Use Supplier Return for Credit Only with Additional Flows

Use Supplier Return for Credit Only with Additional Flows

In certain situations, when you return goods to your supplier, you don't expect them to send you a replacement for the returned goods. Instead, you expect the supplier to send you a credit for the value of goods to be replaced. Therefore, you don't want the original purchase order reopened to ensure that goods can't be received against that purchase order in the future.

Financial management is crucial for businesses, especially to maintain budgetary control to prevent overspending. In various sectors, it is essential to verify transactions against allocated budgets and current budget usage. Similarly, for industries with a heavy focus on projects, monitoring on-hand inventory by project and task is important to ensure timely and cost-effective project completion.

In certain scenarios, when goods need to be returned to suppliers, the expectation might not be a replacement but rather a credit issued to the respective department or project budget. This ensures that previously used funds are returned to the budget so they can be allocated to other critical needs.

Update 25A introduced the ability to process returns to suppliers for credit in organizations without budget control or project-driven supply chain management. However, In this update, this functionality is extended a step further for you to perform similar credit returns even in organizations that utilize budget control and project-driven supply chain processes.

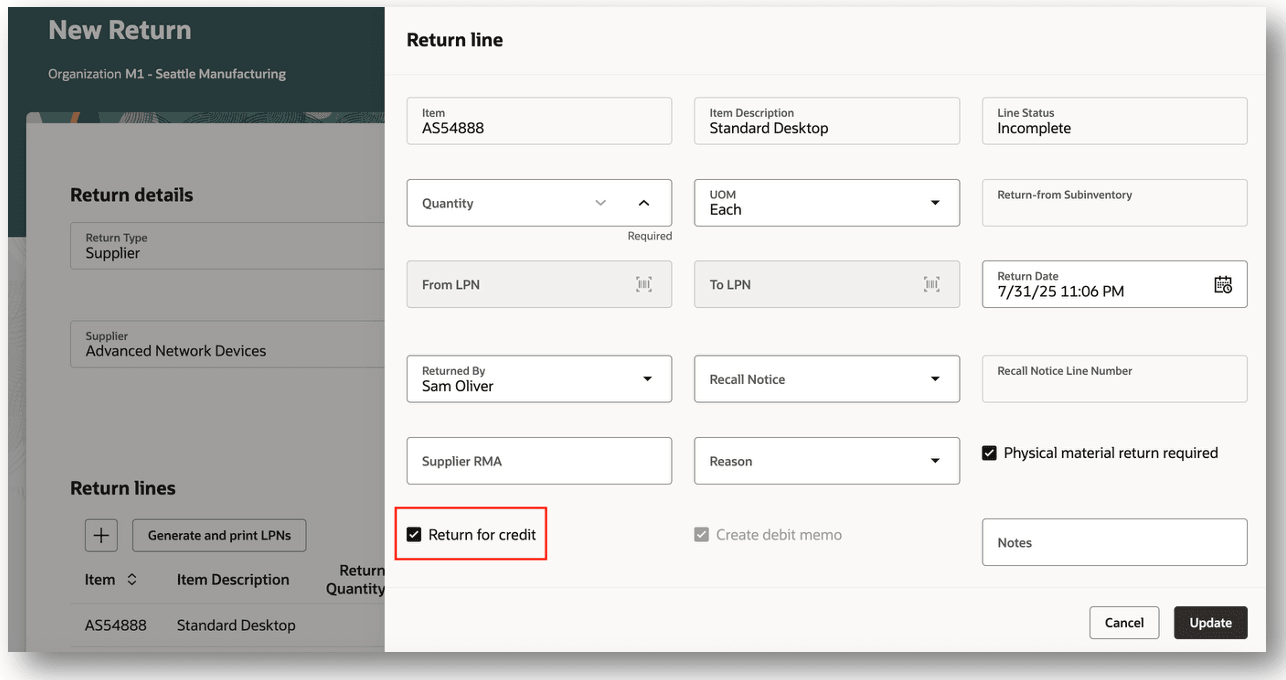

Return for Credit

Cost Management

In Cost Management, there are some considerations for return for credit scenarios. In the return for credit process, there is no change in receipt accounting for the purchase order receipts marked to be accrued at the end of the period. Regarding budgetary control, there will be no new obligation on the receipt return for credit event, only the expense will be reversed to recover budget balances. For retroactive pricing scenarios, there isn't a change in the logic to process retroactive price updates since it's based on the uninvoiced net receipt quantity.

Based on the timing of invoices, you might discover that some balances in accrual line type, which should be reconciled using the existing accrual clearing capability.

It's important to note that there won't be an accrual reversal booked for return for credit. This event won't be included in the accrual matching or reconciliation. The PO accrual account will be the default account for the trade clearing distribution, which will also be the default account in the automatically unmatched debit memo created from receiving in the Accounts Payables on the return for credit event from Receiving for the item expense line.

