Example: Use Case

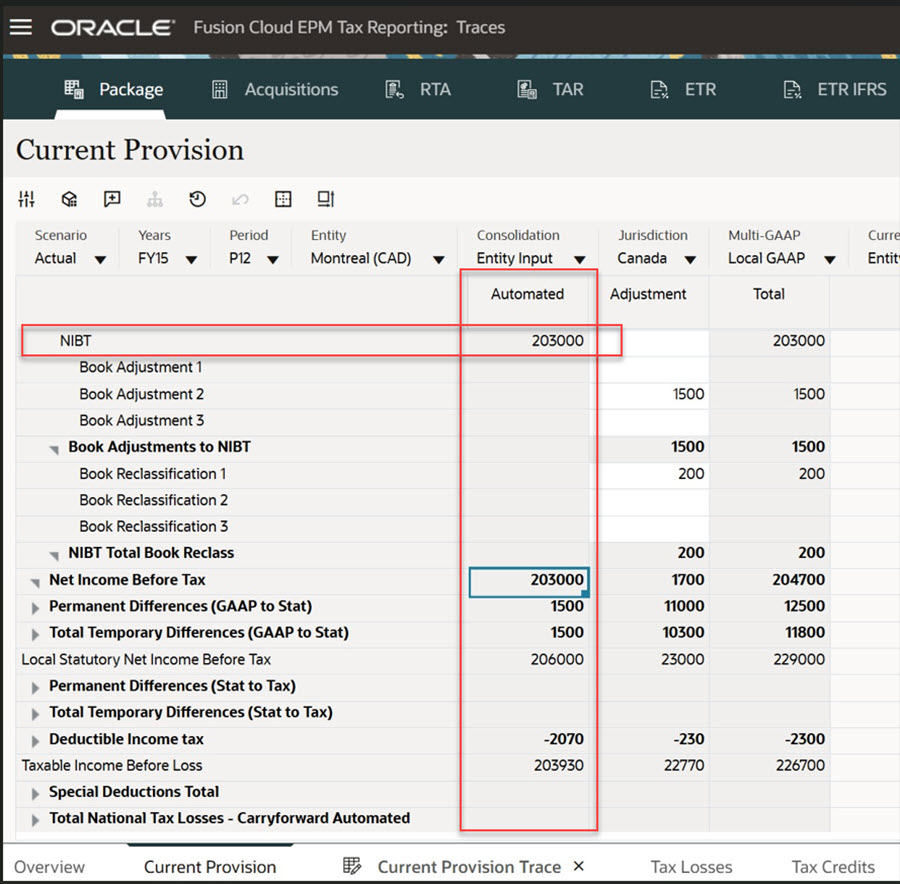

Let’s assume that you have a NIBT Expense and seeing a trend of it in for the current year, you notice that this account has a high\low value as compared to prior quarter and you feel that you would like to investigate.

With Tax Automation Trace:

