Enhanced Duty Tax Calculation

This optional feature, when enabled, provides the ability to send multiple classification codes to a third party content provider from the declaration. The content provider can respond with a breakdown of the duties that apply including penalties and exemptions.

You can configure GTM to support an item having multiple classification codes for the same classification type. One classification code is the primary while the others model secondary classification codes such as penalties, penalty exemptions and special programs. You can use the existing Lookup Product Classification action on declaration line to copy the classification codes from the item to your lines.

NOTE: This optional feature works in conjunction with the existing Optional Feature called 'MORE THAN ONE 98-99 ITEM CLASSIFICATION'. You must enable the 'MORE THAN ONE 98-99 ITEM CLASSIFICATION' optional feature to support entering and storing multiple classification codes on the item, transaction line and declaration line.

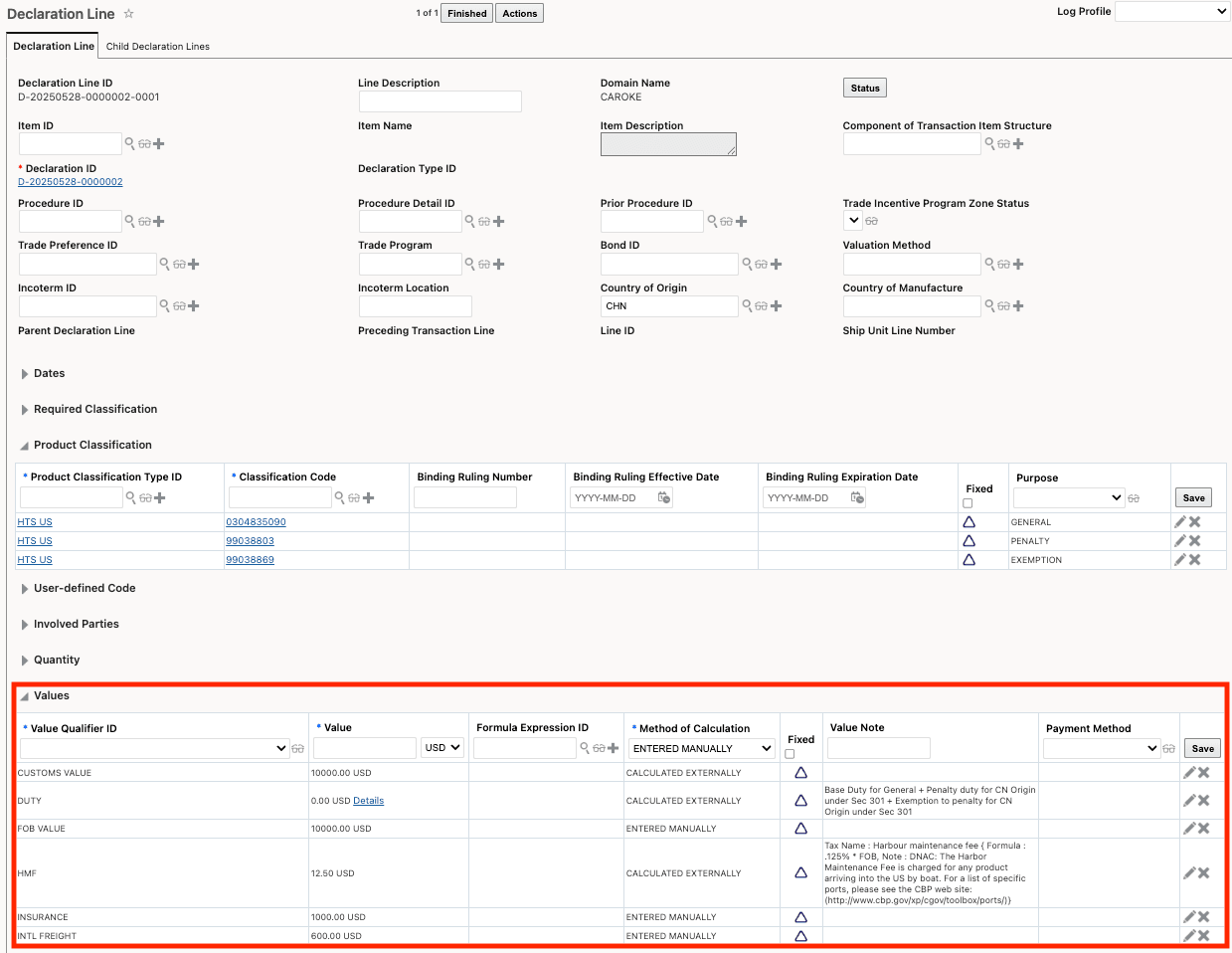

Once the classification codes are available on the declaration line, you can trigger the Estimate Duty and Taxes action/agent action on the Declaration. GTM sends the product classification type, product classification code and trade program to the third party content provider. The response includes the base duty as well as details for penalties and penalty exemptions based on the country of origin. This information is stored in the Values grid on the Declaration Line depending on the value returned. A Method of Calculation = CALCULATED EXTERNALLY indicates a value is from a third party content provider.

After you trigger the Estimate Duty and Taxes action and receive a response, you can see all the values on the declaration line including any values returned from the third party content provider. In this example, a few values have been returned including the duty.

NOTE: The duty is 0.00 USD and is calculated externally.

Declaration Line with Duty Value

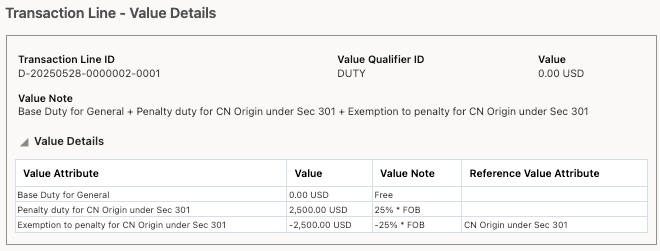

If you want to see more information on the duty returned, click 'Details' next to the value. GTM displays a window with the information.

NOTE: There is a duty under Section 301 but an exemption is available which results in a Duty of 0.00 USD.

