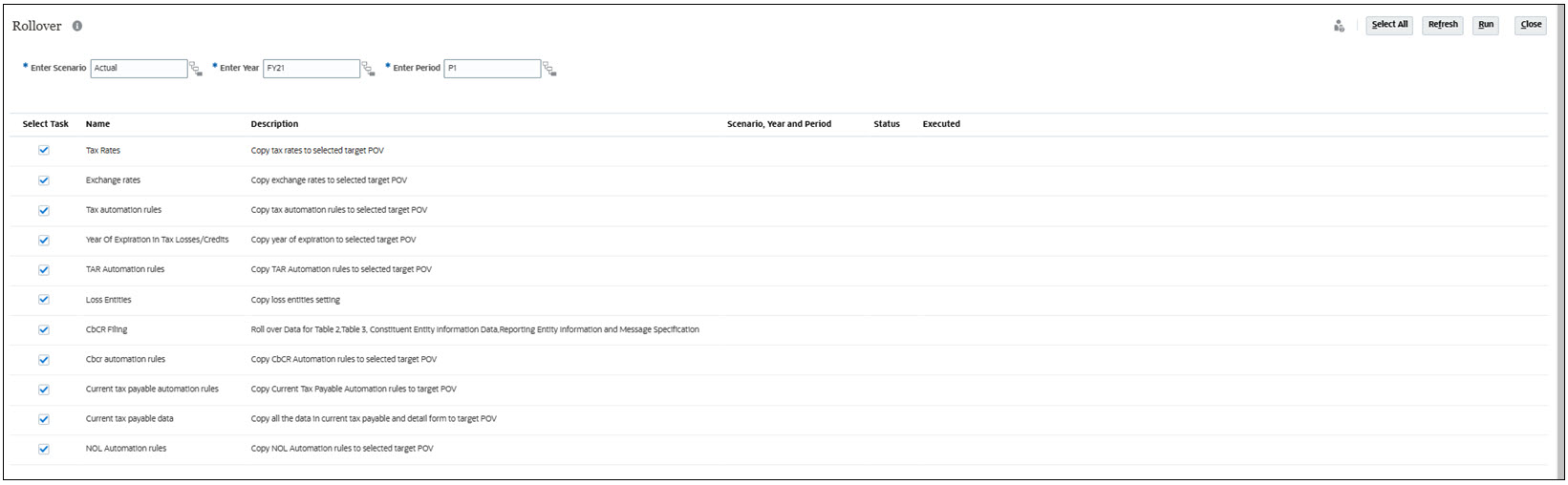

Performing a Rollover

The rollover must be performed by the System Administrator or a Power User.

To perform a rollover:

- From the Home page, select Application, then

Configuration, and then select

Rollover.

- On the Rollover screen, select the Target point of of view

where configurations will be copied to.

- Scenario --Select a scenario from the list of scenarios.

- Year --Select a year from the list.

- Period --Select a base period from the list of periods. The Target period is the selected period in the POV and the Source is the period prior to it. For example, for FY21 P1, the prior period is FY20 P12.

- Click to select the type of rollover you want to perform:

- Tax Rates-- Copy tax rates to the selected target POV

- Exchange Rates-- Copy exchange rates to the selected target POV

- Tax Automation Rules-- Copy tax automation rules to

the selected target POV

Note:

Before running the Tax Automation rollover, ensure that all level 0 entities including FCCS_Global Assumptions and No Entities are not locked for the target Scenario, Year, and Period. You must unlock them before you can complete the rollover. - Year of Expiration in Tax Losses/Credits-- Copy the Year of Expiration for any tax losses or credits to the target POV.

- Loss Entities-- Copy the loss entities setting.

- CbCR Filing-- Rollover the following Country by

Country Reporting forms:

- Table 2

- Table 3

- Constituent Entity Information

- Reporting Entity Information

- Message Specification

Note:

Table 1 is not rolled over because that data is entered for the new period. The rollover also excludes all unique elements that are specific for a particular reporting period/year/scenario, such as document reference ID’s, correction message ID’s, reporting Periods, Timestamps, and so on. These fields are a part of Further Information and Jurisdictional Documentation Specification reports which are not copied.Note:

Rollover also works for parent entity if data entry at parent entity is enabled. - CbCR Automation Rules-- Copy CbCR Automation Rules to

populate Table 1 data for the target period

Note:

Before running the CbCR Automation Rules, you must ensure the following conditions are met:- Ensure that all level 0 entities including FCCS_Global Assumptions and No Entities are not locked for the target Scenario, Year, and Period. You must unlock them before you can complete the rollover.

- Consolidation has been run on the Consol cube to update the CbCR cube.

-

Current Tax Payable Automation Rules-- Copy Current Tax Payable Automation rules to populate data for the target period. Select the Copy tax payable automation rules checkbox in the Rollover screen to copy the automation rules (copied from the prior period to the next period) that you defined in Current Tax Payable Automation form.

-

Current Tax Payable Data-- Copy all the data in current tax payable and detail form to populate data for the target period. Select the Current tax payable data checkbox, to copy all user entered data and not the automated data. Automated data gets populated only during consolidation.

Note:

- Roll over of Current Tax Payable Automation rules remains same. The only difference is in Current Tax Payable data when the user selects first as target period and rule as current tax payable data, the data of P12 of previous year is not copied.

- Automated data is not copied. Only user entered data is copied.

- NOL Automation -- Copy NOL Automation Rules to populate the data for the target period.

Note:

If you do not want to perform rollover for a particular rollover type, unselect that particular rollover by choosing the option Select All → unselect the option.Table 22-1 Examples of Roll Over of Current Tax Payable Automation Rules

Rule Name Target POV Expected Result Current Tax Payable Automation Rules Target POV: Actual, FY15,P2 Current Tax Payable Automation rules are copied from "Actual,FY15,P1" to "Actual, FY15,P2" Current Tax Payable Automation Rules Target POV: Actual, FY16,P1 Current Tax Payable Automation rules are copied from "Actual,FY15,P12" to "Actual, FY16,P1" Current Tax Payable Data Target POV: Actual, FY15,P2 Current Tax Payable data are copied from "Actual,FY15,P1" to "Actual, FY15,P2" Note:

Only user entered data is copied and not automated data.Current Tax Payable Data Target POV: Actual, FY16,P1 No data gets copied from "Actual,FY15,P12" to "Actual, FY16,P1" You can click Select All to select all rollover types at one time.

- Optional: Review the details for the previous rollover:

- Scenario, Year and Period - If this is the first time the rollover is being run, this column is blank.

- Status of the rollover.

- Date the rollover was executed.

- Click Run to perform the selected rollovers. When the rollover is complete, the Status and Executed date and time are displayed.

- Verify the Rollover results in the new period.

Note:

For CbCR Automation Rules, only the CbCR rules are copied. If you check the Data Status CbCR screen, no data in the new period is impacted. - Optional: For CbCR Automation Rules only, perform the

following steps to populate Table 1:

- Run Consolidation on the Consol cube.

- Run Consolidation on the CbCR cube. The CbCR Automation Rules pull the associated data to populate Table 1, and the Calculation status of the entities is updated to Impacted.