Redwood: Implement Cost Accounting Using Quick Setup

You can use the quick setup option to configure cost accounting settings with just a cost organization code, name, and cost method. The quick setup process uses intelligent templates based on the selected cost method and creates all the necessary costing setup entities to help you process transactions right away.

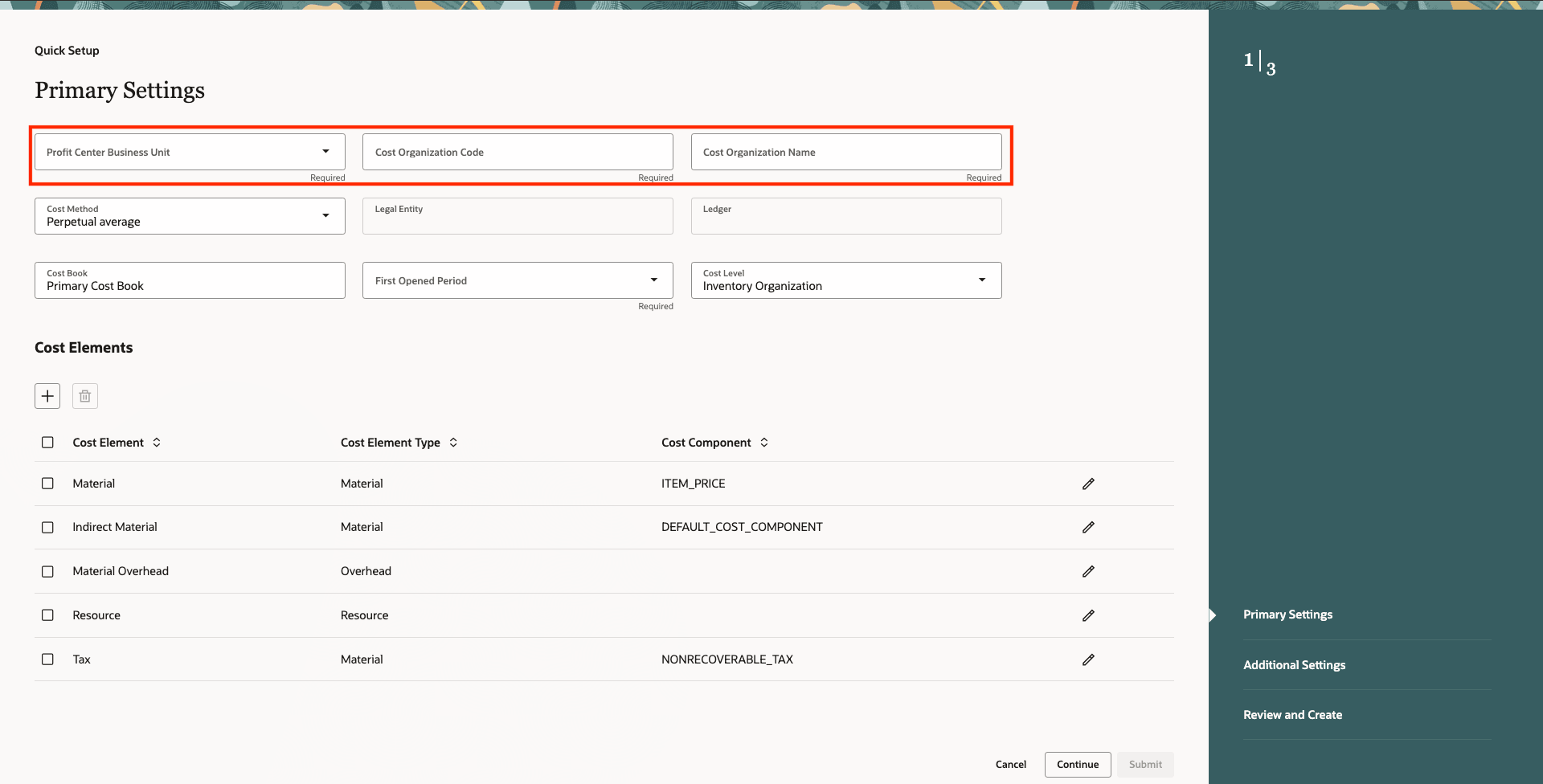

After you choose the profit center business unit, you need to enter a cost organization code and cost organization name as mandatory information.

The following information can be reviewed and modified in the Primary Settings page:

- The legal entity, primary ledger, and first open period will be defaulted after you choose the Profit Center Business Unit.

- You can choose the cost method that you would like to use for all items in the cost organization (options are the Standard Cost, Perpetual Average, Periodic Average, and Actual cost methods).