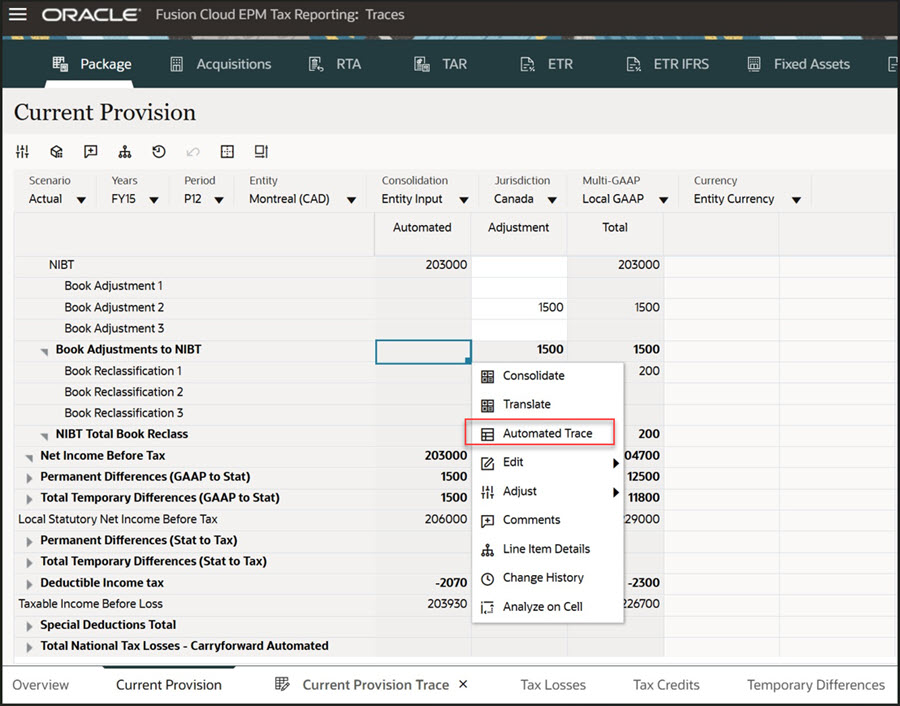

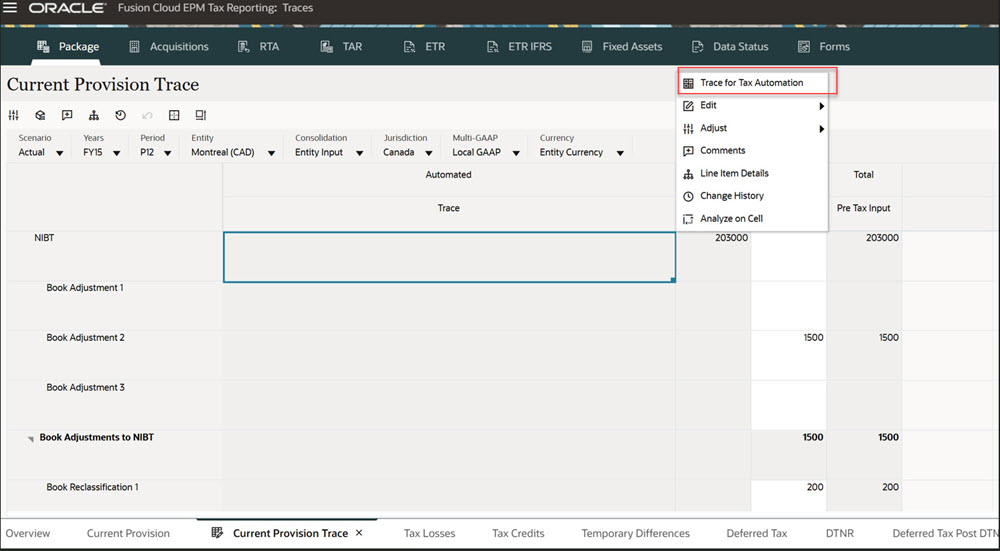

- You navigate to Tax Automation Trace form by using Automated Trace action menu or

right click on cell to open the Current Provision Trace form.

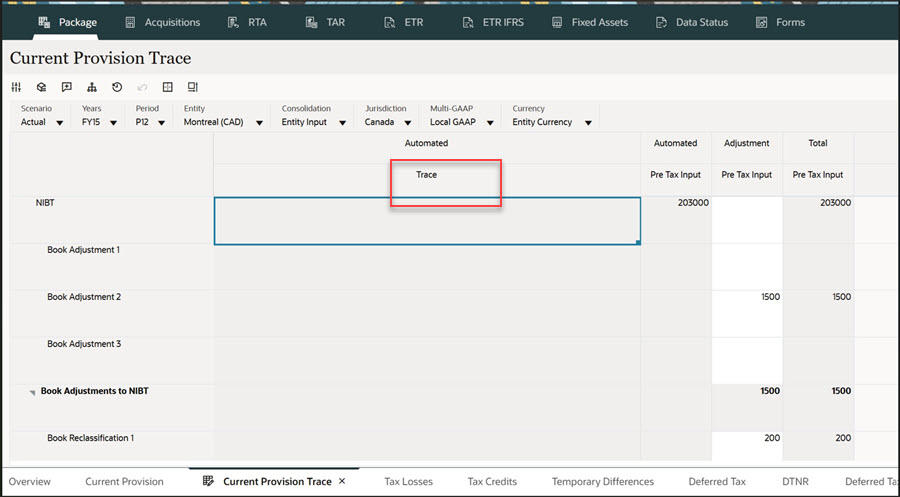

- On the Trace form you must run business rule Trace for Tax Automation.

