Trade Incentive Program Value Calculation

GTM now includes a value calculation feature that computes various values during the Entry-Exit matching process. The user interface allows you to configure:

- Target Value Qualifiers: For the calculated values.

- Source Value Qualifiers: For the base values used in calculations.

The feature supports two distinct program value calculations:

- Duty Drawback Programs.

- Suspension Tax Programs, such as Temporary Imports (US) or Inward Processing (UK), tailored for the specific requirements of each TIP type.

The Customs Value Balance is initially set to match the Customs Value declared in the entry declaration/transaction line using data configuration. Match Exits to Entries action decrement or increment the target balances as configured in the value calculation. In certain programs, not all duties or taxes paid are eligible for a full claim. For instance, in the United States, duties are fully paid upon import. However, only a percentage may be eligible for a claim, depending on factors such as depreciation or the duration the items remained in the country. The application uses the new trade incentive program rates to calculate the duty to be claim.

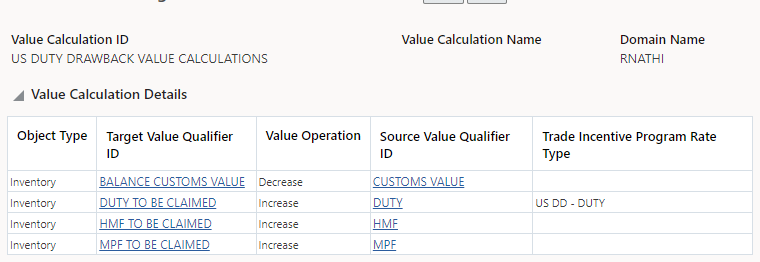

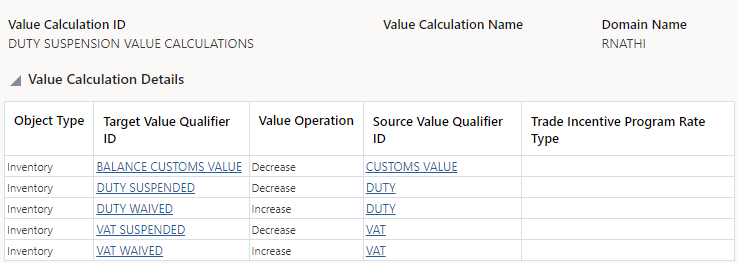

Below, a setup example for duty drawback and suspension value calculations:

Duty Drawback Value Calculations

Duty Suspension Value Calculations

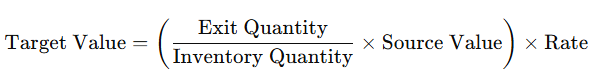

GTM calculates the values to be deducted or incremented based on the following formula:

Formula

If the Rate is not defined, it defaults to 100% (i.e., 1.0).

This enhancement improves value tracking accuracy, enables customization for different trade incentive programs, and ensures better compliance with international trade regulations.

Steps to Enable

You don't need to do anything to enable this feature.