Configuring GloBE Income and Covered Tax Automation

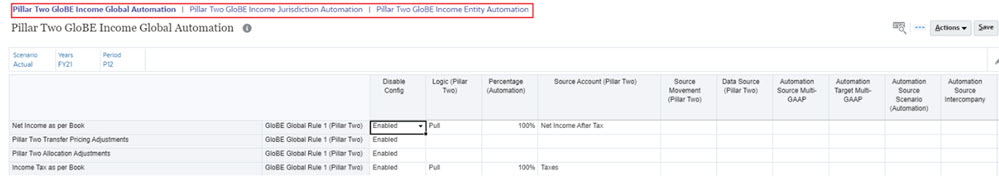

You can set Global or Jurisdiction or Entity rules for Adjustment accounts.

Note that:

- The Percent is limited to +/- 100%

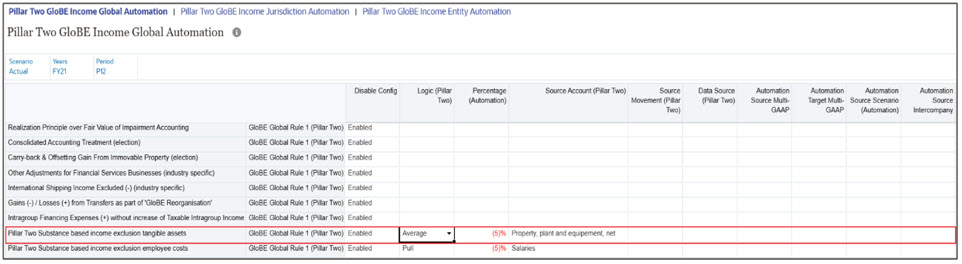

- The Logic provides Pull and Average

- Pull: Pulls the balances from the source account

- Average: For Substance Based Income (SBIE) accounts, an additional

pillar two logic "Average" is available in Pillar Two GloBE Income

Automation. It calculates the average of the current year and the prior year

ending period (P12) values.

For example, if there is a value of Tangible Assets for Prior year (that is, FY23 / P12) = 3000 and for current year (that is, FY24 / P12) = 5000, then SBIE average = (3000+5000) /2 = 4000.

Based on "Percentage (Automation)" carve-out available for such accounts, that is, after average was calculated, the relevant amount should be multiplied with the percent entered in "Percentage (Automation)", carve-out, that is, after calculating the average value (4000 * - 5% = -200)

The example below shows a SBIE tangible assets account with Average logic.

Note:

The Average logic is available in all Pillar Two automation forms such as GloBE Income/Covered Tax/Other Accounts and Safe Harbors automation forms. - Source account is required.

- Source Movement: TRCS_SourceBookClosing (that is, parent of Trial balance closing, Book closing and Closing Book vs Tax Basis). This will be the default source movement when left blank.

- Source Data Source: TRCS_SourcePreTax (that is, parent of Total Data source including Data Input, Managed Input and Supplemental data). This will be the default source data source movement when left blank.

- Additionally data can be moved from between Multi-GAAP and/or Scenario

The Pillar Two Automation works in the same way as Tax Automation in the tax provisioning process. The only difference is that in Pillar Two Automation, you have the column to select Source as a Data Source where it is either Pre-tax or Tax. The application ultimately processes the combined set of Global, Jurisdiction, and Entity Level Rules which are stored at the entity level. To see the set of rules applicable to an Entity you have to look at the Entity level rules which can be a combination of Global, Jurisdiction and Entity level rules enabled and/or disabled.

Note:

Pillar Two Automation rules at the parent tax calculations enabled entity calculates values in Entity Consolidation, when the trial balance from base entity is available. For example, if the trial balances are loaded at the base entity and parent entity is setup with Pillar Two Automation rule, then Pillar Two Automation rules will pull trial balance data in Entity Consolidation and posts to Pillar Two Account and Entity Consolidation .How it works: The Global rules when set are copied to the Jurisdiction and Entity level upon save. Global Rules can be disabled at the Jurisdiction or Entity level and then a new Jurisdiction or Entity Rule can be created to have an alternative calculation. The only detail that is allowed to be changed at the Jurisdiction or Entity level for a Global Rule is the Enabled/Disabled column.

Jurisdiction Rules can be disabled at the Entity level and then a new Entity Rule can be created to have an alternative calculation. The only detail that is allowed to be changed at the Entity level for a Jurisdiction Rule is the Enabled/Disabled column.

You can save the new Entity Rules at the Entity level. You can see the type of rule (that is, Global, Jurisdiction, Entity) by looking at the rule name. You can also add additional rules to the metadata as needed.

Note:

To configure Pillar Two without using Pillar Two automation rules you can enter data directly in the GloBE Income and Covered Tax Forms. The POV must be set to Entity, Jurisdiction, Entity Currency, and Entity Input to enter data.