Generate Sustainability Activities from Invoices

Payables Invoices are an important source of data for emission calculations. For example, the purchase of any goods or services adds to your Scope 3 Category 1 emissions. You probably also receive invoices for fuel and energy that contribute to your Scope 1 and Scope 2 emissions. Manual processing of emission calculations from individual invoices is generally not feasible as most companies receive very large volumes of invoices. Most organizations resort to calculating and reporting emissions at the aggregate-spend level, but that creates auditability issues. In addition, the inability to slice and dice by department, location, and cost center makes this data unusable for identifying opportunities for emission reduction.

Invoice classification allows you to configure rules to classify invoices into activity types and map them to spend types (or other attribute values such as fuel types) based on the data on the invoice such as the natural account, purchasing category, supplier, and description. Oracle Sustainability automatically creates activities from the classified invoices and then calculates associated emissions. Invoice classification works at the level of individual invoice distributions, allowing you to create an activity for each distribution of an invoice.

After configuring invoice classification rules, run the Generate Sustainability Activities from Payables Invoices scheduled process. This scheduled process selects Payables Invoices using the parameters you have passed, applies invoice classification rules, and then creates an activity for each eligible invoice distribution by using the activity classification on the applicable rule. If no rule applies to the invoice distribution, the activity created will use the default activity type set in the Default Activity Type for Invoice Classification profile option. You can schedule this process to run daily or weekly to automatically generate activities for any invoices that become eligible for processing.

With invoice classification, you can start by calculating emissions from purchases using standard and generic emission factors such as spend-based factors. As you start to obtain specific and accurate emission factors from suppliers, you can combine these with granular purchase data from invoices and record the resulting emission changes in your sustainability ledger. In addition, the ability to drill through from an activity to the source invoice provides important business context and the traceability that auditors require. The ability to combine invoice distributions with emissions provides you the opportunity to garner actionable insights.

Here's the demo of these capabilities:

Steps to Enable

Prerequisites

- You must be able to create sustainability activities and be able to calculate emissions using matched factors. For this, you should have configured one or more sustainability ledgers, activity types, and emission factor mappings.

- You must be using Oracle Fusion Cloud Financials for managing supplier invoices.

Configure Invoice Classification Rules

- Assign a value to the Default Activity Type for Invoice Classification profile option. Because a vast majority of activities resulting from Accounts Payable invoices belong to Scope 3 Category 1 - Purchased Goods and Services, Oracle recommends that you choose the activity type as Purchased Goods and Services.

- Navigate to the Invoice Classification Rules page and click Sync Activity Classifications. This submits a scheduled process request and prepares a list of activity classification categories from emission factor mappings. This process should complete in a couple of minutes.

- Configure Invoice Classification Rules.

You can create rules in two ways - by using the Invoice Classification Rules page and by using the published VB Add-in spreadsheet. These rules allow Oracle Sustainability to determine which activity type and activity type attribute values to use when generating an activity for an eligible invoice distribution, by using fields on the invoice, line, and distribution. You can create two types of rules - exclusion and assignment.

