Setting up FX Rate by Source Account

To set up the FX rate by source account, follow the steps below:

- Tag the source data sources for source accounts:

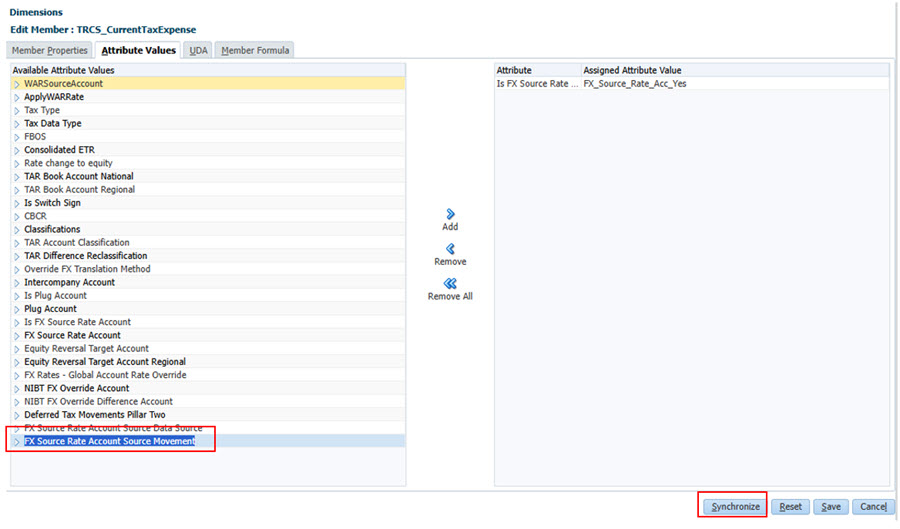

For any data source that will serve as a source for the source rate account, add the attribute: FX_Source_Rate_Acc_Source_DataSource_Yes. This can be any data source that is valid for tax accounts. It can be a parent or child but it if is a parent it must be dynamic calc. For example, configure TRCS_Tax as a source data source for the source FX rate Account for TRCS_NDefTaxTotal and TRCS_CurrentTaxExpense Accounts:

Note:

Best Practice: Apply FX_Source_Rate_Acc_Source_DataSource_Yes to the following Data Source: TRCS_Tax. - Optional: Tag the source movements for source accounts

