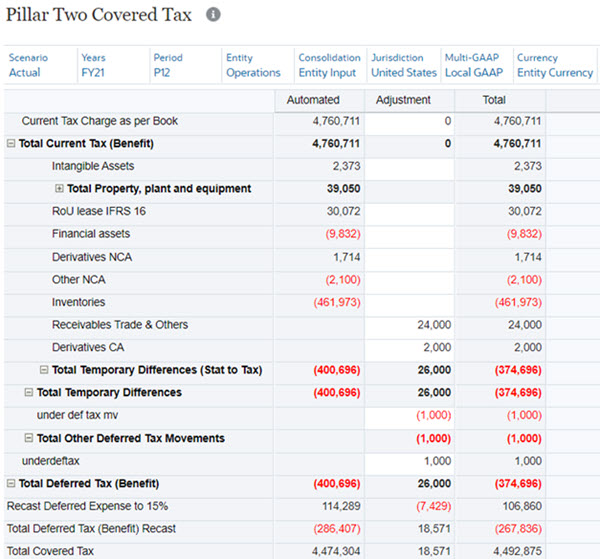

Working with Pillar Two Covered Tax

Covered taxes referred as taxes imposed on a in scope Entity's income or loss.

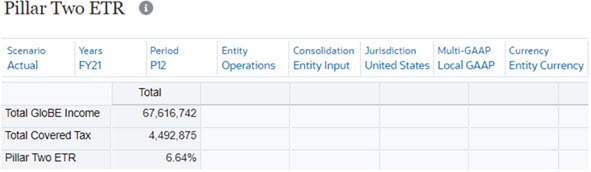

Pillar Two ETR

The Pillar Two Global ETR is determined by dividing the amount of covered taxes by the amount of income as determined under the GloBEIncome.

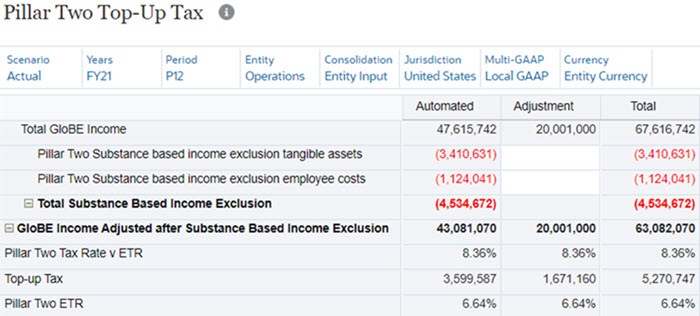

Pillar Two Top-up Tax

When the Entities ETR is below the Pillar Two tax rate, the Top-up tax percentage for the Entity must be calculated. This is computed by subtracting the ETR from the Pillar Two tax rate (for example, if the ETR is 10%, the Top-up Tax percentage is equal to 15% - 10% = 5%).

Top-up Tax % = Minimum Pillar Two rate - Entities ETR

The Top-up Tax percentage is then multiplied by the total income in the jurisdiction to determine the amount of Top-up Tax.

The total income for the Entity is equal to the GloBE Income less the Substance Based Income Exclusion (that is, an excluded routine return on tangible assets and payroll).

See also: Calculating Recast