- Based on the cost method , you can select the appropriate cost levels. For standard and periodic average cost methods, Cost Organization and Cost Organization + Inventory Organization will be available. For perpetual and actual cost methods, an additional option of the Subinventory cost level is available.

- By default, five cost elements are added to the setup. You can add more cost elements or edit the existing cost elements and also edit the cost components to which they are mapped.

Quick Setup Primary Settings

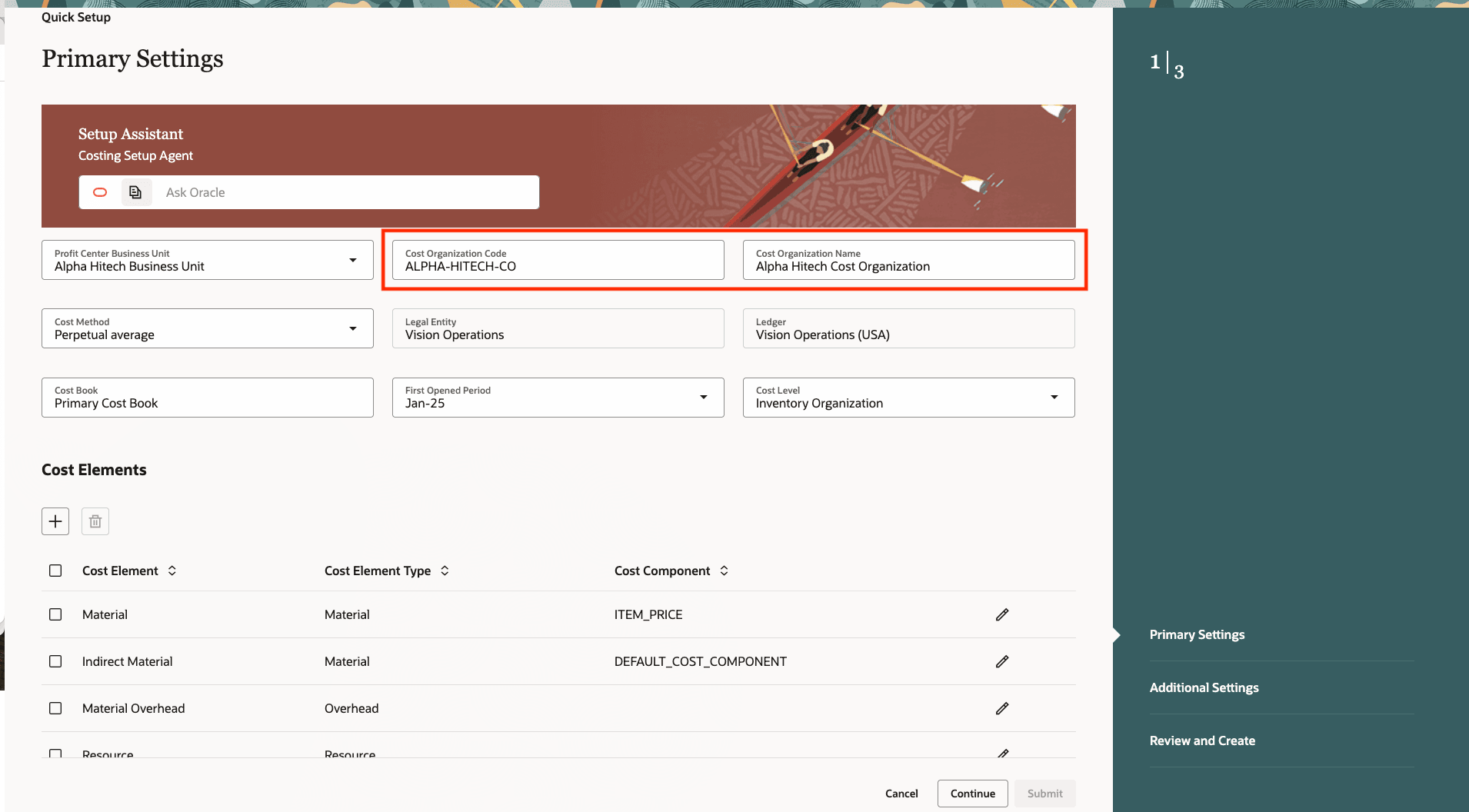

After you've entered the mandatory information and have reviewed or edited the default values for other fields, you can move to the Additional Settings page.