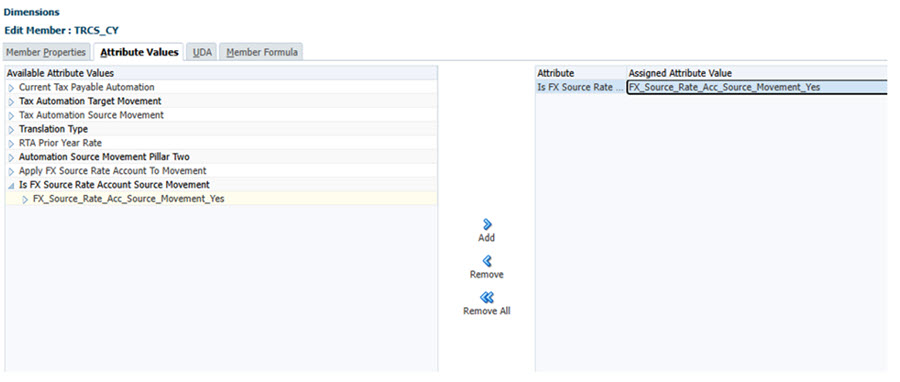

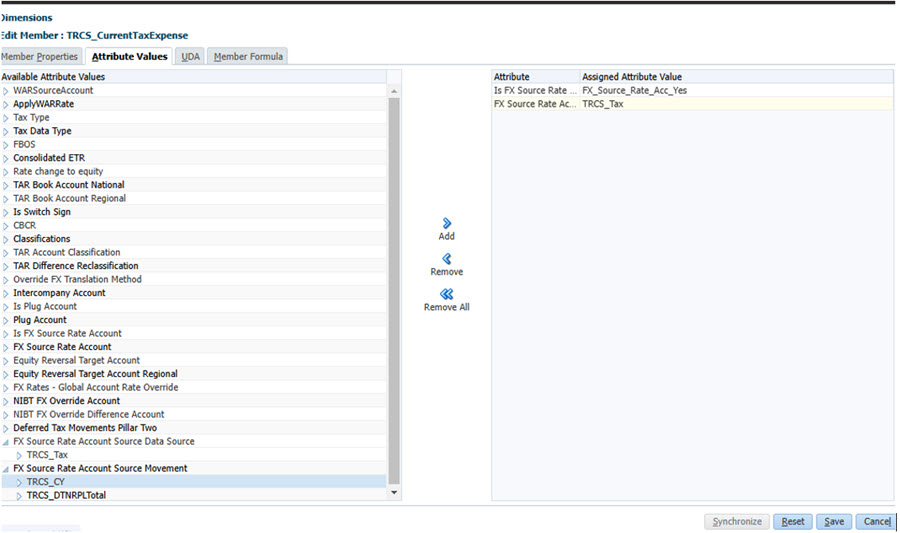

For any movement that will serve as a source for the source rate account, add the attribute: FX_Source_Rate_Acc_Source_Movement_Yes. This can be any movement that is valid for tax accounts. It can be a parent or child but it if is a parent it must be dynamic calc.

For example, configure TRCS_CY this is not needed unless you have a use case with an alternative movement:

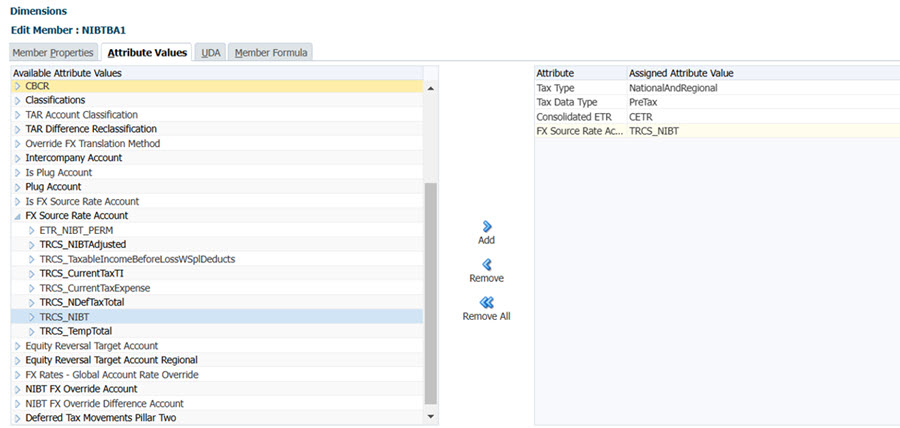

- Tag the Source Account

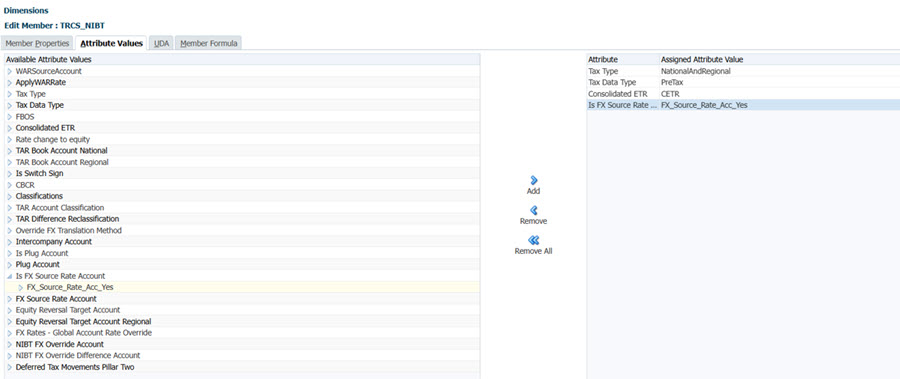

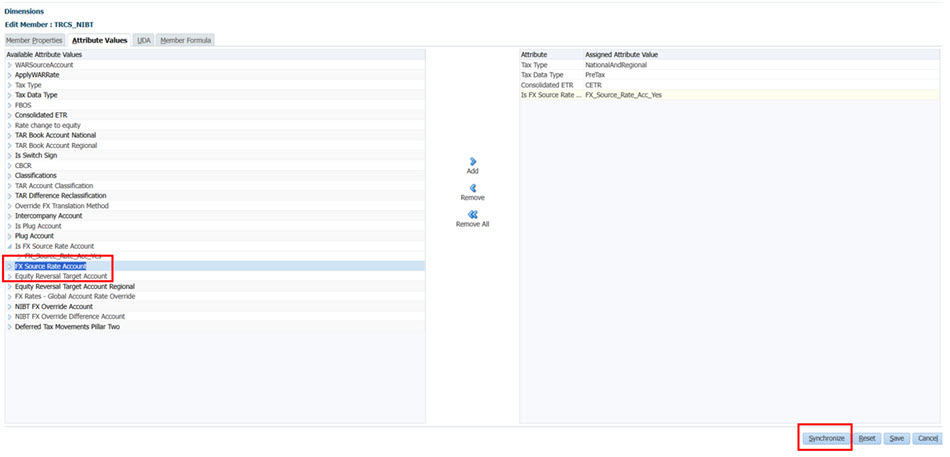

For any account that will be a source rate account, add the attribute: FX_Source_Rate_Acc_Yes. This can be any account that is valid for the Current Year Total Movement and can be a parent or child account. For example, configure NIBT as a source FX rate Account for NIBT Book Adjustments and NIBT Reclassification Accounts:

Note:

Best Practice: Apply FX_Source_Rate_Acc_Yes to the following Accounts:- Current Provision

- TRCS_NIBT

- TRCS_TaxableIncomeBeforeLossWSplDeducts

- TRCS_CurrentTaxTI

- TRCS_CurrentTaxExpense

- TRCS_NIBTAdjusted

- Deferred Tax: TRCS_NDefTaxTotal

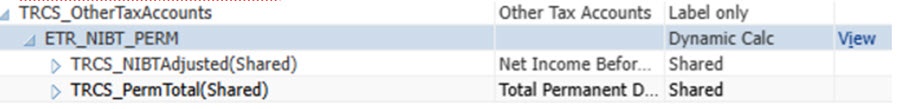

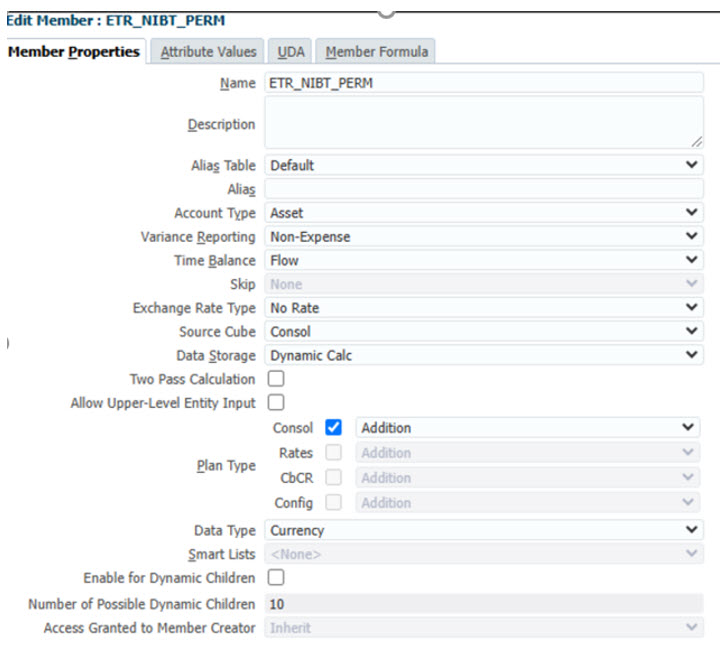

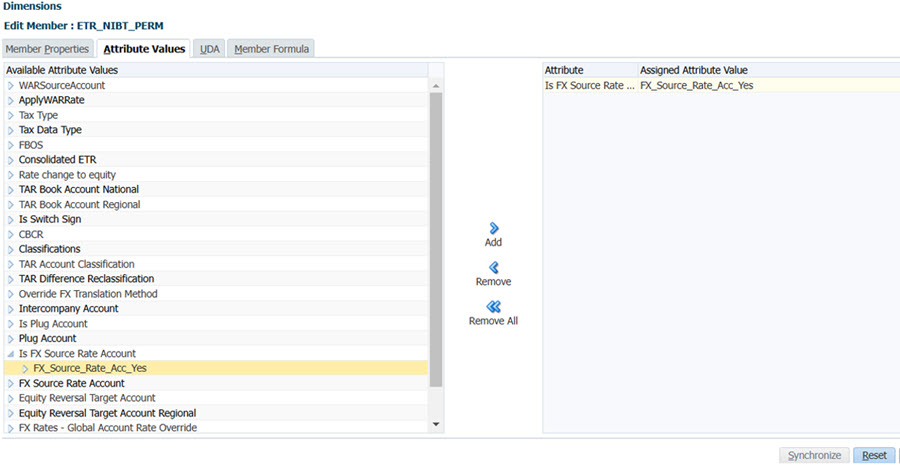

- Consolidated ETR: ETR_NIBT_PERM (New account for blended rate in the Consolidated ETR)

- Current Provision

- Create new source account FX members as needed

Create any new source accounts as needed as source rate accounts. For example, for the consolidated ETR form, create a new parent account ETR_NIBT_PERM to track the combine average rate of TRCS_NIBTAdjusted and TRCS_PermTotal as there is no out of the box system account that combines these two account. You need this to have the correct weighted rate for TRCS_TaxForeignRateDifference.

