Add India as a National Jurisdiction

National jurisdictions categorize the provision for income tax at a federal or country level.

To add India as a national jurisdiction:

-

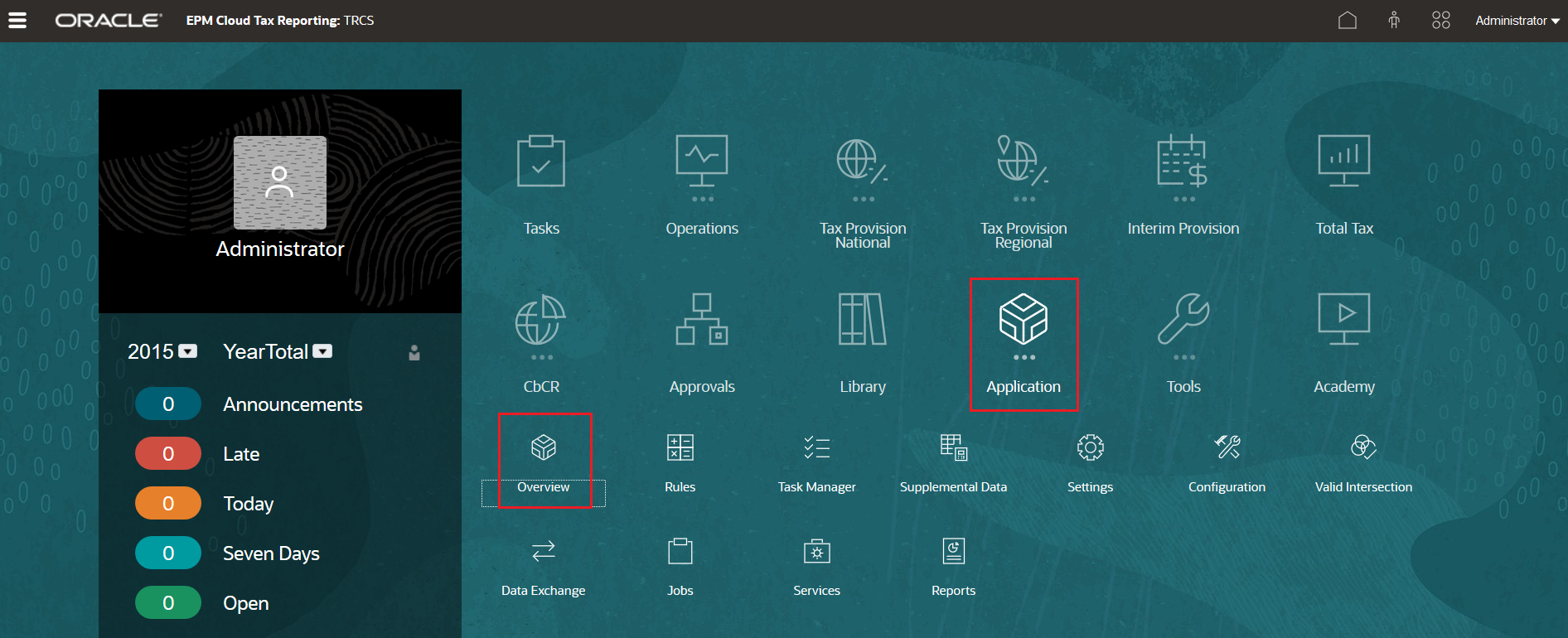

On the Tax Reporting Home page, select Application, and then select Overview.

