Learning About Tax Automation Trace

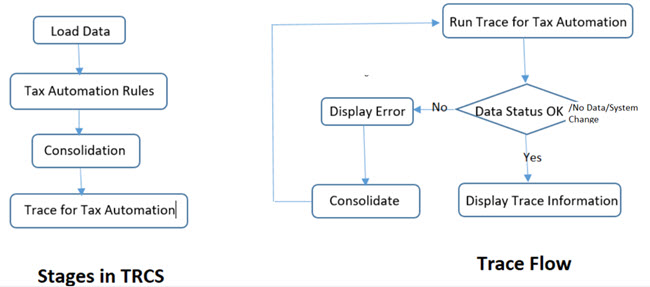

In Tax Reporting, you provide the mapping between tax and source account in the Tax Automation form and the Current Provision form shows the Tax account values. The Trace Automation option provides you a detailed information about how source data moves from book account to Tax Account, the logic, percentage etc. applied. Using trace automation the Administrator or the Power User can run Tax Automation for all entities, or for selected entities.

You can also use a trace capability to view the details of how the data is calculated based on the source data. From the Tax Automation Trace screen, you run the onDemand rule called "Trace for Tax Automation". This rule calculates the Tax Automation amount. After you run the onDemand rule, you can view the trace information.

Note that Trace information is available on a consolidated data. If data is not consolidated it will throw an error message.

Note:

- Only PULL, MOVE, and SQUEEZE rules are supported.

- Tax Automation Trace feature support is available only for Current Provision National.

- Tax Automation Trace will not be seen if there is no source data in custom dimension-enabled applications.

The following diagram is a graphical representation of the different stages in Tax Reporting and Trace Flow:

Restrictions:

- Trace is provided through Taxable Income only on the current provision form and not for any additional provisions items.

- Tax Automation Trace will not work for parent intersection. It will display for base members and Parent Tax Calculation entity only.