Trade Incentive Program Rate

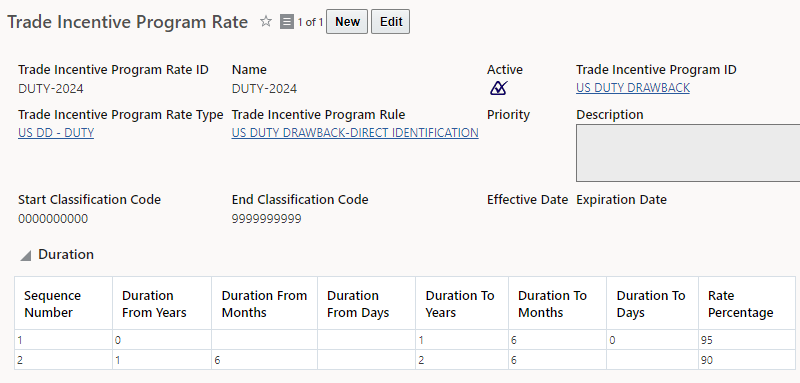

GTM has been enhanced to support duty drawback recovery rates based on how long the goods have remained in the country, with specific rates applied for defined periods (e.g., 0 to 1 year, 1 to 2 years, etc.). When creating a rate, the application enables you to define various attributes, including:

- Name: specify the name of the rate. For example, Duty Drawback Rate for India.

- Active Flag: check the box when the rate becomes available.

- Rate Type: Categorize the rate based on shared characteristics, such as drawback rates, excise tax rates, or other relevant categories.

- Trade Incentive Program: Specify the program to which the rate applies.

- Trade Incentive Program Rule: Specify the rule to which the rate applies.

- Priority: Establish priority across rates within the same program and rule.

- Description: Add detailed information about the rate.

- Classification Codes Range: Indicate the range of classification codes the rate applies to.

- Effective and Expiration Date: Set the validity period for the rate.

- Duration: Specify the periods the goods may have remained in the country for which specific rates apply.

Two recovery rate examples based on how long the goods have been in the country prior to being exported:

- 0 to 18 months — Applicable Rate: 95%

- 18 months to 2.5 years — Applicable Rate: 90%

Below, you can see how to setup these two scenarios in GTM:

Trade Incentive Program Rate

This feature provides a structured approach to rate management, ensuring accuracy, flexibility, and alignment with diverse business and regulatory requirements.

Steps to Enable

You don't need to do anything to enable this feature.