-

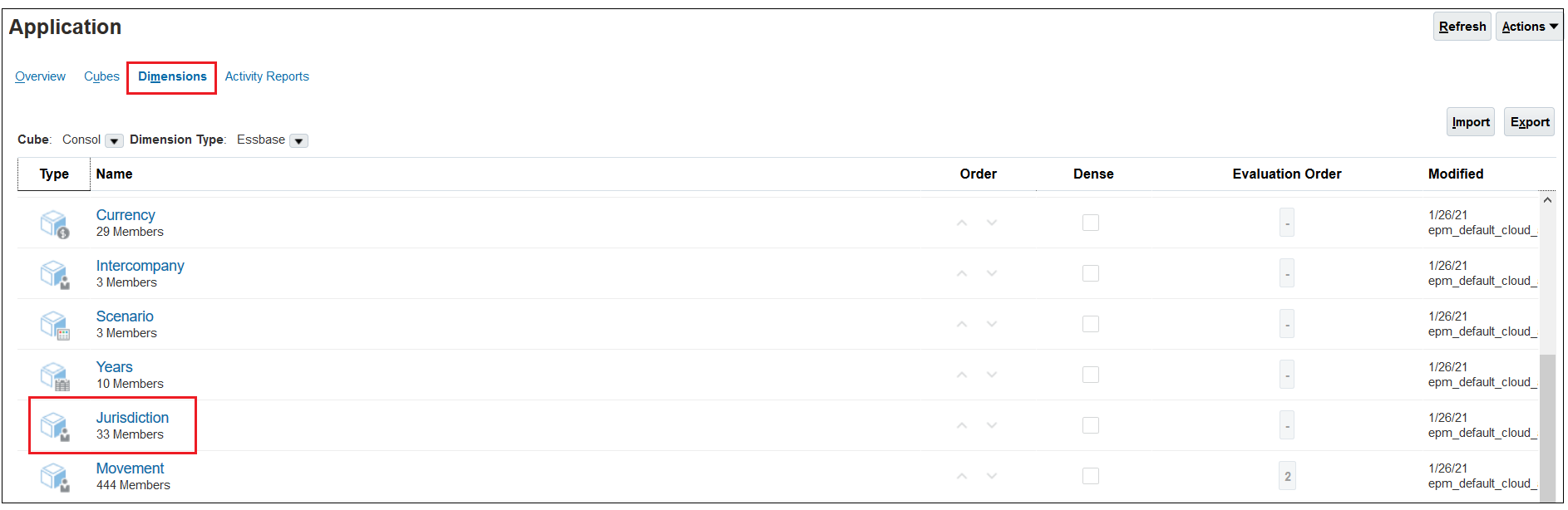

On the Application page, select Dimensions, and then scroll down and select jurisdiction.

-

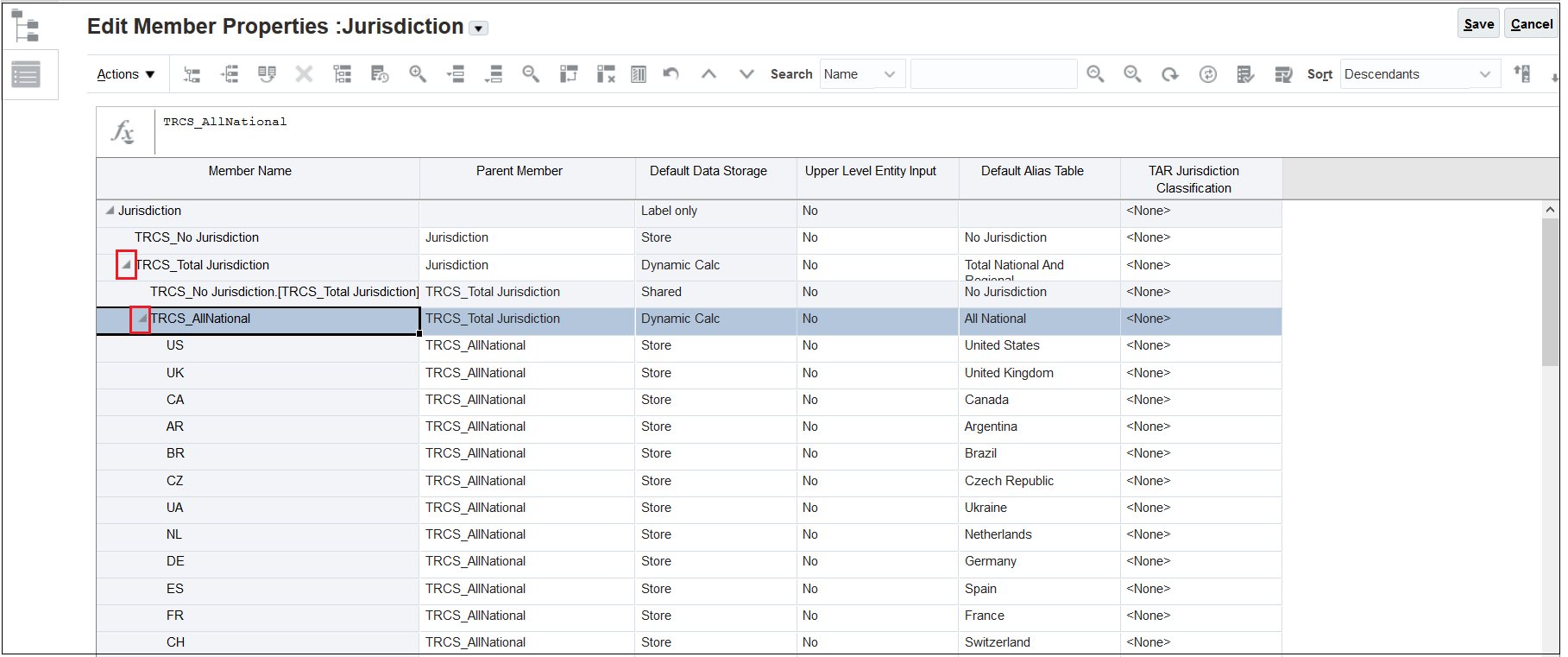

Expand TRCS_Total Jurisdiction, and then expand TRCS_AllNational.

