Enhancements to Rounding of Values for Customs Filing

This feature enables you to perform rounding of values on your declarations and declaration lines. Some customs regimes have certain requirements for the values that are submitted for filing purposes. In a previous release, support for rounding values less than 1 to 1 was introduced. With this enhancement, GTM can round values to whole numbers. In addition, changes have been made in the configuration of rounding values less than 1 to 1. In the Declaration Type, you can configure the values you want to round based on value qualifier. When a declaration and/or declaration line is created or modified, GTM only rounds the values that you have configured.

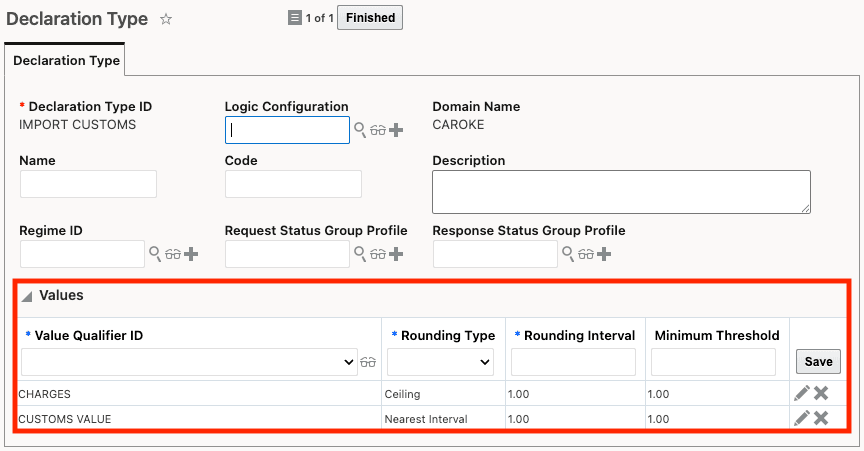

You can configure the following data for the rounding rules in the Declaration Type:

- Value Qualifier - list the qualifiers you want to round

- Rounding Type - select from 3 available rounding types:

- Ceiling - round up based on the rounding interval

- Floor - round down based on the rounding interval

- Nearest Interval - round to the closest value based on the rounding interval

- Rounding Interval - defines the interval you want to use for rounding

- Minimum Threshold - the minimum value that can be reported. For example, when you define the minimum threshold as 1, any value below 1 is rounded up to 1.

In this scenario, you are reporting CUSTOMS VALUE and CHARGES as part of your customs filling.

- CUSTOMS VALUE must be reported as a whole number and cannot be reported as less than 1.

- CHARGES must be rounded up to the next whole number and cannot be reported as less than 1.

Declaration Type with Value Qualifiers

Once configured, GTM rounds all values when a declaration is created or modified using the Declaration Type via:

- Declaration and Declaration Line managers

- Create/Add to Existing Trade Transaction action and agent action

- Integration

NOTE: When rounding is enabled, the rounded values are saved to the declaration in the database.

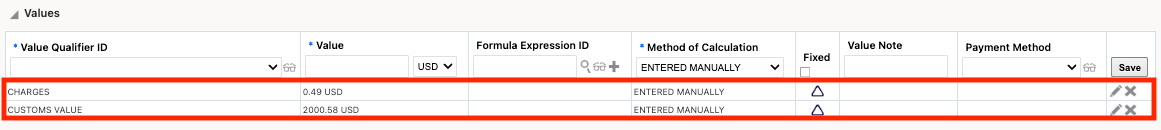

In this example, you are creating a declaration from a trade transaction which includes the following values:

Trade Transaction Values

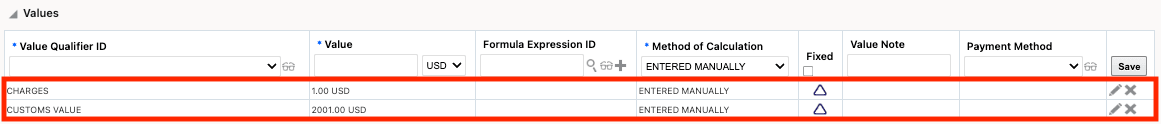

When you create the declaration/declaration line from a trade transaction/trade transaction line, the values are rounded as follows:

- CHARGES are rounded up to 1 due to the minimum threshold

- CUSTOMS VALUE is rounded to the closest rounding interval of 1

Declaration Values

For users of declaration management, this feature provides the ability to round values in support of calculating customs value in alignment with local regulations.

Steps to Enable and Configure

You can define the value qualifiers you want to round in the Declaration Type > Values section. When a Declaration Type is specified for a declaration, GTM rounds all value qualifiers you've defined on the declaration and declaration lines.

Tips And Considerations

When rounding is enabled, the rounded values are saved to the database.