Using RTA Bifurcate

- Create a TRCS application without enabling RTA Bifurcate feature. See Creating the Application.

- Navigate to Application->Configuration→Enable Feature. Select RTA Bifurcate and click on Enable. See Enabling RTA Bifurcate.

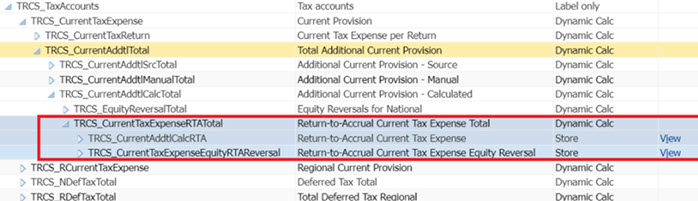

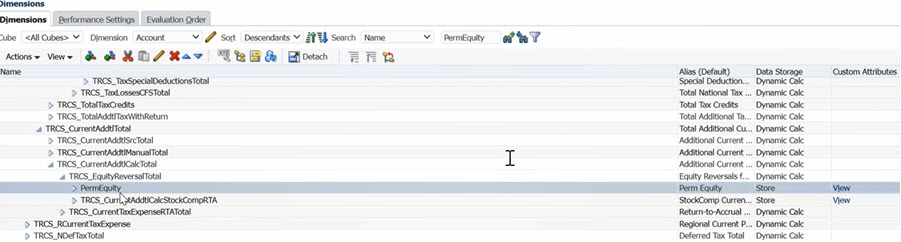

Notice the new metadata that gets created:

TRCS_CurrentTaxExpenseRTATotal, TRCS_CurrentTaxExpenseEquityRTAReversal, TRCS_CurrentTaxExpenseRTATotal(Shared), TRCS_RCurrentTaxExpenseRTATotal, TRCS_RCurrentTaxExpenseEquityRTAReversal and TRCS_RCurrentTaxExpenseRTATotal(Shared)

Note:

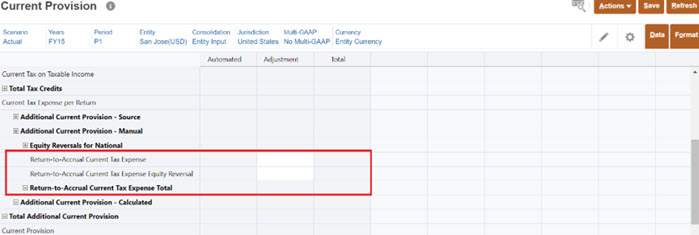

- Under Current Provision National, the hierarchy of Additional Current Provision calculated has a new child member. The following members are present in the Additional Current Provision calculated hierarchy:

- TRCS_CurrentTaxExpenseRTATotal

- TRCS_CurrentAddtlCalcRTA

- TRCS_CurrentTaxExpenseEquityRTAReversal.

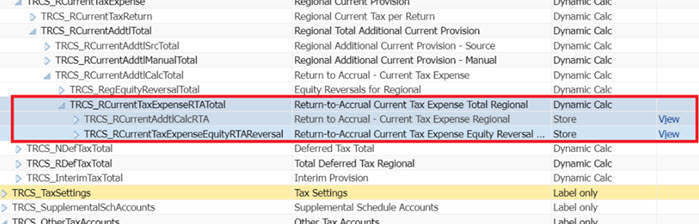

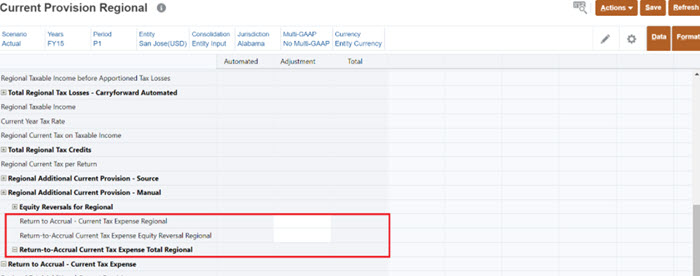

- Under Current Provision Regional, the hierarchy of Return to Accrual Current Tax Expense has a new child member. The following members are present in the Return to Accrual Current Tax Expense hierarchy:

- TRCS_RCurrentTaxExpenseRTATotal

- TRCS_RCurrentAddtlCalcRTA

- TRCS_RCurrentTaxExpenseEquityRTAReversal

- Under Current Provision National, the hierarchy of Additional Current Provision calculated has a new child member. The following members are present in the Additional Current Provision calculated hierarchy:

![]() Learn more about Tax Reporting by watching video: Overview: Working With Metadata in Tax Reporting

Learn more about Tax Reporting by watching video: Overview: Working With Metadata in Tax Reporting

Table 26-2 Using RTA Bifurcate

| Action | Result |

|---|---|

|

|

|

Note that:

|

| Navigate to ETR form. | The Return to Accrual Current Tax Expense Total is 8000 |

| Navigate to TAR form. | At Automated Total you see Income Tax Payable as -7000 and Equity Reversal as -1000 |

|

Note that:

|

| Navigate to ETR Regional form. | The Return to Accrual Current Tax Expense Total is 12000 |

| Navigate to TAR Regional form. | At Automated Total, Income Tax Payable is -10500 and Equity Reversal as -1500 |

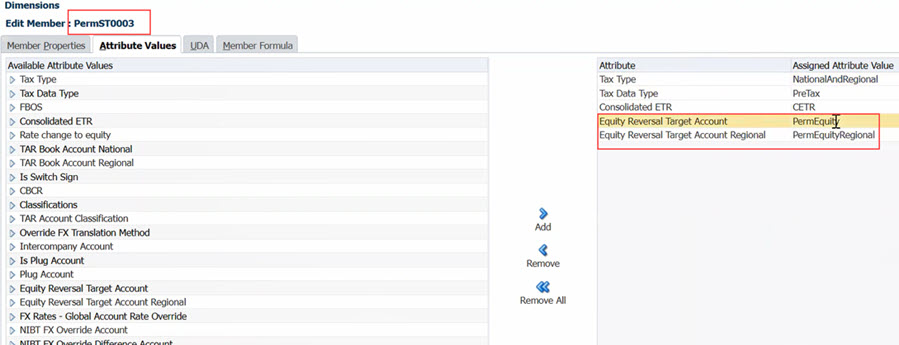

Now, follow the same steps for Permanent Acccount:

- Navigate to Dimension Editor and search for Permanent Account (PermEquity).

- Attach attributes Tax and National.

- Share this member under TRCS_CurrentAddtlMTotal.

- Edit any Perm accounts and attach the atrribute PermEquity and perform Refresh Database.

- For actual FY16 P12 have some data entered against Deductions for example, 3000.

- Run consolidation for Actual FY16 P13 and Actual FY17 P1.

- Navigate to Current Provision National.

- Ensure the Current Tax Expense value is sum of tax affected perm and temp accounts. Note that, Return to Accrual Current Tax Expense Equity reversal value as 1000(5000*0.2) + 600(3000*0.2)=1600

Note:

You can create a separate account for Regional and perform the same steps.