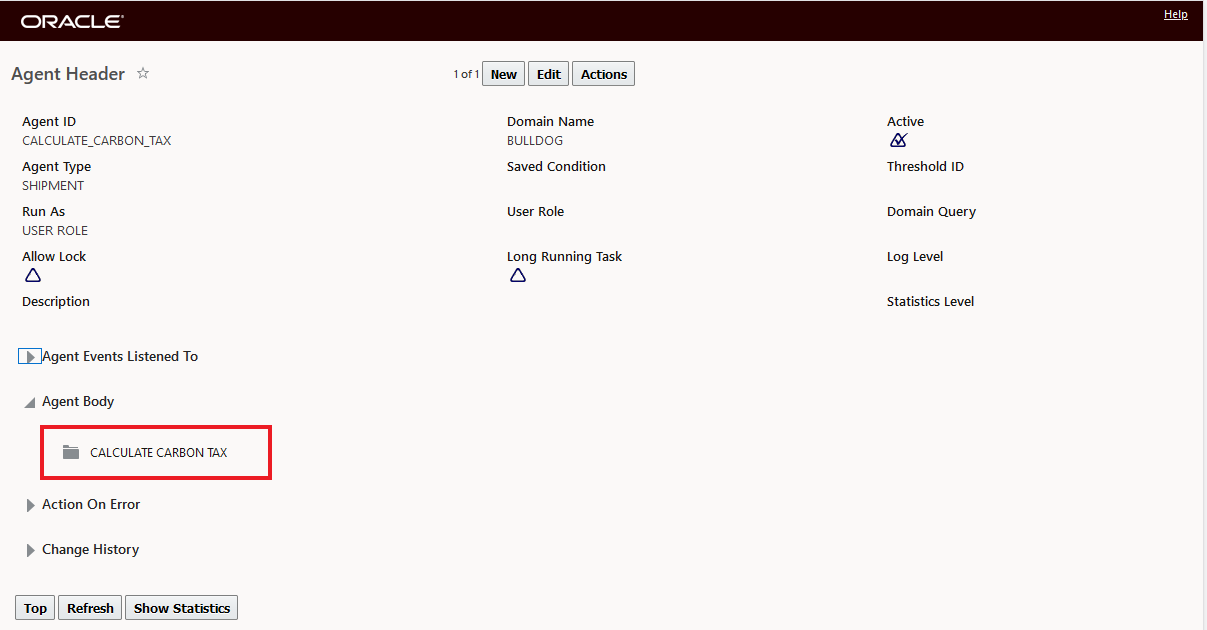

Agent Action Calculate Carbon Tax

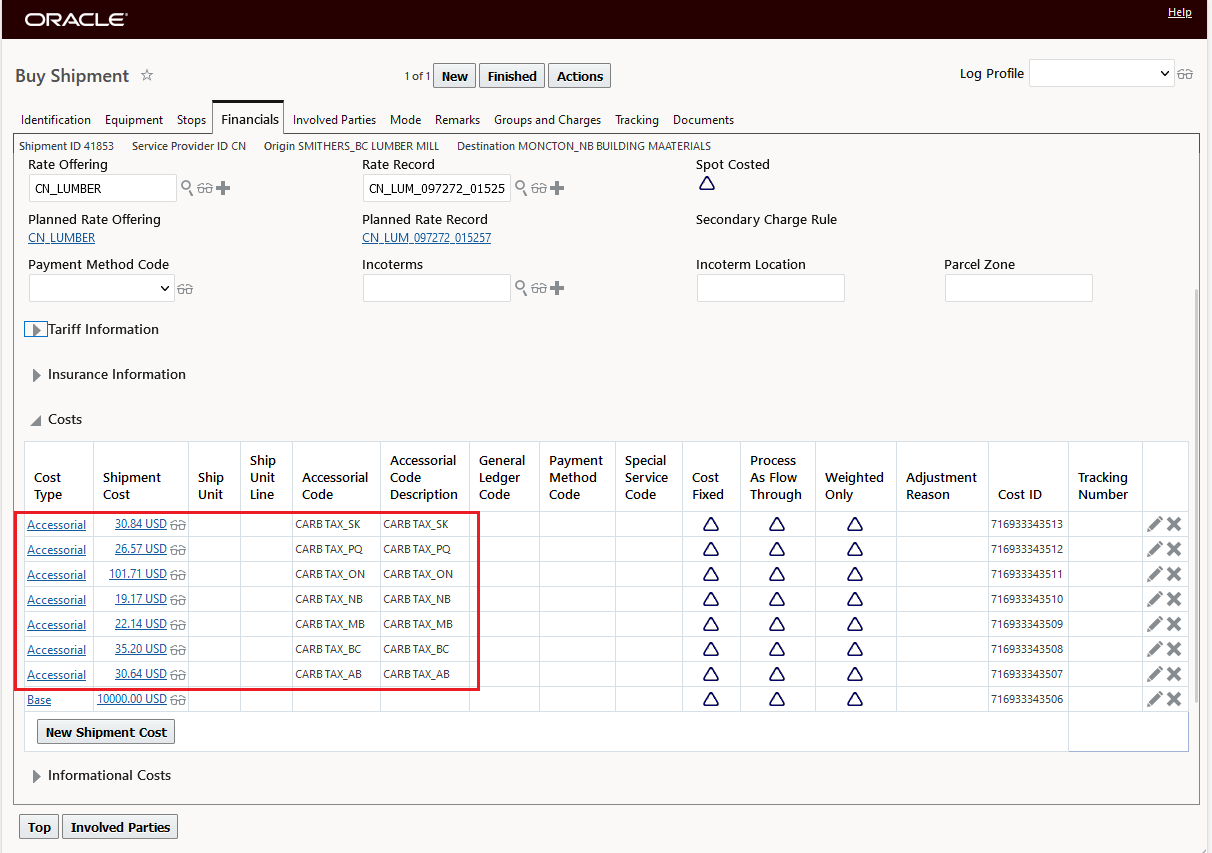

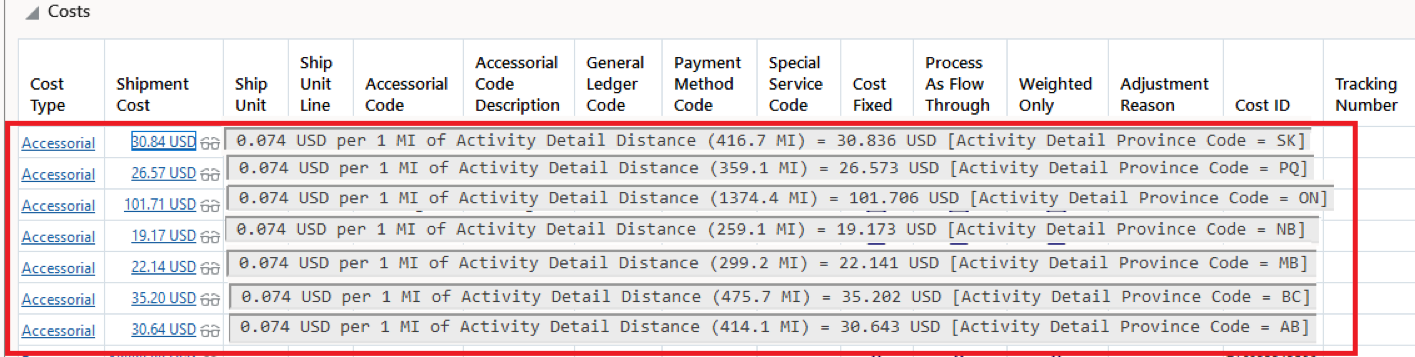

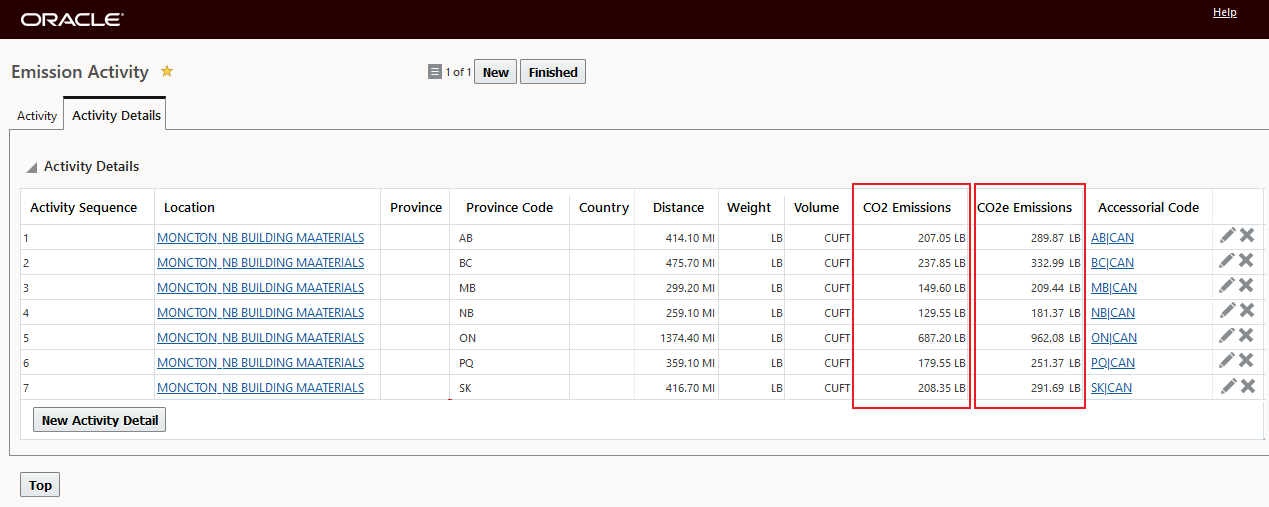

In this example, the total distance of 3,598.30 miles has a Carbon Tax applied for each of the Provinces involved. The Calculated Carbon Tax for each province is shown below.

