Example Use Case

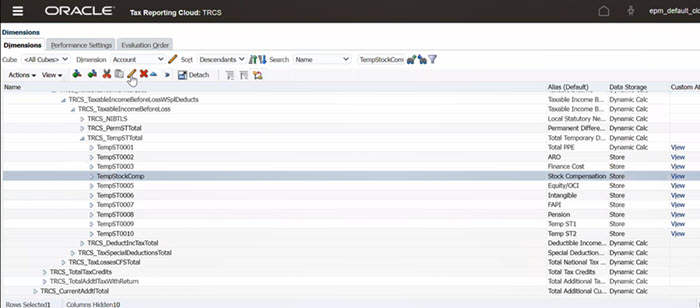

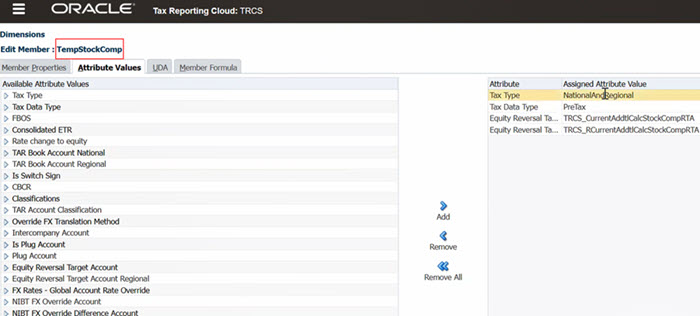

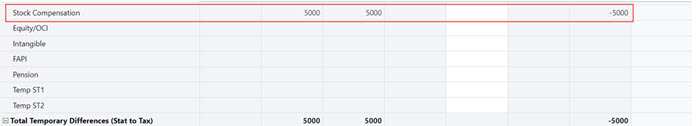

In the example below, you have set up (Stock Compensation) as Equity Reversal Target Account.

The equity reversal type is set for both National and Regional, so this Temp account is valid for both.

Note that, Stock Compensation is a temporary account.

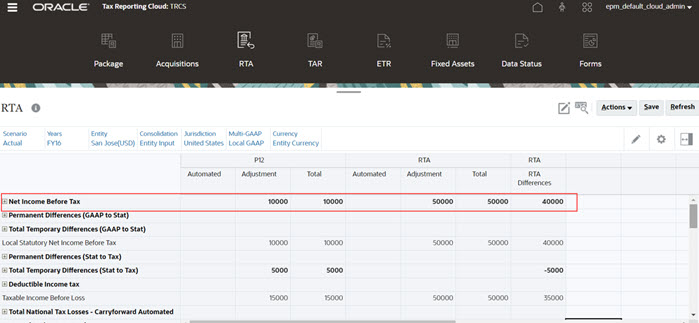

- For Actual FY16 P12 you have the following values:

- Net Income Before Tax (NIBT), Adjustment column shows: 10,000

- Stock Compensation: 5000

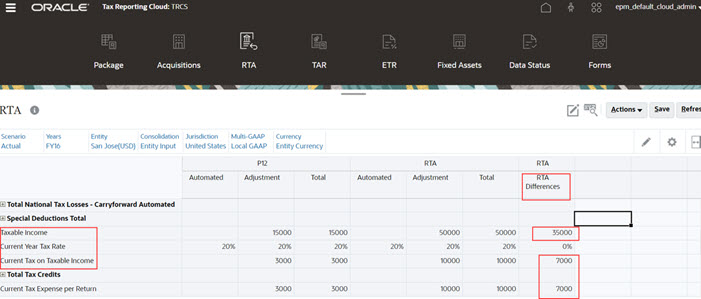

- For Actual FY16 P13 (RTA) you have the following values:

- Net Income Before Tax (NIBT), RTA Adjustment: 50,000

- Net Income Before Tax (NIBT), RTA Differences (RTA(P13) – P12): 40,000

During Current Tax Expense calculation the Stock Compensation (value: 5000) is also included (that is, 40000-5000=35000).

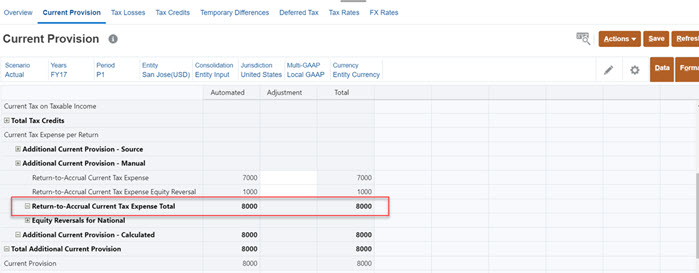

Note the following values in the screenshot below:

- Taxable Income, RTA Differences= RTA (P13) – P12: 40000-5000=35000

- Current Tax on Taxable Income, RTA Differences: 35000*20 (Current Year Tax Rate)/100=7000

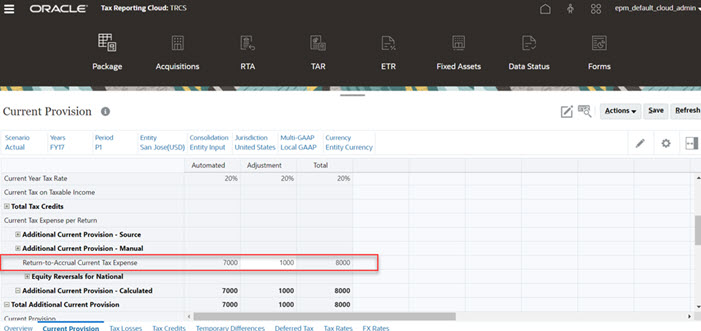

Now, in order to account for that you need to make a manual adjustment of 1000 (5000*20/100) as shown in the screenshot below.

Note that once you have enabled RTA Bifurcate, you do not need to make any adjustment since the values are pulled automatically.