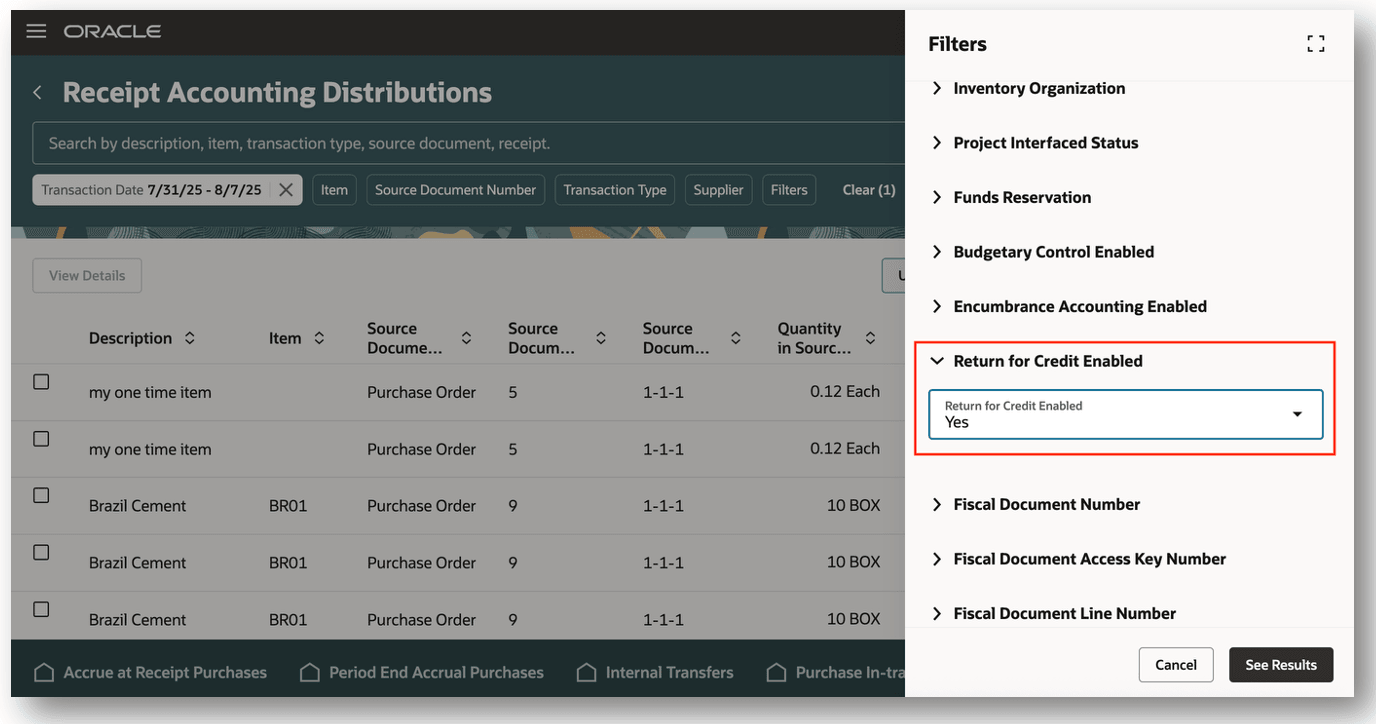

To assist Cost Accountants in managing the return for credit process, a return for credit indicator has been introduced. For example, the return for credit indicator is available as an additional accounting source in the receipt accounting subledger under receiving event class to support user configuration of accounts.

Additionally, the return for credit indicator is now a search attribute in the Receipt Accounting Distributions page for you to easily identify distributions specific to return for credit scenarios. Regarding receipt returns enabled for Projects, Budgetary Control, and Encumbrance. it will be recorded directly in Projects.

Automatic debit memos will be created for receipt returns. The debit memo created for the receipt return will be at the PO price as an unmatched invoice. Variances in the AP invoice won’t be reversed. Lastly, Cost Management will always perform an adjustment to inventory value on return using the original invoice value with IPV.

Receipt Accounting Distributions

Accounts Payable - Accrue on Receipt

When processing a return for credit in the Accounts Payable, there are some considerations for accrue on receipt scenarios. In accrue on receipt scenarios, the distribution account on the debit memo line will be the accrual account from the purchase order to adjust the accrual account generated in the Receipt Accounting.

In the event budgetary control is enabled for the purchase order and after the return for credit is initiated, an unmatched debit memo is created. However, the funds reservation against the return will happen in the Receipt Accounting or Cost Accounting based on destination type expense or inventory. This feature ensures that the debit memo lines sourced from Receiving due to return for credit and any related non-recoverable tax lines won't have funds reserved again in the Payables.

When a purchase order is linked to a specific project and task, the cost transfer to Project Costing will happen in the Receipt accounting or Cost accounting based on destination type expense or inventory. Debit memo lines sourced from Receiving due to return for credit and any related non-recoverable tax lines won't be transferred to Projects again from the Payables.

For Asset related purchase orders, if the capitalization is enabled at receipt, the debit memo lines sourced from Receiving due to return for credit, will not be transferred to Assets again from Payables. Similarly, for asset related purchase orders, when the capitalization is enabled at payables invoice, the debit memo lines sourced from Receiving due to return for credit, will be transferred to Assets from Payable.

