Working with Source Account Foreign Exchange (FX) Rate

Tax Reporting allows for a Target Account to use the same FX translation rate as another Source Account. In some cases, accounts need to match the FX rate of another account. This can be true for Credits, Losses, NIBT Book Adjustments, NIBT Reclassifications and others. The translated values must flow consistently from: Current Provision -> Deferred Tax -> ETR -> NOL/Credit Detail -> CTP -> TAR

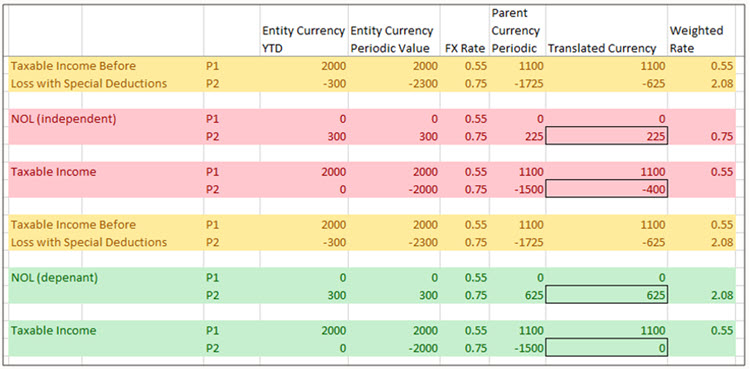

For example, see the screenshot below:

If NOL (see, Working with Net Operating Losses (NOL)/Credits) translates at a different FX rate versus Taxable Income Before Loss with Special Deductions, then you get an inconsistent value in Parent/Reporting Currency. However, if NOL translates using the rate of Taxable Income Before Loss with Special Deductions, then you get the correct Parent/Reporting Currency value for Taxable Income.

Related Topic: Setting up FX Rate by Source Account