Declaration Line with Duty Value Details

This enhancement allows for complying with more complex regulatory and duty management scenarios, saving users time and effort.

Steps to Enable and Configure

If you need to change the Opt In state for this feature:

- Go to the Optional Feature UI - Configuration and Administration > Property Management > Optional Features.

NOTE: Your user must have the DBA.ADMIN user role to use this functionality.

- Select the Enhanced Duty Tax Calculation feature.

- Run the desired Action for the feature - Opt In or Opt Out.

GTM ships with a property called gtm.dutyTax.dsg.enhancedExternalSystem.name which points to the new external system called 'ENHANCED_DESCARTES_DUTY_TAX_SERVICE'. Enabling the optional feature ensures that GTM is using the property and external system which supports multiple classification codes. If you want to use a different external system for the callout to Descartes, you can update the external system in the gtm.dutyTax.dsg,enhancedExternalSystem.name property.

NOTE: The URL is included in the External System called 'ENHANCED_DESCARTES_DUTY_TAX_SERVICE' which ships with GTM. You MUST edit this external system and update your User Name and Password if you want to use this optional feature. You can use the same User Name and Password that you use for other external systems associated with Descartes content.

Tips And Considerations

This optional feature is available for trade transactions and declarations only. It does not work for the Duty & Tax Analysis or the Landed Cost Simulator.

When the Optional Feature is not enabled:

- GTM uses existing functionality where a single product classification type, product classification code and trade program are sent to the third party content provider. The response includes one total duty value which may include a penalty on the basis of the country of origin. The duty is reflected in the Values grid with a Value Qualifier of DUTY.

- The Details button will display next to the value but if you click to open the Value Details, the results are null.

Key Resources

- For more information on the optional feature called 'MORE THAN ONE 98-99 ITEM CLASSIFICATION', please refer to the 24A and 24B What's New document.