By Province Calculated Carbon Tax

The Cost Detail for the Carbon Tax Accessorials is provided below, in this example the rate per mile is the same - it could easily be different since the setup here is based on a standard rate record setup for an accessorial charge, the more interesting item is the distance travelled in each Province - which is calculated by calling - in this case - PC*Miler Rail and allows for the calculation of the cost for each Province covered in this shipment. So, for example, the 416.7 Miles the shipment travels through the Province of SK- Saskatchewan results in a Carbon Tax for SK of 30.84 USD.

Cost Detail Carbon Tax by Province

Emission Activity

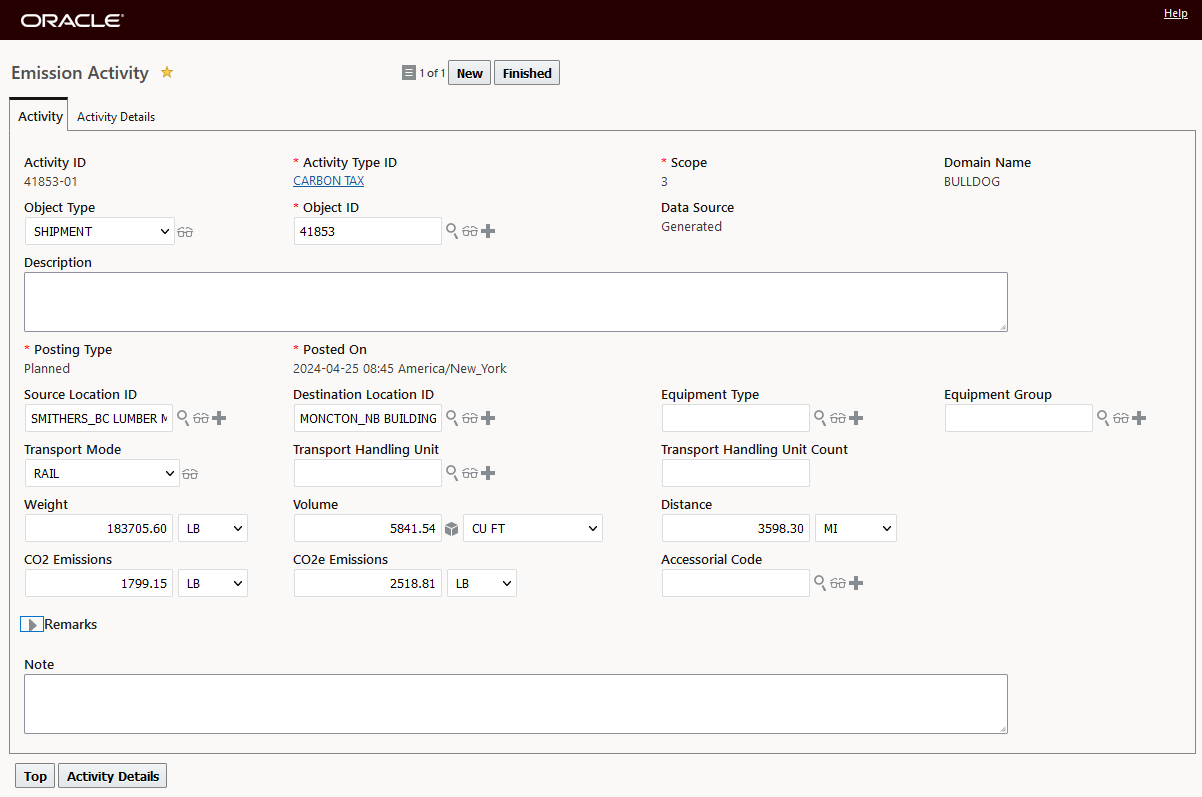

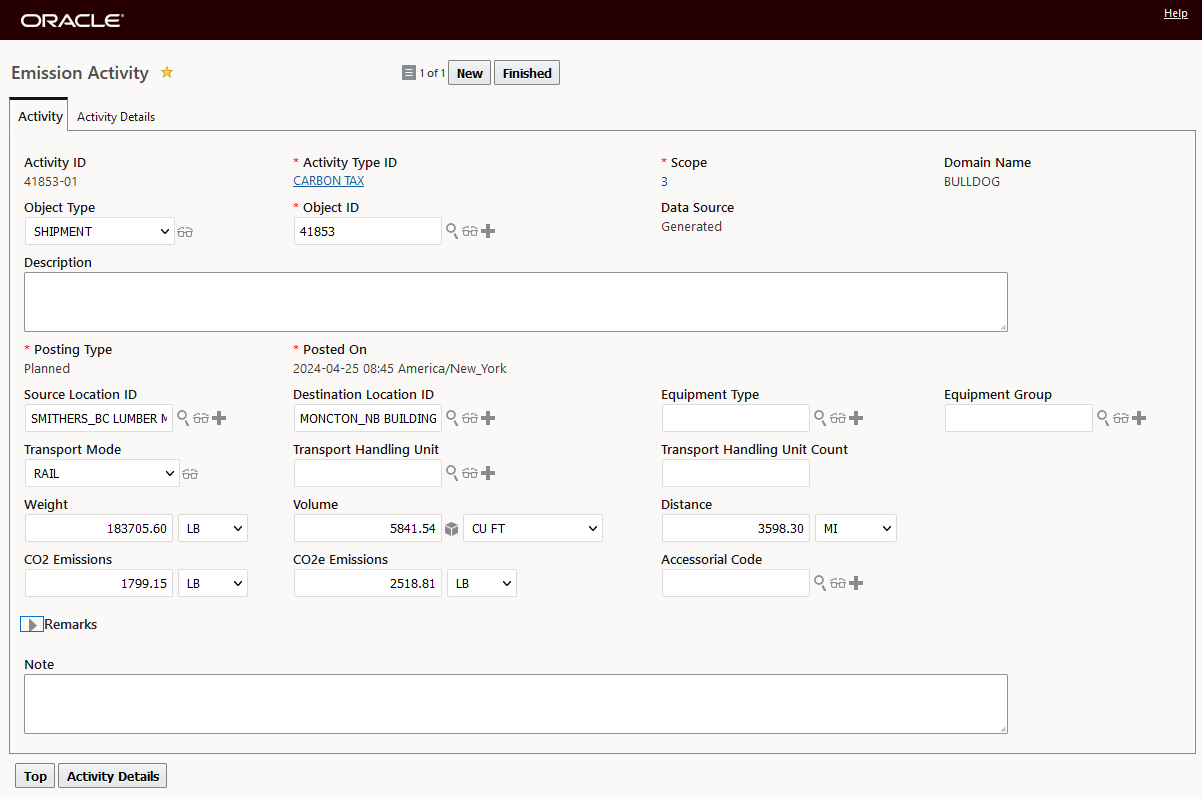

The Carbon Tax functionality utilizes the ESG Infrastructure delivered in a previous release. The Calculate Carbon Tax action when run will generates an Emission Activity and Emission Activity Detail record(s) to capture the taxable distance by Province and the Accessorial Code (and related Accessorial Cost) used to determine the Carbon Tax charges.

Below is the Emission Activity record generated for the Shipment 41853. The application - in addition to calculating the Carbon Tax, will also calculate the CO2 and CO2e Emission for both the Emission Activity and Emission Activity Detail records when the Calculate Carbon Tax action is run. The C02 and CO2e calculations are based on the distance traveled and value of the emission set in the properties glog.esg.carbonTax.CO2EmissionPerMile (set to 0.5 in this example) and glog.esg.carbonTax.CO2eEmissionPerMile (set to 0.7 in this example).

