Configuring Other Accounts and Other Accounts Automation

Transfer book/tax accounts from provision into pillar two currency and Jurisdiction for reporting purposes.

Example: Combined reporting of country level current and deferred tax plus global minimum tax

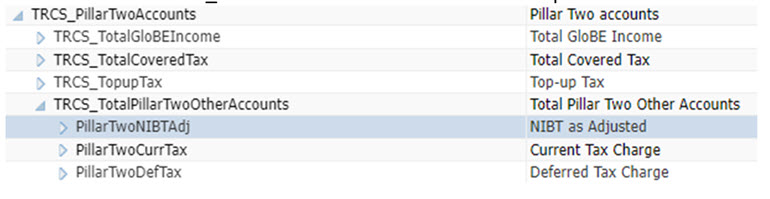

- Create members under "TRCS_TotalPillarTwoOtherAccounts" as required. See also: Working with Dimensions

and Working with Members

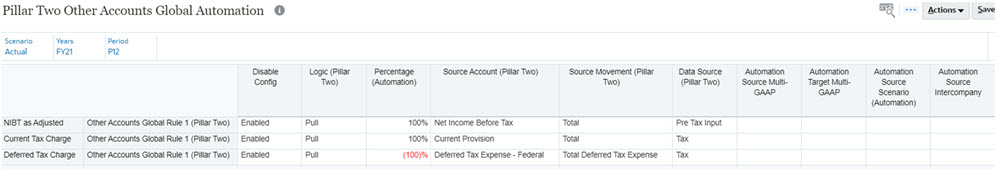

- Setup Other Accounts automation rules. You can set Global or Jurisdiction or Entity

rules for Adjustment accounts.

Note that:

- The Percent is limited to +/- 100%

- The Logic provides Pull and Average

- Pull: Pulls the balances from the source account

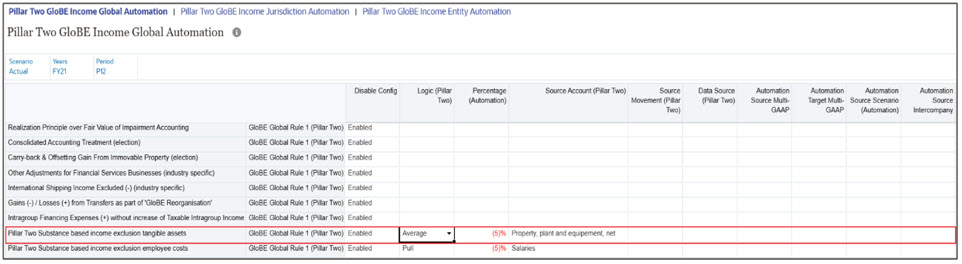

- Average: For Substance Based Income (SBIE) accounts, an

additional pillar two logic "Average" is available in Pillar Two

GloBE Income Automation. It calculates the average of the current

year and the prior year ending period (P12) values.

For example, if there is a value of Tangible Assets for Prior year (that is, FY23 / P12) = 3000 and for current year (that is, FY24 / P12) = 5000, then SBIE average = (3000+5000) /2 = 4000.

Based on "Percentage (Automation)" carve-out available for such accounts, that is, after average was calculated, the relevant amount should be multiplied with the percent entered in "Percentage (Automation)", carve-out, that is, after calculating the average value (4000 * - 5% = -200)

The example below shows a SBIE tangible assets account with Average logic.

Note:

The Average logic is available in all Pillar Two automation forms such as GloBE Income/Covered Tax/Other Accounts and Safe Harbors automation forms. - Source account is required.

- Source Movement: TRCS_SourceBookClosing (that is, parent of Trial balance closing, Book closing and Closing Book vs Tax Basis). This will be the default source movement when left blank.

- Source Data Source: TRCS_SourcePreTax (that is, parent of Total Data source including Data Input, Managed Input and Supplemental data). This will be the default source data source movement when left blank.

- Additionally data can be moved from between Multi-GAAP and/or Scenario

For example:

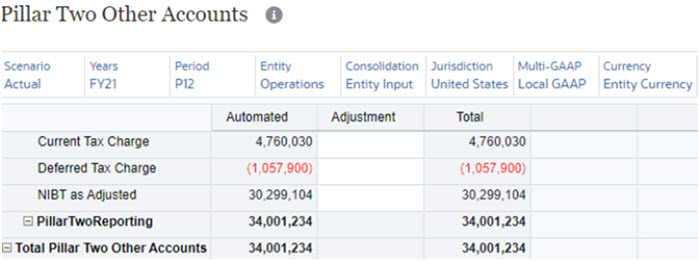

- Navigate to Home → Library and under Pillar Two → Pillar Two

other Accounts, and run consolidation to view the data pulling into other

accounts.

How it works:The Global rules when set are copied to the Jurisdiction and Entity level upon save. Global Rules can be disabled at the Jurisdiction or Entity level and then a new Jurisdiction or Entity Rule can be created to have an alternative calculation. The only detail that is allowed to be changed at the Jurisdiction or Entity level for a Global Rule is the Enabled/Disabled column.

Jurisdiction Rules can be disabled at the Entity level and then a new Entity Rule can be created to have an alternative calculation. The only detail that is allowed to be changed at the Entity level for a Jurisdiction Rule is the Enabled/Disabled column.

You can save the new Entity Rules at the Entity level. You can see the type of rule (that is, Global, Jurisdiction, and Entity) by looking at the rule name. You can also add additional rules to the metadata as needed.