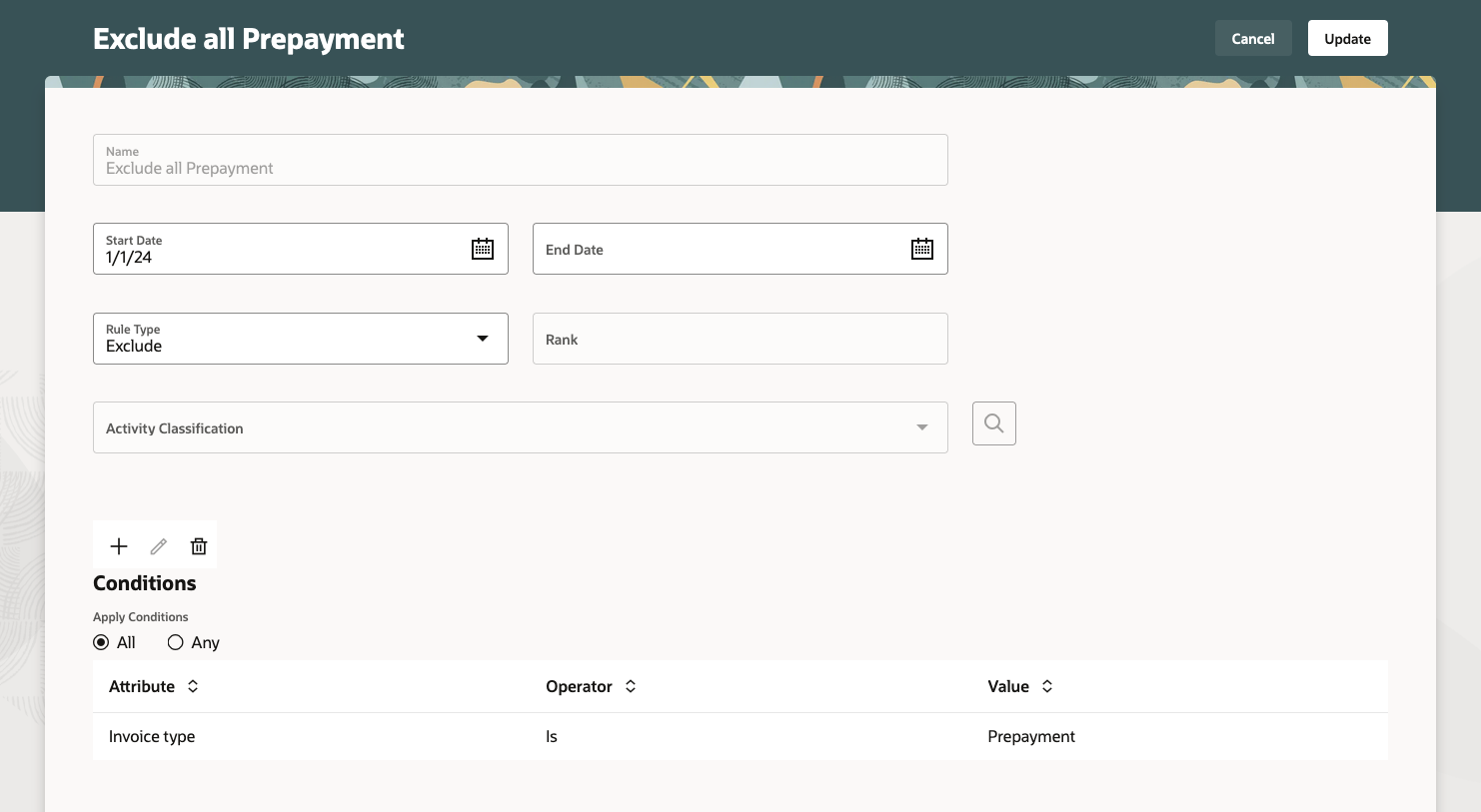

Exclusion Rules

Create these rules to identify any invoice distributions that must be excluded from processing into activities. For each exclusion rule, identify the rule conditions that are applicable.