-

Click

(Add Child button).

(Add Child button).

-

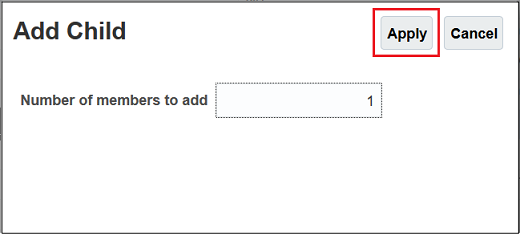

In the Add Child dialog box, since we are just adding one member (India), click Apply.

-

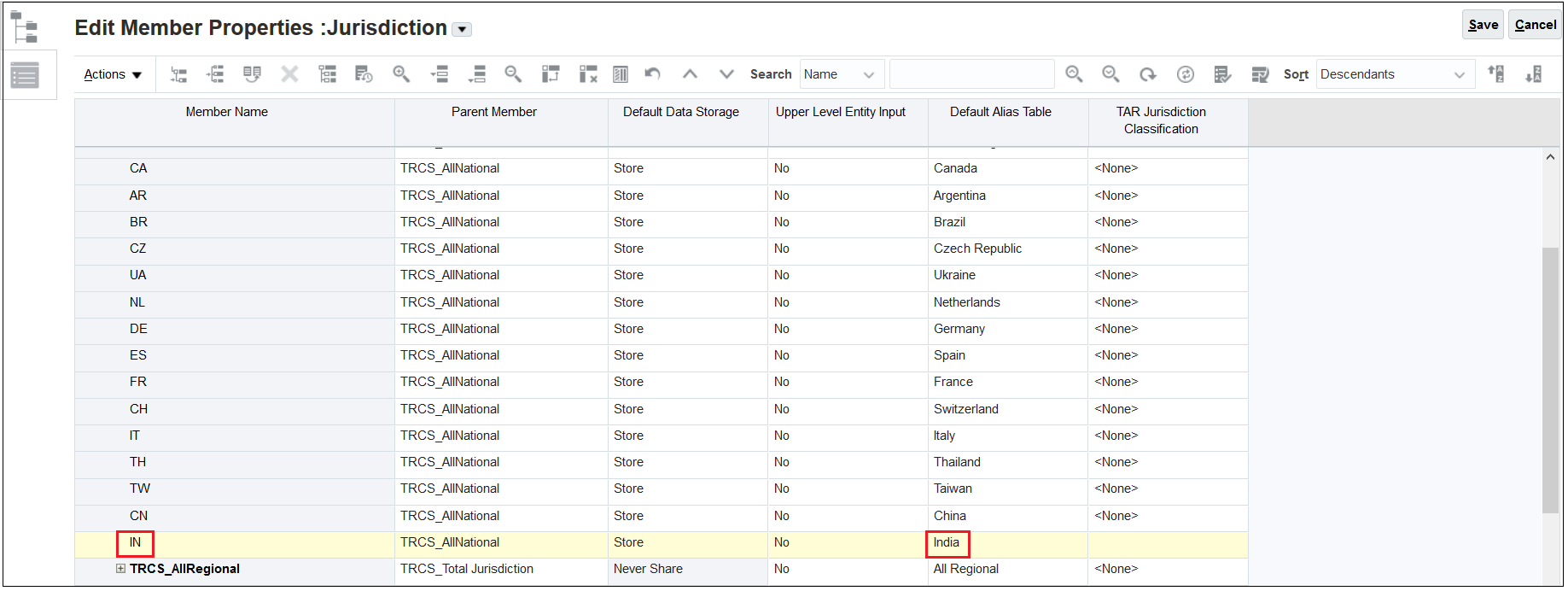

Enter IN for the Member Name and India for the Default Alias Table.

When adding a national jurisdiction, best practices are to use two-character ISO codes for the jurisdiction name.