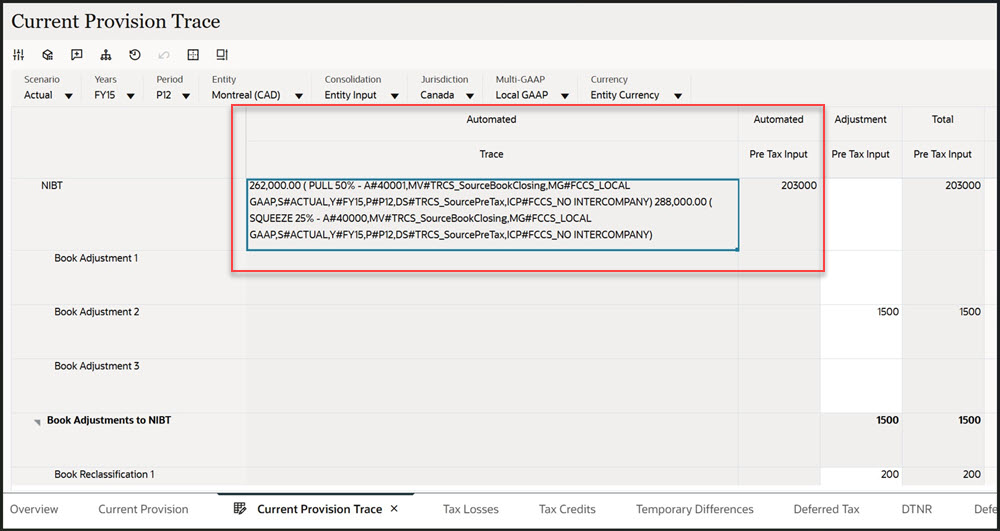

- On completion it will generate amount stored at source along with the source POV.

- You can now compare the source and target value side by side in a single form that is, Trace (source) vs Automated (target).

- You can look into Trace detail which shows Logic applied, Percentage of source amount and Source

POV.

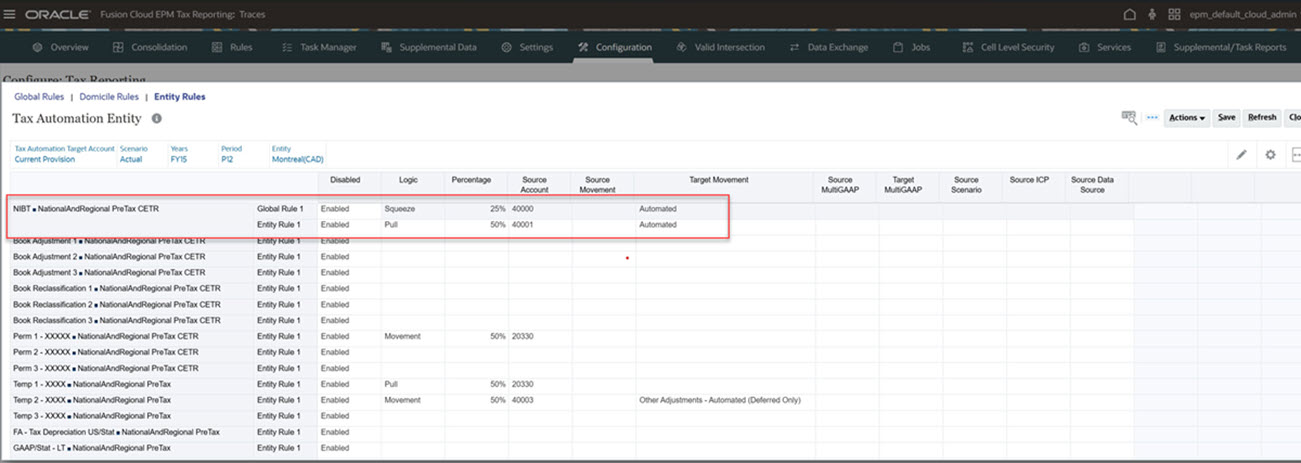

- If any issues are identified in the Trace information you can go to Tax Automation form and correct the mappings.