Accounts Payable - Accrue at Period End

In non-accrual scenarios, the distribution account on the debit memo line will be the PO charge account to reverse the overstated PO charge account during original invoice creation. In the event when Budgetary Control is enabled for the purchase order, after the return for credit is initiated, the funds reservation against the return will happen in Payables for the unmatched debit memo. Any related non-recoverable tax lines will also be subjected to budgetary control in Payables.

When a purchase order is linked to a specific project and task, the cost transfer to Project Costing will happen in Payables for the unmatched debit memo. Any related non-recoverable tax line will be transferred to the Projects Costing in Payables. For asset related purchase orders, Debit memo lines sourced from Receiving due to return for credit, will be transferred to Assets from Payables.

The tax attributes associated with a debit memo line will be automatically copied from the purchase order line after the return for credit debit memo is imported into Payables. The taxes for the debit memo line will be recalculated in Payables based on the applicable tax rules based on the tax attributes. Invoice variances in the original purchase invoice will not be reversed through the return for credit debit memo. Currently, variances aren't reversed even for return to vendor automatic debit memo functionality since the debit memo is matched to the purchase order and not the parent invoice. To adjust the reversal of invoice variances in the debit memo, Payables users need to create adjustment entries manually on the debit memo.

Project Costing

When return for credits are made against project referenced purchase orders to a destination type of inventory or expense that accrues at receipt, the return details will be reflected in the Projects subledger based on the return transactions recorded in Receiving and Cost Management. Funds will be reserved for the returned amount against the project's control budget when budgetary control applies. Since the purchase order is not reopened in the case of returns for credit, the funds associated with the return for credit will not be reinstated as a purchase order obligation. It is important to note that the Accounts Payable does not interface to the Project Costing for the unmatched debit memo. Accounts Payable will also not reserve funds against the project control budget for the unmatched debit memo. This is because the return for credit detail is informed for the respective project, and funds reserved as part of the return transactions in Receiving, Cost Management, and Project Costing.

When a return for credit is made against a project referenced purchase order with destination type of expense that does not accrue at receipt, the return will be reflected in the Projects subledger based on the unmatched debit memo created in the Accounts Payable. When the project associated with the return is budgetary controlled, funds will be reserved for all amounts recorded on the unmatched debit memo in both Accounts Payables and Project Costing. Lastly, funds won't be reinstated for a purchase order obligation for returns that are made for credit.

This feature ensures that businesses with more complex financial and operational structures can also benefit from efficient return and credit management.

Steps to Enable and Configure

You don't need to do anything to enable this feature.

Tips And Considerations

- The Return for credit checkbox is applicable only if the status of the line being returned is delivered and the purchase order destination type is Inventory or Expense.

- Return for credit is not allowed under the following conditions:

- Purchase orders with destination type work order

- Organization is located in Brazil

- Business unit or the legal entity is enabled for delivery-based taxes

- Drop ship flows

- Consigned inventory flows

- Global procurement and intercompany flows

- Return of material residing in receiving subinventories

- Business unit or the legal entity is enabled for delivery-based taxes

- Retroactive pricing updates

- Organization is located in Brazil

- When a return for credit transaction is performed, a debit memo is created:

- An unmatched debit memo is automatically created in the Accounts Payable interface

- The invoice source will be Return for Credit

- You must run the Import Payables Invoices process to import the debit memo.

- The invoice number of the debit memo will be in the RFC - < Transaction Id of the Return to vendor receiving transaction> - < PO Number > format.

- The debit memo will have additional reference key columns to identify the purchase order and receipt details. These columns in the AP_INVOICE_LINES table will store these references:

- Reference_Key1= PO Header Id

- Reference_Key2= PO Shipment Id

- Reference_Key3= PO Distribution Id

- Reference_Key4= RCV Transaction Id

Key Resources

- Oracle Fusion Cloud SCM: Using Receiving guide, available on the Oracle Help Center.

- Oracle Fusion Cloud SCM: Implementing Manufacturing and Supply Chain Materials Management guide, available on the Oracle Help Center.

- Oracle Fusion Cloud SCM: REST API for Oracle Supply Chain Management Cloud, available on the Oracle Help Center.

- Oracle Fusion Could SCM: File-Based Data Import (FBDI) for SCM, available on the Oracle Help Center.

Access Requirements

Users who are assigned a configured job role that contains these privileges can access this feature:

- Manage Receiving Receipt Returns (RCV_MANAGE_RECEIVING_RECEIPT_RETURNS)

- Return Receipt with the Responsive Self Service Receiving Application (RCV_RETURN_RECEIPT_WITH_PWA)

- Return using Responsive Receiving (RCV_RETURN_RECEIVING_RECEIPT_PWA)

- Manage Self-Service Receiving Receipt Return (RCV_MANAGE_RECEIVING_RECEIPT_RETURN_SELF_SERVICE)

These privileges were available prior to this update.