Emission Activity Record

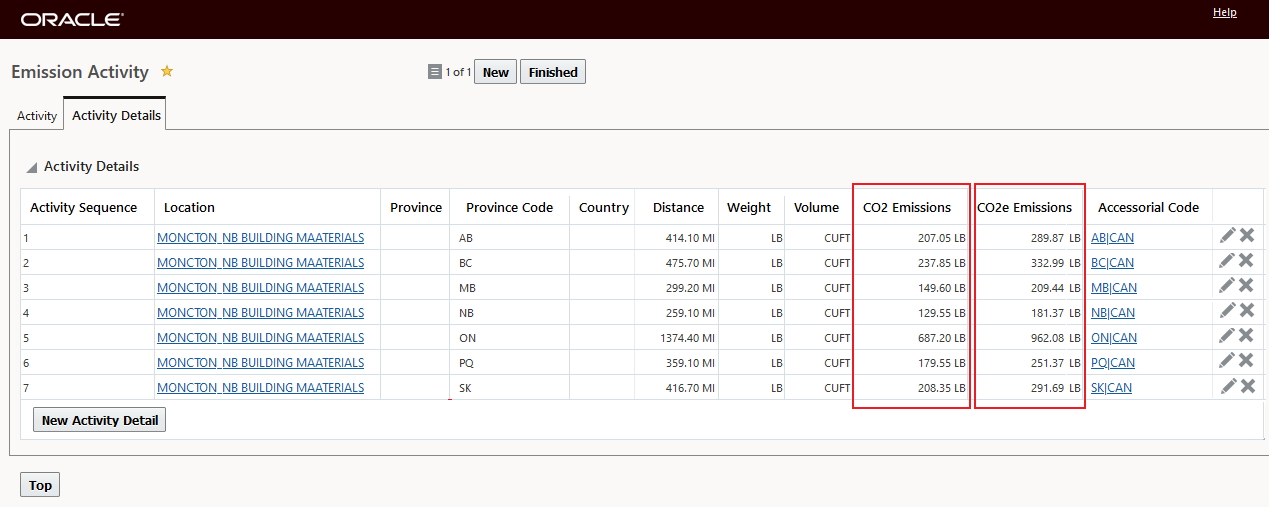

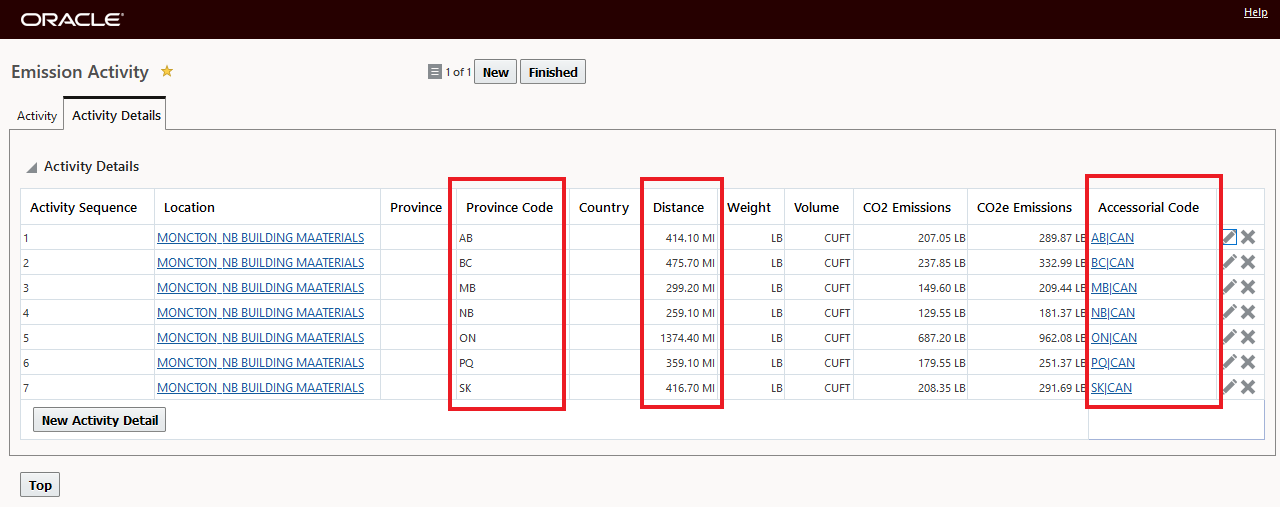

Below is the Emission Activity Detail record with the CO2 and CO2e Emission highlighted. Again, the C02 and CO2e calculations are based on the distance traveled and value of the emission set in the properties glog.esg.carbonTax.CO2EmissionPerMile - set to 0.5 in this example and glog.esg.carbonTax.CO2eEmissionPerMile - set to 0.7 in this example.

Emission Activity Detail

This feature simplifies the calculation and settlement activities related to Canada's Provincial specific Carbon Tax.

Steps to Enable

When the action Calculate Carbon Tax is run - either via the UI or as an Agent action- the following logic is invoked:

- The action sends the request to the External Distance Engine (EDE) - in this example Trimble MAPS PC*Miler|Rail. The EDE that is used with the Calculate Carbon Tax action is configured with the property glog.esg.carbonTax.RateDistanceID.

- There are two options for how the request to the configured EDE is handled - which options to used is configured in the property glog.esg.carbonTax.IsProvinceLevelBreakUp. You have two options:

- With the property set to true - the distance for the shipment will be broken up by Province.

- With the property set to false the total distance for the shipment without the Province level breakup will be provided.

In this example the desire is to have the distance provided by Province - so the property will be set to true..

- The result of the request(either as a single all-in distance or by Province) will be used to create Emission Activity Detail records for the Shipment. The Emission Activity Detail records will be created for the Emission Activity Type that is configured in the property glog.esg.carbonTax.ESGActivityTypeID. In this example, Activity Type ID = CARBON TAX.