Specify cost organization name and code

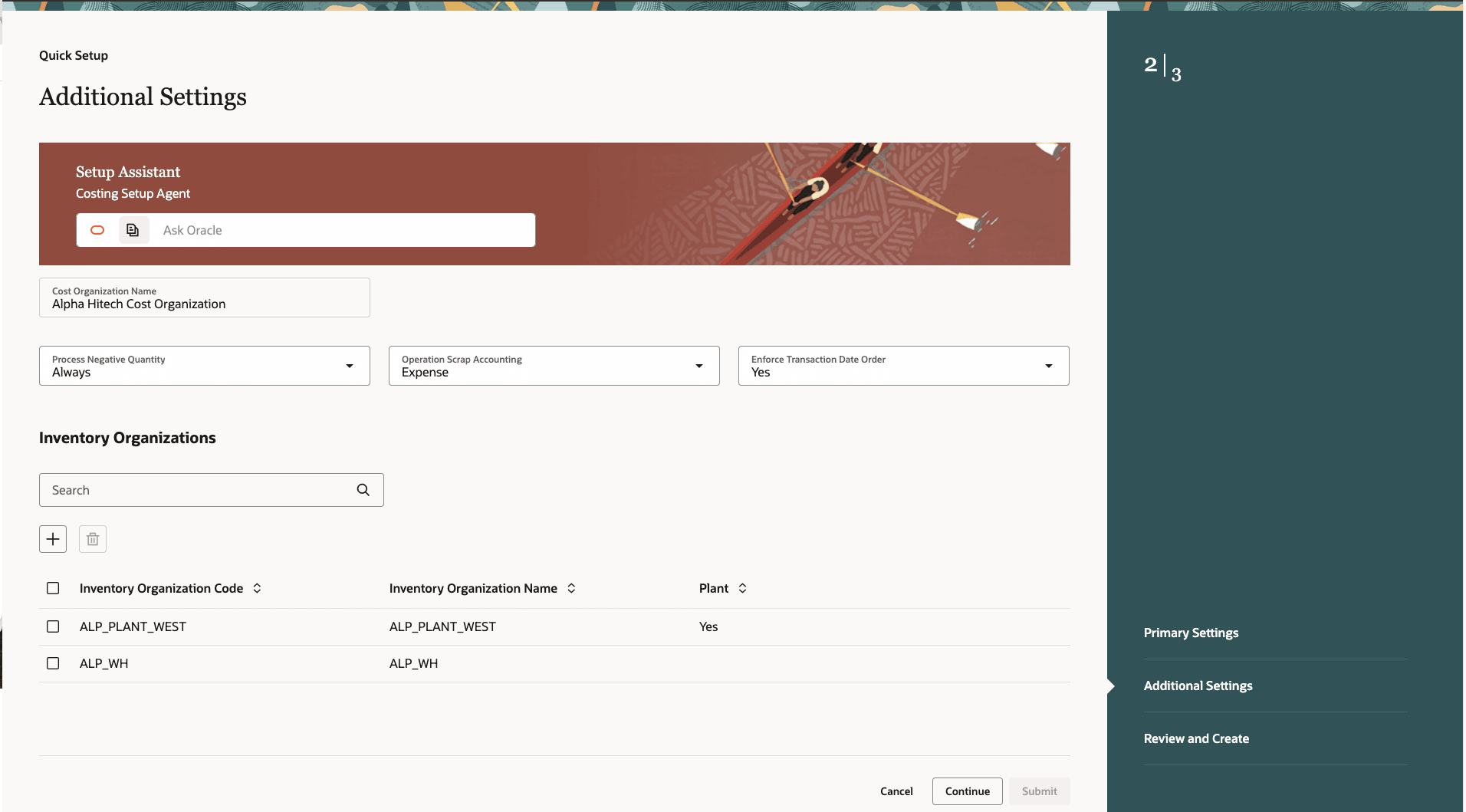

Depending on the cost method chosen, a few additional setup information are shown here with defaults chosen. You can review the information and edit them based on your requirements. All inventory organizations mapped to the profit center business unit and haven't been associated with a cost organization will be shown here. You can remove the ones that you don't want to associate with this cost organization and add the ones that you might have removed erroneously.

