Configuring Other Deferred Tax Movements for Covered Tax

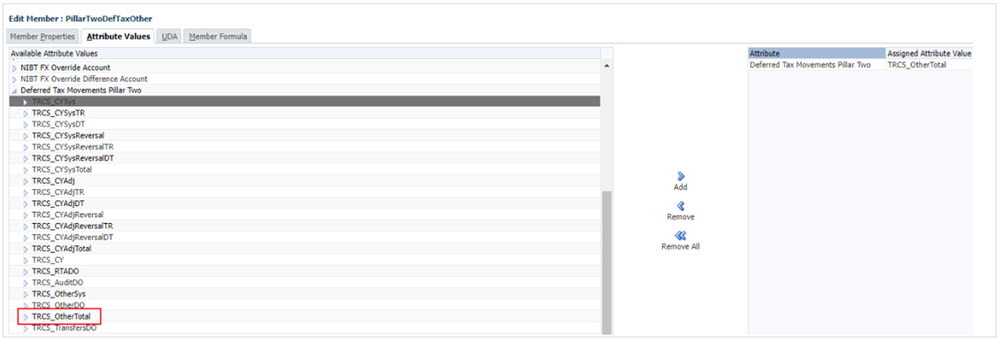

You can configure Pillar Two accounts to read from any deferred tax movement member for only Total Temporary Differences (Total GAAP to Stat and Total Stat to Tax). The example below explains on pulling Other Adjustments Total (TRCS_OtherTotal) from Deferred Tax Provision.

- Navigate to Dimension library and expand to the hierarchy

TRCS_TotalOtherDefTaxMovements as below:

- Click on Add to create a member and associate the member with the appropriate

deferred tax movement member as below:

Note:

Attribute "Deferred Tax Movements Pillar Two" is pre-populated with descendants of Deferred tax closing balance hierarchy. Any new custom movements created will be seen automatically.

- Save the member and Refresh database to commit the changes.

- Covered Tax form is setup to automatically show the members created under TRCS_TotalOtherDefTaxMovements

- Open the Covered Tax form and run Consolidate.

Note:

Deferred tax movement for pillar two configuration pulls Total Temporary differences value for the assigned deferred tax movement member.