Configuring Temporary Differences Movements for Covered Tax

You can configure Pillar Two accounts to read from temporary differences accounts by sharing either entire temporary differences GAAP to Stat and/or temporary differences Stat to Tax hierarchies, or by sharing selected temporary difference accounts from current provision.

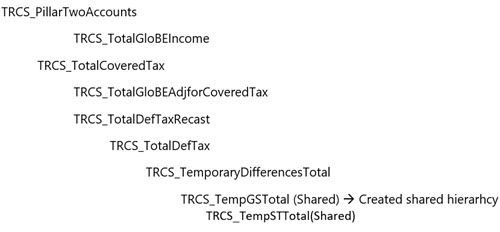

Below example explains on adding Temporary difference GAAP to Stat and Stat to Tax parents as a shared member.

- Navigate to dimension library and expand to the hierarchy

TRCS_TemporaryDifferencesTotal (as shown below).

- Save the changes and refresh data base.

- Navigate to the Covered Tax form and run the consolidation to pull the data of temporary differences current year movement including reversals (that is, stock compensation equity accounts).