Additional Settings

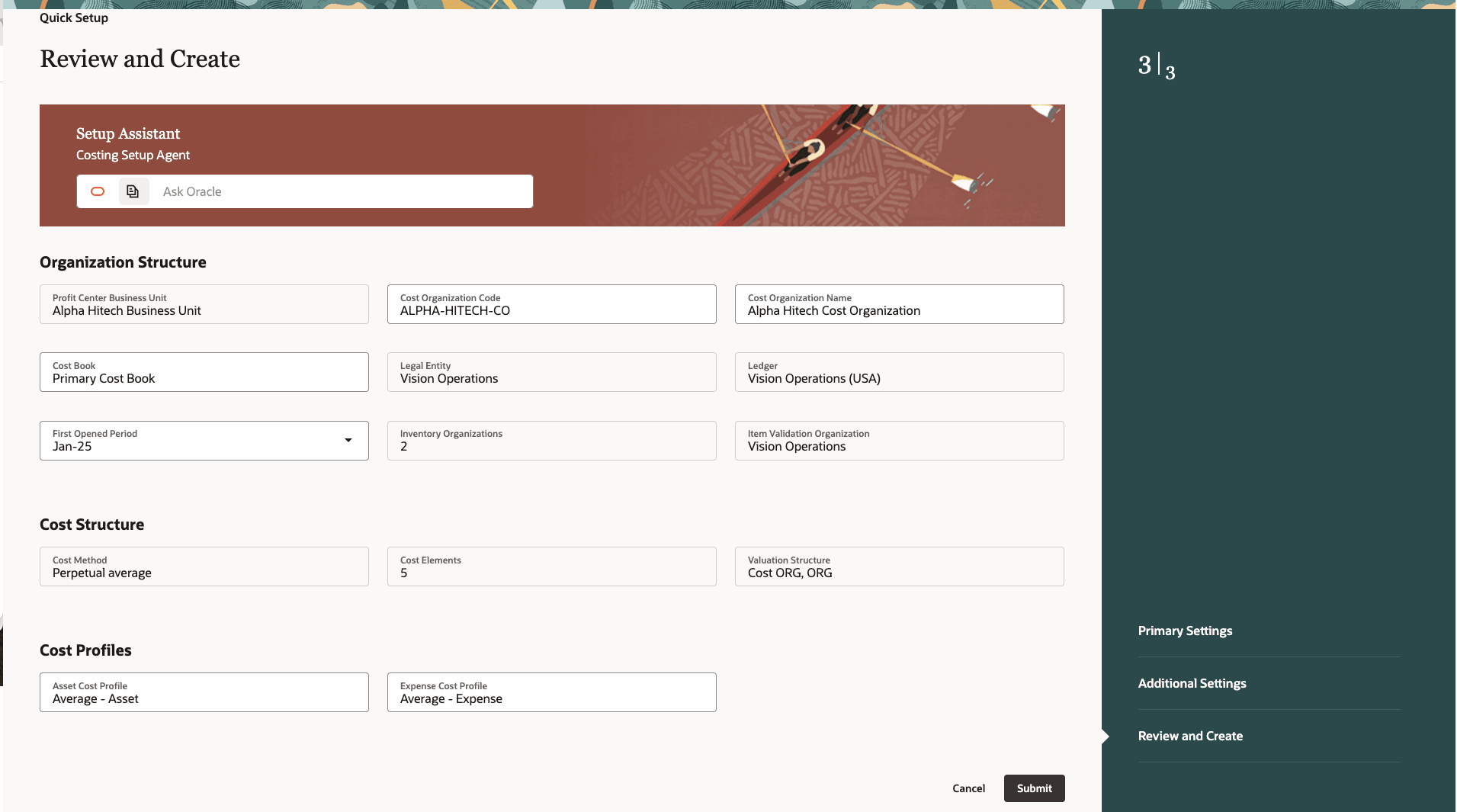

In the next step, you can review the information that has been collected by the quick setup process and edit any of the choices you have made. If you're satisfied with the configuration options, click Submit to create the cost accounting setups.