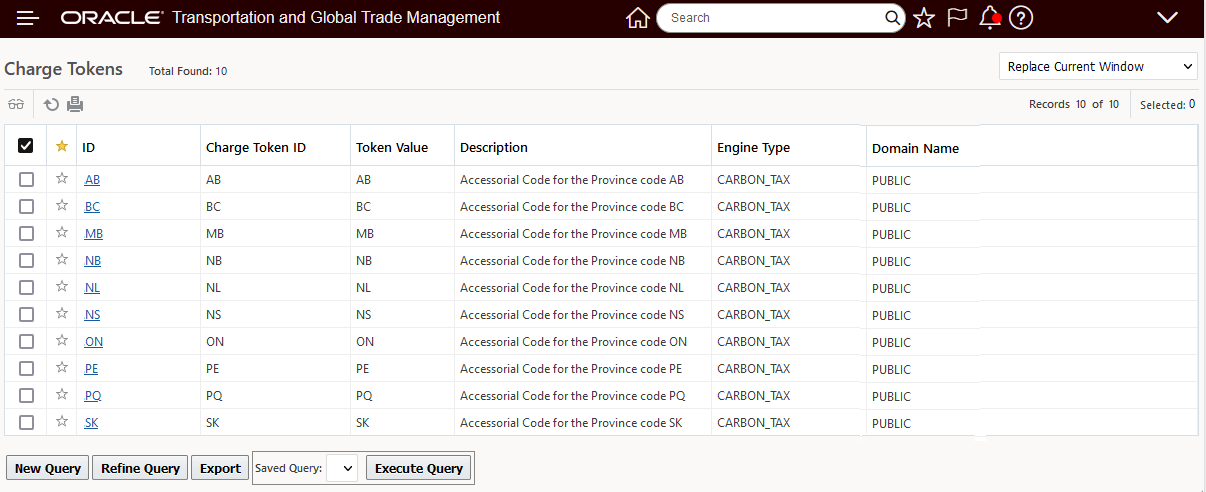

- With the glog.esg.carbonTax.IsProvinceLevelBreakUp set to true, then the Emission Activity Detail records will be created with Province Code and corresponding Accessorial Code defined in Charge Token Set configured in the property glog.esg.carbonTax.ProvinceToAccCodeMap.chargetokenset.

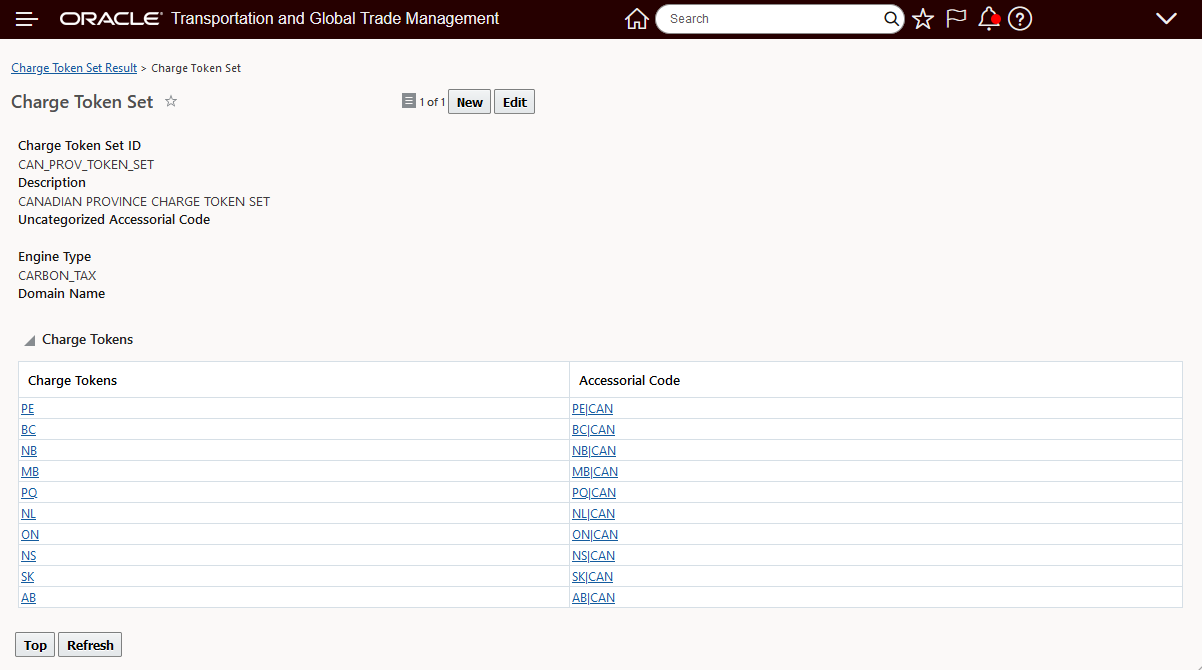

Canadian Province Charge Token Example

- The hierarchy in finding the Charge Token in Charge Token Set is based on the response from EDE is as follows:

- i) Province Code

- ii) Province Code + || + Country Code

- iii) Country Code

Example of the Charge Token Set linking the Charge Token to the Accessorials

Charge Token Set Example

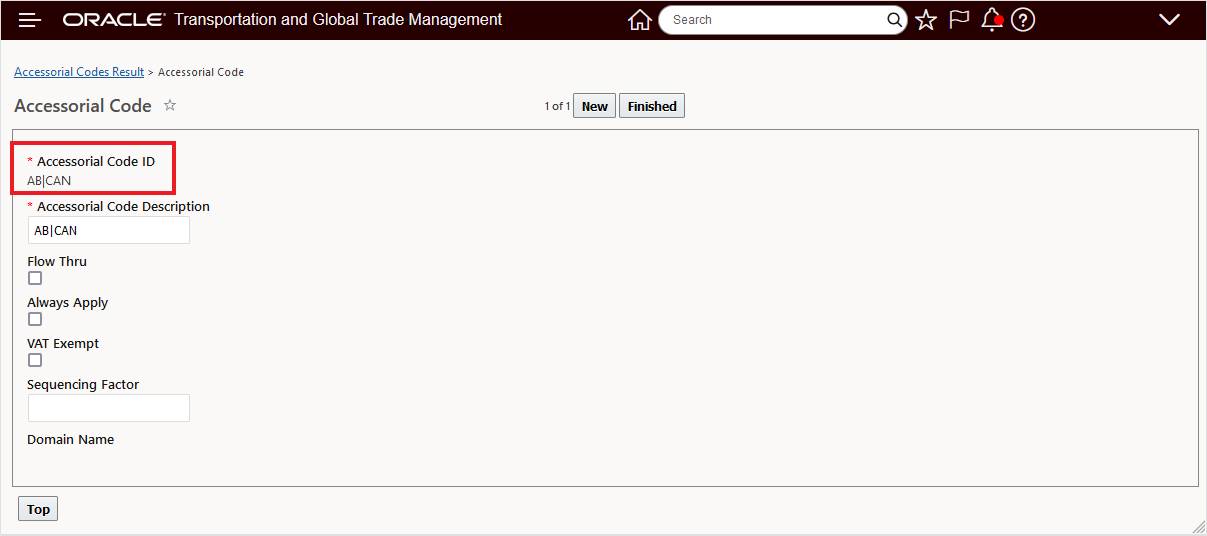

Following through on all the setup pieces - the AB|CAN Accessorial code below maps to the Accessorial Cost AB|CAN.