- Populate Source FX Rate Accounts

After configuring the Source FX Rate Accounts, you must synchronize the FX Source Rate Account attribute.

- Populate Source FX Rate Account Source Data Source

After configuring the Source FX Rate Account Data Sources, synchronize the FX Source Rate Account Source Data Source attribute:

- Optional: Populate Source FX Rate Account Source Movements

After configuring the Source FX Rate Accounts, synchronize the FX Source Rate Account Source Movement attribute:

- Select Source Account FX Rate Source Data Source

Select the source data source for all relevant source accounts:

Note:

Best Practice: Apply FX Source Rate Account Source Data Source TRCS_Tax to the following FX Source Rate Accounts:- TRCS_NDefTaxTotal

- TRCS_CurrentTaxExpense

- Optional: Select Source Account FX Rate Source Movement

Select the source movement for all relevant source accounts:

Note:

- Setting Source Account FX rate Source Movement is optional (if needed for customized use case).

- Creating a Source Account FX Rate Source Movement with a formula pointing to TRCS_AllRegional such as TRCS_ETR → TRCS_AllRegional for ETR can be used to tie together Regional and National translation.

- Select Source FX Rate Account for Target

Select the source account for all relevant target accounts, see below:

Note:

Best Practice: Apply Source Account FX rate to the following Target Accounts:- TRCS_NIBT (for example, Source Account)

- NIBTBA Accounts (for example, Target Account)

- NIBT Reclass Accounts (for example, Target Account)

- TRCS_NIBTAdjusted: TRCS_InterimTaxAEETRAdjustment

- TRCS_TaxableIncomeBeforeLossWSplDeducts: Loss Accounts

- TRCS_CurrentTaxTI: Credit Accounts

- TRCS_CurrentTaxExpense

- TRCS_TARFExpenseCurrent

- Cur Tax Payables

- TRCS_NDefTaxTotal

- TRCS_TARFExpenseDeferred

- TRCS_TARFDeferredNonCurrentAssets

- TRCS_TARFDeferredNonCurrentLiabilities

- ETR_NIBT_PERM: TRCS_TaxForeignRateDifference

- TRCS_NIBT (for example, Source Account)

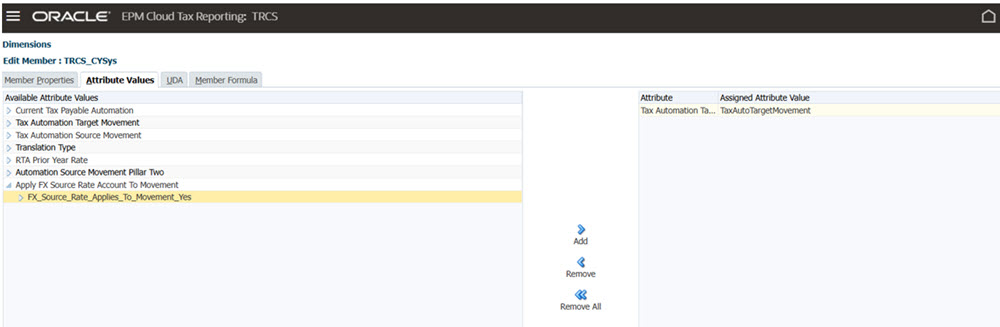

- Select Movements to apply Source FX rate Account Calculation

Apply FX_Source_Rate_Applies_To_Movement_Yes attribute to the Movements that use the Source Account FX rate Account. This attribute only applies to base level movement and not parents. For example, configure the source FX rate Account setting to apply to the Automated Movement (TRCS_CYSYS):

Note:

Best Practice: Apply Source Account FX rate to the following Movements:- TRCS_CYSys

- TRCS_CYAdj

- TRCS_DTNRCY

- TRCS_DTNRPY

- TRCS_DTNRCYNonPL

- TRCS_DTNRPYNonPL

- TRCS_ETR

- TRCS_PayTaxCharge

- TRCS_PayTaxChargeSys

- TRCS_PayTaxChargeOCIEq

- TRCS_PayTaxChargeOCIEqSys

- TRCS_PayRefRTA

- TRCS_PayRefRTASys

- TRCS_TLCCreatedAutomated

- TRCS_TLCCreated

- TRCS_InterimTotalAEETR