Review Setups

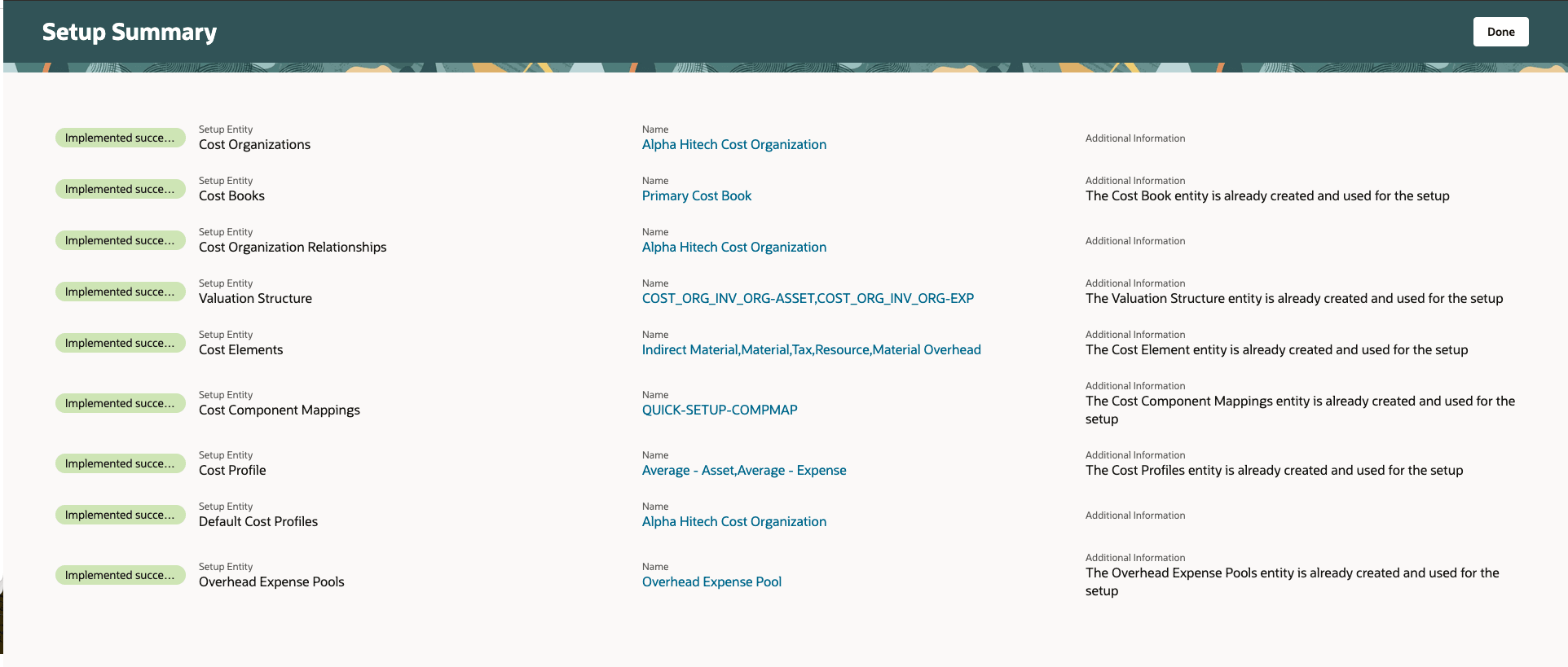

The quick setup will orchestrate all the setups based on the choices you've made and display the entities created. If any of the entities already exist, they're reused as part of the setup. You can navigate to the individual entities to review them and make changes as per your requirements.

Quick Setup Summary

Quick Setup provides rapid implementation capabilities with intelligent defaults using cost method specific templates that have been built based on best business practices. You can have a fully functional costing setup in a matter of minutes and with minimum inputs.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

- Quick Setup is useful when you want to quickly setup Cost Accounting for a new implementation, such as for conference room pilots, demonstrations, and so on. To ensure that you leverage all the costing differentiators, review the individual setups created by the quick setup and personalize them to suit your organization's requirements.

- Prerequisites required to use quick setup:

- Legal Entity

- Primary ledger

- Profit Center Business Units

- Inventory organizations mapped to the profit center business unit.

- All the costing setup entities are created in the Enterprise Set.

- At least one cost element is required and it needs to be mapped to the default cost component to ensure that the transactions can be successfully processed.

- If you don't see any inventory organizations in the quick setup process, check if the inventory organizations have been mapped correctly to a profit center business unit.

- You can modify the setups created by the quick setup by navigating to the individual pages. For example, if you would like to review and modify the cost profiles, you can do so from the Cost Profiles page. Do note that some of the attributes can't be modified after you process transactions, hence it's imperative that you make the necessary changes before processing transactions.

- The following steps are required to process new transactions in the cost organization that you'e created:

- Open the first period from the Cost Accounting Periods page.

- Create a new run control for the newly created cost organization and cost book combination from the Cost Processing Run Control (or Create Cost Accounting Distributions) page.

Key Resources

- Oracle Fusion Cloud SCM: Implementing Manufacturing and Supply Chain Materials Management Guide, available on the Oracle Help Center.

- Oracle Fusion Cloud SCM: Using Cost Management Guide, available on the Oracle Help Center.

Access Requirements

Users who are assigned a configured job role that contains the following privilege can access this feature:

- Configure Costing Using Quick Setup Template (CST_CONFIGURE_COSTING_RAPID_IMPLEMENTATION_PRIV)