Working with Pillar Two Forms

The following forms are available:

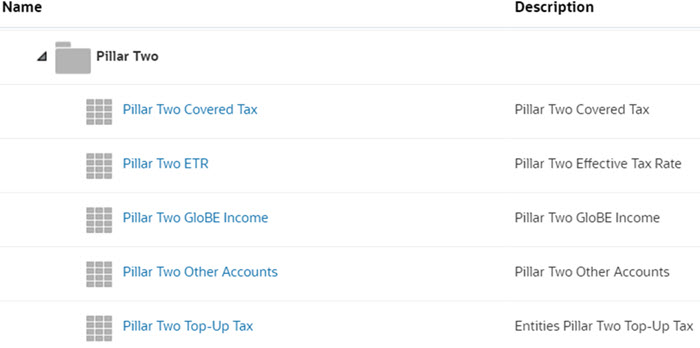

Pillar Two

- Pillar Two Covered Tax

- Pillar Two ETR

- Pillar Two GloBE Income

- Pillar Two Top-Up Tax

- Pillar Two Other Accounts

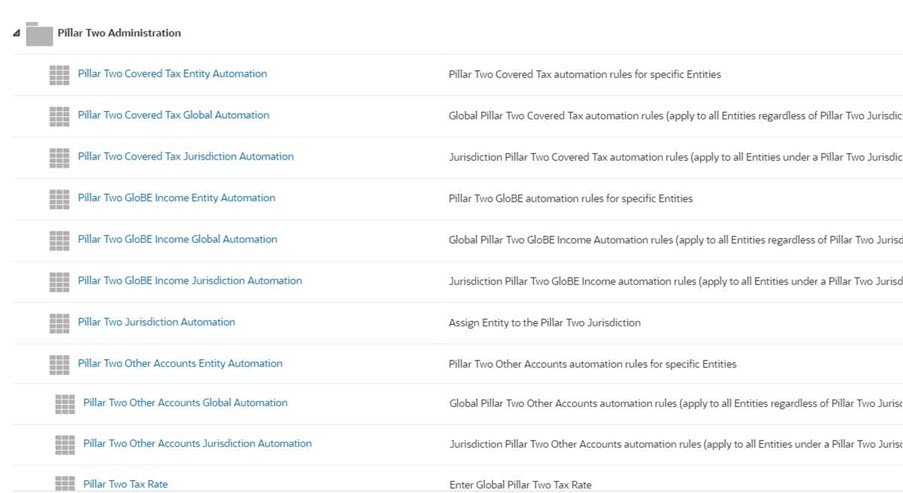

Pillar Two Administration

- Pillar Two Covered Tax Global Automation: Global Pillar Two Covered Tax Automation rules (apply to all Entities regardless of Reporting Jurisdiction)

- Pillar Two Covered Tax Jurisdiction Automation: Jurisdiction Pillar Two Covered Tax Automation rules (apply to all Entities under a Pillar Two Jurisdiction)

- Pillar Two Covered Tax Entity Automation: Pillar Two Covered Tax Automation rules for specific entities

- Pillar Two GloBE Income Global Automation: Global Pillar Two GloBE Income Automation rules (apply to all entities regardless of Reporting Jurisdiction)

- Pillar Two GloBE Income Jurisdiction Automation: Jurisdiction Pillar Two GloBE Income Automation rules (apply to all entities under a Reporting Jurisdiction)

- Pillar Two GloBE Income Entity Automation: Pillar Two GloBE Automation rules for specific entities

- Pillar Two Other Accounts Global Automation: Global Pillar Two Other Accounts Automation rules (apply to all entities regardless of Reporting Jurisdiction)

- Pillar Two Other Accounts Jurisdiction Automation: Jurisdiction Pillar Two Other Accounts Automation rules (apply to all entities under a Reporting Jurisdiction)

- Pillar Two Other Accounts Entity Automation: Pillar Two Other Accounts Automation rules for specific entities

- Pillar Two Jurisdiction Automation: Assign entity to the Pillar Two Jurisdiction

- Pillar Two Tax Rate: Enter Global Pillar Two Tax Rate