Manage Credit Check

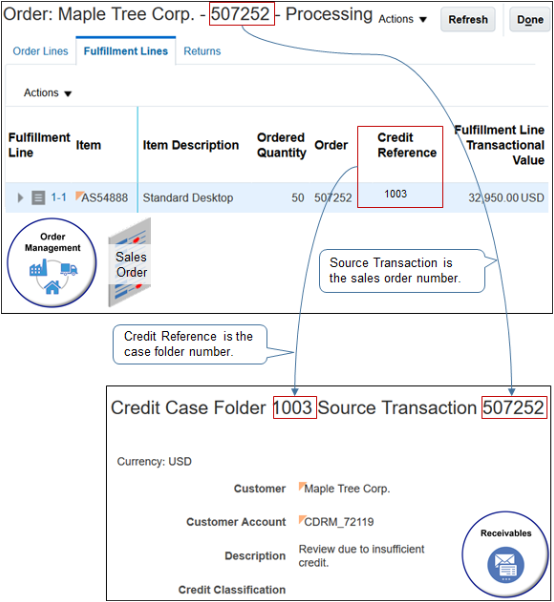

Use the fulfillment view to examine credit check details, including status updates.

Credit check is a calculation that determines whether the credit that's currently available for the customer account is equal to or greater than the transaction amount.

If your sales order requires credit check, then Oracle Accounts Receivable creates a case folder. A case folder is a page in Accounts Receivable that includes details about the customer, such as credit limit, credit rating, and so on, and the sales order. A credit analyst uses the case folder to determine the action to take, such as remove the credit hold, increase credit limit, and so on.

Note

-

Each case folder includes a unique number.

-

The Credit Reference attribute on the fulfillment line in Order Management references the case folder in Accounts Receivable.

-

The Source Transaction attribute in the case folder references the Sales Order Number attribute in Order Management. Accounts Receivable uses Source Transaction because an account might reference a transaction that's not a sales order in some other application.

Assume you create sales order 507252, it goes into credit check hold, a credit analyst releases the hold, and you must examine credit check details.

-

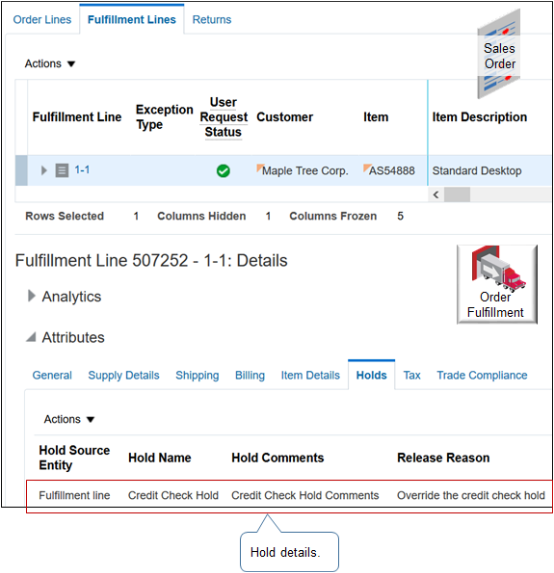

Examine hold details.

-

In the Order Management work area, on the Overview page, search for your sales order.

-

On the Order page, click Actions > Switch to Fulfillment View.

-

Click Fulfillment Lines.

-

In the Details area, click Holds, then examine hold details.

-

-

Examine the credit reference.

-

Click View > Columns, then add a check mark to Credit Reference.

The Credit Reference attribute displays the case number.

-

-

Get details about credit check.

-

Click Tasks > Manage Order Orchestration Messages.

-

On the Manage Order Orchestration Messages page, enter the value, then click Search.

Attribute

Value

Orchestration Order

507252

-

In the Search Results, click the row that contains this value.

Attribute

Value

Order Orchestration Function

Credit Verification

-

In the Fulfillment Task Messages area, examine the message.

For example:

Credit analyst Aaron Holmes approved the credit request for fulfillment line in sales order 507252. The credit analyst approved the amount 32,950.00, and then closed case folder 1003 on date 2018-04-11.You can't modify some sales order attributes when the sales order is on credit check hold because they affect credit check. For example, you can't modify Bill-to Customer, Ordered Quantity, UOM, and so on.

-

Credit Review Pending

The Credit Review Pending status means one or more order lines failed credit check when you submitted the sales order.

If you must change the sales order, use the Revert to Draft action, make your changes, then resubmit the sales order.

For example, you can reduce quantity. Reducing quantity reduces the extended amount and increases the likelihood that the order line will pass credit check.

Assume maximum credit for the customer is $10,000, the customer orders a quantity of 11 for an item that costs $1,000 each, which results in an extended amount of $11,000 that exceeds the credit limit. You can reduce quantity to 9 to bring the extended amount down to $9,000, which is below the credit limit.

Revise Sales Orders That Are Under Credit Check Review

Here's some of the revisions you can do.

-

Cancel the entire sales order.

-

Cancel the fulfillment line that's under credit check hold.

-

Revise attributes that don't affect credit check.

You can't revise these attributes because they affect credit check.

-

Bill-to Customer

-

Ordered Quantity

-

Ordered UOM

-

Transaction Currency Code

-

Extended Amount