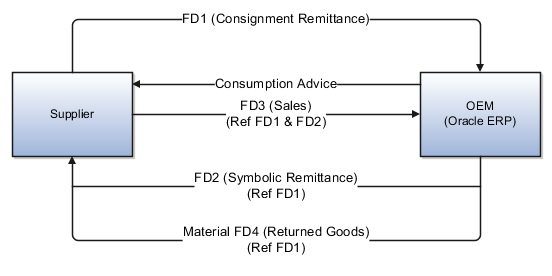

Supplier Consigned Receipt Flow

This flow involves the following steps:

-

Supplier issues a Consigned Remittance Fiscal Document (FD1) and delivers goods to the buyer as consigned in nature.

-

When buyer consumes the goods, they generate an outbound Symbolic Return Fiscal Document (FD2) indicating the ownership change, and sends to the supplier.

-

The supplier then generates Sales Fiscal Document (FD3) and sends to the buyer for payment.

-

Finally, buyer generates FD4 for any return of consigned goods to the supplier.

This figure shows the steps involved in a supplier consigned receipt flow.

Fiscal document capture handles transactions from the buyer's perspective. So the Fiscal Document Specialist captures FD1 and FD3 fiscal documents sent by the supplier to the buyer.

Consigned Remittance Fiscal Document (FD1)

FD1 contains information of the items and quantity sent on consigned and price-related information like Item price, Inclusive ICMS tax, Exclusive IPI tax, and charge lines like Freight, insurance, discount, and so on.

The ICMS and IPI taxes in FD1 are eligible for recovery. The Other Expenses charge in FD1 (Consignment Remittance fiscal document) will always be zero, because the Other Expenses in FD3 (Consignment Sales) will only accommodate the IPI tax amount.

Initially, only goods are sent without the ownership change. So, only a receipt is created, but not invoice.

FD1 can have charges that are allocated to the item lines, but as they're not accrued or paid to supplier, they aren't accounted as landed costs until the ownership change is recorded. However, they're accounted to Consigned Inventory Value to calculate the value of goods and for insurance purposes.

FD1 can only have quantity complementary fiscal documents.

Sales Fiscal Document (FD3)

As a buyer or manufacturer, when you consume goods, you generate an outbound Symbolic Return Fiscal Document (FD2) indicating the ownership change for the goods you have consumed, and send it to the supplier.

Supplier then creates corresponding sales fiscal document (FD3) based on FD1 and FD2, and sends it back to you. So there will always be a 1-1 match between FD2 and FD3.

The PIS and COFINS taxes are inclusive in nature and are eligible for recovery. There will be no complementary fiscal documents for FD3.

In Inventory, the consumption advice documents contain details of the goods consumed by you. This consumption advice generation will be based on the Consigned PO Agreement and the specified frequency.

In Accounts Payables, during tax calculation, the tax lines in FD1 (ICMS and IPI) are taken as delivery based taxes, and the tax lines in FD3 (PIS and COFINS) as non-delivery based taxes.

On consigned receipt, there is only ICMS tax line which is inclusive in nature. Therefore, Accounts Payables reverses the item accrual line based on the receipt, and generates variance lines for invoice-based PIS and COFINS taxes. Accounts Payables calculates the difference between the item prices on invoice for the corresponding receipt.

Let's consider a scenario where the item price is 50.00 Brazil Real and ICMS inclusive tax (at the rate of 10 percent of ICMS) is 5.00 Brazil Real. The raw price will be 45 Brazil Real, (that's, the difference between the Item Price and ICMS inclusive tax). If exclusive tax accrual is 5 percent of the IPI tax and IPI exclusive tax is 2.50 Brazil Real, once the seller sends FD3, the values are adjusted in the fiscal document as follows.

The following table displays the adjusted values in the fiscal document on receipt of FD3 from the seller:

|

Particulars |

On Receipt |

On Invoice |

|---|---|---|

|

Item price on fiscal document |

50 |

50 |

|

Raw item Price |

45 |

NA |

|

ICMS inclusive tax (at the rate of 10% ICMS inclusive) |

5 |

5 |

|

PIS Inclusive (at the rate of 5% PIS Inclusive) |

NA |

2.5 |

|

COFINS Inclusive ((at the rate of 5% COFINS Inclusive) |

NA |

2.5 |

|

Revised raw item price |

NA |

40 |

The following table displays the Accounts Payables distributions on receipt of FD3 from the seller:

|

Particulars |

On Invoice |

|---|---|

|

Reverse item price accrual (that's, price used on receipt) |

45 |

|

Favorable IPV line (that's, difference between the raw item price on receipt and invoice) |

-5 |

|

TRV line for taxes on invoice |

NA |

|

PIS |

2.5 |

|

COFINS |

2.5 |

For more information, see the Manage Receipt Accounting chapter in the Using Supply Chain Cost Management user guide.