Exclusion Rule

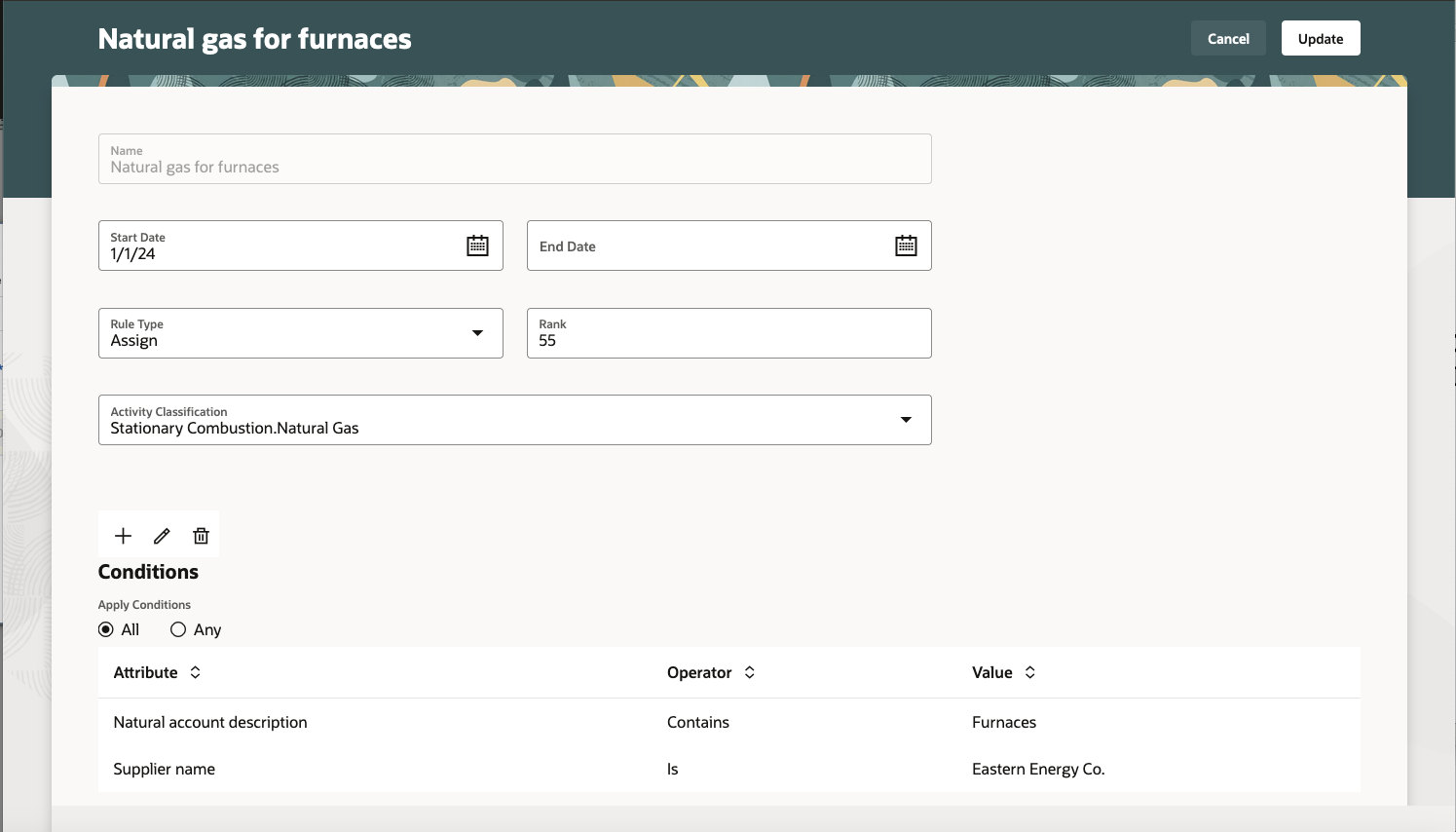

Assignment Rules

Create these rules to identify invoice distributions that must be included for processing into activities. Assignment rules tell the system which activity type and activity type attribute values must be used when creating activities for invoice distributions that satisfy the rule criteria. For each invoice classification rule, identify the rule conditions and the activity classification.

Assignment Rule

Tips And Considerations

- Oracle Sustainability generates activities only from invoice distributions that are posted and accounted. The application does not keep track of any changes that happen to the invoice after the activity is generated.

- When configuring activity types, if you associate the predefined Quantity and Amount measure types, then these measures will automatically get populated from the corresponding amount and quantity on the corresponding invoice distribution. If the activity type has emission factor mappings that use either the amount or the quantity measure that match the activity, then emissions are calculated automatically when the activity is created.

- When evaluating invoice classification rules, Oracle recommends that you run the scheduled process with a small date range and iterate on refining the rules. After you are satisfied with the rules, you can schedule the job to run daily or weekly without any date parameters populated. This will ensure that any invoice that gets accounted late will also be processed, and no invoice distribution is missed out.

- If you have the necessary function privilege and data-security policies assigned to grant you access to Payables Invoices, then you will be able to drill through from the activity to the invoice. This may sometimes be useful to access the supplier's invoice PDF copy that may contain information that is required for emission calculation on your activity.

- Deleting an activity that was generated from Payables Invoices will result in a new activity being created later in its place.

- If an activity is incorrectly classified, do one of the following:

- Edit the activity and update the activity type attributes.

- If the activity type is incorrect, then fix the rule that caused the activity to be created with the incorrect activity type, and then delete the activity either from the user interface, or by using FBDI, or VB Add-in spreadsheets. The activity will be re-created using the updated rules the next time the Generate Sustainability Activities from Payables Invoices scheduled process runs.

- If no activity was supposed to be created for the invoice distribution, then you can do one of the following:

- Update the measures to zero and post the activity to the ledger with an appropriate note in the description. This way, this activity will not have an impact on emission reporting.

- Post the activity to the ledger and then cancel it to achieve a similar effect.

- Create an exclusion rule, and delete the activity or activities. New activities will no longer be generated in its place because the exclusion rule will apply.

Key Resources

- What's new for Update 24D: Set Up Data for Oracle Fusion Cloud Sustainability

- What's new for Update 24D: Maintain sustainability Ledger As the Source of Truth for Statutory Reporting

- What's new for Update 24D: Manage Sustainability Activities

- What's new for Update 24D: Calculate Emissions Associated with Sustainability Activities

Access Requirements

Users who are assigned a configured job role that contains these privileges can access this feature:

- Manage Invoice Classification Rule for Sustainability Activities (SUS_MANAGE_INVOICE_CLASSIFICATION_RULES)

- Generate Sustainability Activity from Payables Invoice (SUS_GENERATE_ACTIVITIES_FROM_INVOICES)

- View Payables Invoice (AP_VIEW_PAYABLES_INVOICE_PRIV) - to drill into an invoice from an activity

In addition to the preceding privileges, for users to have the ability to drill into the invoice from an activity, users should have Business Unit-based data security policy with the Actions drop down set to Manage Payables Invoice.