Usecase Example: Allocation Process

For example:

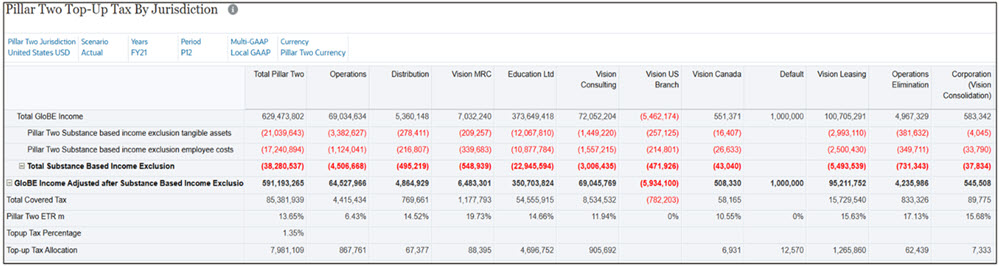

- Vision US Branch has Negative GloBE Income, hence no Top-up tax allocation

- Vision MRC with ETR above 15% will still be considered for Top-up tax allocation

- Default Entity with no covered tax and 0% ETR will still be considered for Top-up tax allocation

See the usecase example - Entity: LE101 (Operations)

- Entity GloBE Income : 69,034,634.00

- Aggregated Positive GloBE Income: 634,935,976.23 (sum of Operations: 69,034,634 + Distribution: 5,360,148 + Vision MRC: 7,032,240 + Education Ltd: 373,649,418 + Vision Consulting: 72,052,204 + Vision Canada: 551,371 + Deafult: 1,000,000 + Vision Leasing: 100,705,291 + Operations Elimination: 4,967, 329 + Corporation (Vision Consolidation): 583,342)

- Jurisdiction Excess Profit: 591,193,265.44

- Top up Tax % Rounded to 4 = 1.35%

- Entity level TopUp Tax = (591,193,265.44 * 1.35% = 7,981,109.08 ) * (69,034,634.00 / 634,935,976.23) => 867,761.4202