Accessorial Code for AB - Alberta

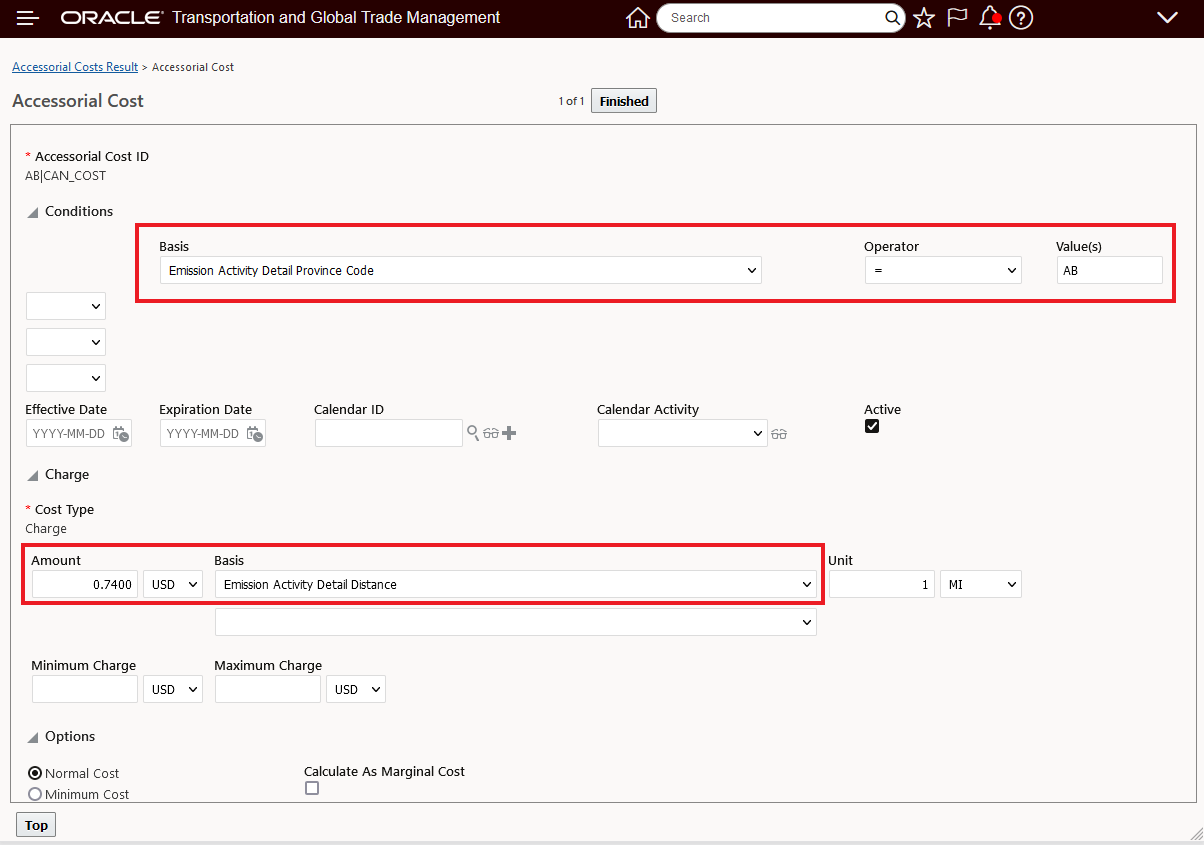

The Accessorial Cost for AB is below - note the Conditions and the Rate Basis are related to the ESG Activity record which is used to bring together the province specific distance, the accessorial and the accessorial cost for the shipment.

Accessorial Cost for AB - Alberta

Below is the Emission Activity record for the sample Shipment 41853.

Emissions Activities for Shipment 41853

The Activity Detail Record below captures both the Province specific distance and the Accessorial Code which are used on the Shipment to Rate the Province specific Carbon Tax Accessorial to complete the Carbon Tax Calculation,

Emissions Activity Details for Shipment 41853

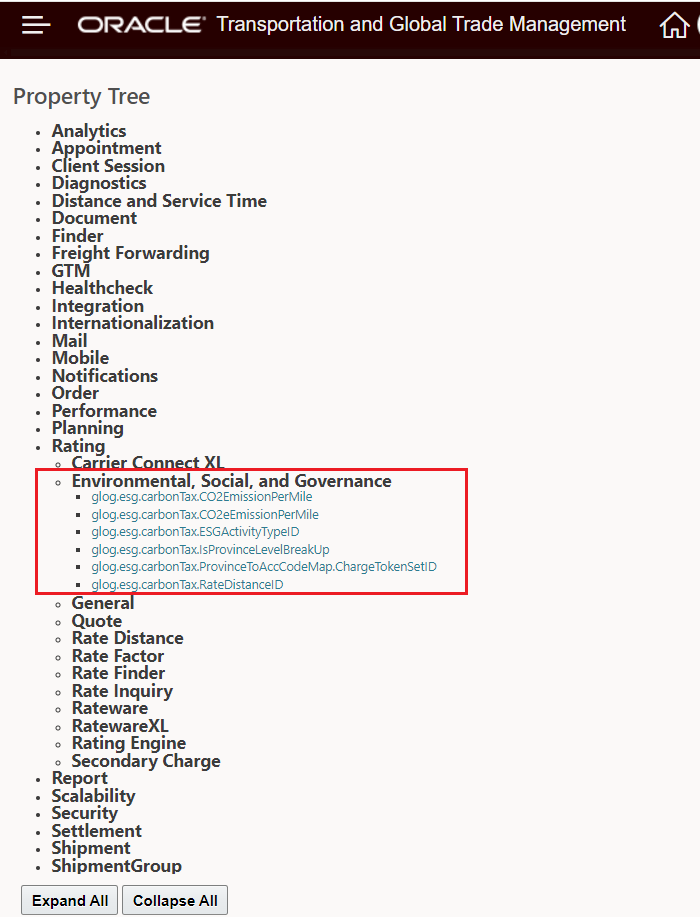

Information about all the Properties related to the Carbon Tax solution configuration can be found in the Property Tree under Rating in the Environmental, Social and Governance subgrouping - as shown below.

Carbon Tax Related Properties

For the example shown - the Environmental, Social, and Governance Carbon Tax properties were set as follows:

ESG Carbon Tax Related Properties

| Instruction | Key | Value |

|---|---|---|

| set |

glog.esg.carbonTax.IsProvinceLevelBreakUp |

true |

| set |

glog.esg.carbonTax.RateDistanceID |

OOTB.PCMILER_RAIL_RD_1 |

| set |

glog.esg.carbonTax.CO2EmissionPerMile |

0.5 |

| set |

glog.esg.carbonTax.CO2eEmissionPerMile |

0.7 |

| set |

glog.esg.carbonTax.ProvinceToAccCodeMap.ChargeTokenSetID |

OOTB.CAN_PROV_TOKEN_SET |

| set |

glog.esg.carbonTax.ESGActivityTypeID |

- You can calculate CO2 and CO2e Emission in Emission Activity and Emission Activity Detail based on the distance traveled and weight of the emission mentioned in the properties glog.esg.carbonTax.CO2EmissionPerMile (set to 0.5 in this example) and glog.esg.carbonTax.CO2eEmissionPerMile (set to 0.7 in this example) respectively.

CO2 and CO2e Emissions Activity Detail Calculated Based on Properties and Distance by Province

Tips And Considerations

The Optional Feature - SUPPORT CALCULATE CARBON TAX- should be enabled to take advantage of this feature.