Seller Drop Shipment Fiscal Documents

You can capture, process, and validate the following:

-

Drop ship sales fiscal documents

-

Complementary fiscal document for tax and price against a seller drop ship fiscal document

For this flow to work, you must have a drop ship agreement. When you create the agreement in Supply Chain Financial Orchestration, ensure that you use ASN as the ownership change event.

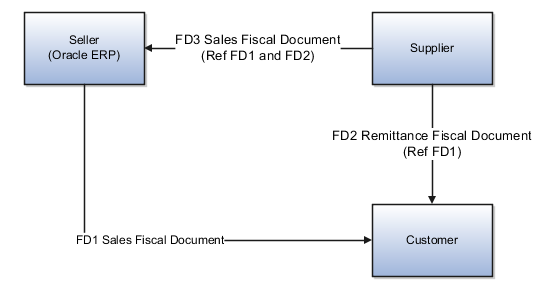

This figure shows the seller drop ship flow.

The process starts when a buyer raises a PO with a seller, who in turn asks the original supplier of the goods to send the goods directly to the buyer. The supplier informs the seller on their shipment readiness. The seller records an Advanced Shipment Notice (ASN) in the application to confirm the sale fulfillment and generates a Drop Ship Sales Fiscal Document (FD1) to buyer.

FD1 reference is shared with the supplier to ship the goods out of their warehouse. The supplier dispatches goods to the buyer location by generating a Drop Ship Remittance Fiscal Document (FD2) referring the Drop Ship Sales Fiscal Document (FD1). The supplier also generates a Drop Shipment Seller Fiscal Document (FD3) referring FD1 and FD2 for payment and sends to the seller.

The seller on receiving the Drop Ship Seller Fiscal Document (FD3) captures and validates it in the Oracle Fiscal Document Capture for fiscal compliance.

Drop Ship Seller Fiscal Document typically contains the material and tax amounts involved in the trade transaction, representing the sale value of the goods shipped by supplier against the drop ship purchase order. Upon validation, this fiscal document is used for the following:

-

Update fiscal references on the drop ship receipt in Receiving

-

Create a payables invoice in Payables

-

Report for applicable recoverable taxes in Tax

-

Cost the drop ship receipt value of the goods in Oracle Cost Management

You can create a complementary fiscal document for tax or price, and receive and validate this document for complementing price or tax of the seller drop shipment fiscal document.

Conditions for the Seller Drop Shipment Flow to Work

The following are the conditions for the seller drop shipment flow to work:

-

The supplier must send an ASN to the seller or the seller themselves should manually record ASN in the Receiving application just before the supplier is ready with shipment to customer.

-

When seller receives FD3 from supplier, as the XML document from supplier might not have ASN reference, the supplier will have to communicate ASN details separately to the Fiscal Document specialist. Fiscal document validation process uses the ASN information as one of key identifier to get the receipt quantities in Receiving. If there is any mismatch, the only option is that the Fiscal Document specialist must cancel FD3 and request for the correct FD from supplier.

-

For a drop ship flow, normally there will be no partial shipments against a PO schedule. However, if for any reason there are partial shipments against the PO schedule quantity, split the original PO schedule to match the shipment. This implies that ASN always matches the FD1, FD2, and FD3. For each shipment separate FD1, FD2, and FD3 are generated.

-

Based on the trade terms, freight can be paid by either customer or seller. In instances where seller pays the freight for a drop shipment to customer, the freight fiscal document will reference FD2, not FD3. Such freight cost is considered as freight for sale shipment and it's not added to the cost of the drop shipped item.

-

Return flow is similar to the regular standard fiscal document flow as there will be a physical return of goods from seller to supplier against the drop ship PO.