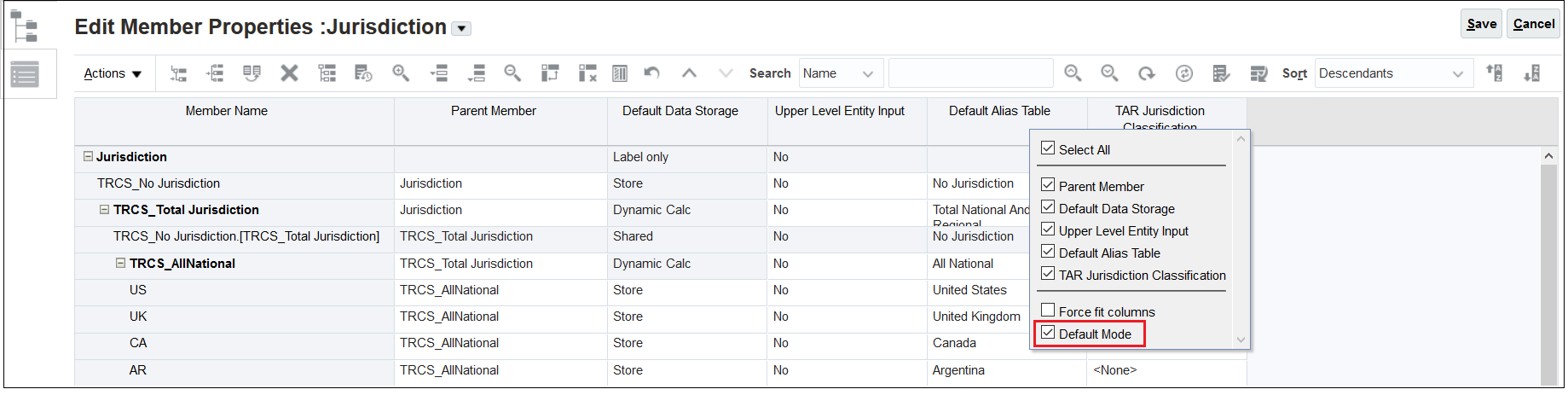

Note that when editing member properties, the default view shows columns for the most frequently-edited properties. To view columns for additional properties, right-click a column heading, and then clear Default Mode.

For example, right-click Default Alias Table. Notice that Default Mode is selected.

In this example, since we don’t need to add columns to modify additional properties, we will leave Default Mode selected. Click the Default Table Alias column heading (or any other column heading) to close the pop-up menu.

-

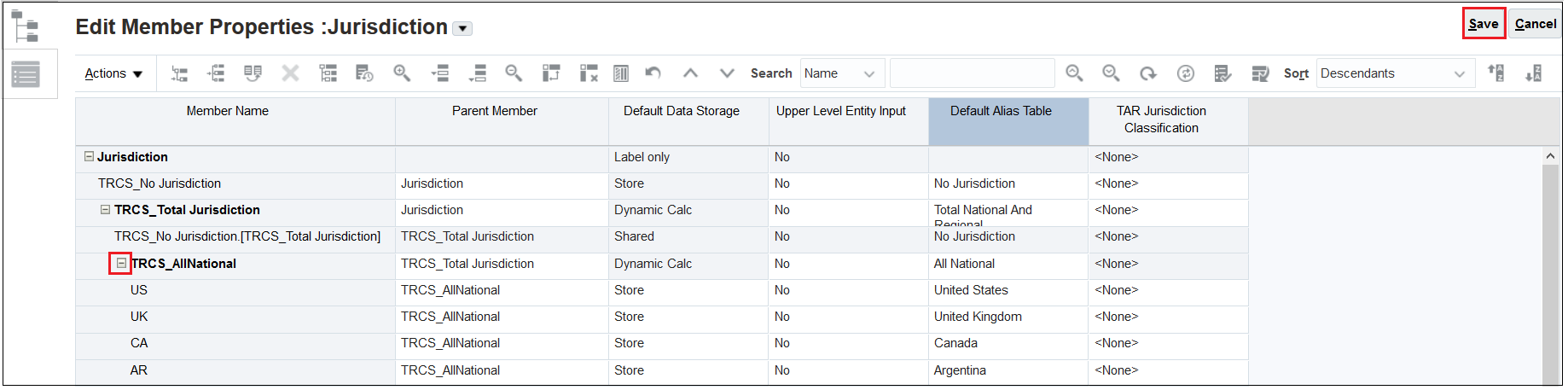

Click Save to save the India national jurisdiction we just entered, and then click the arrow next to TRCS_AllNational to collapse the view.