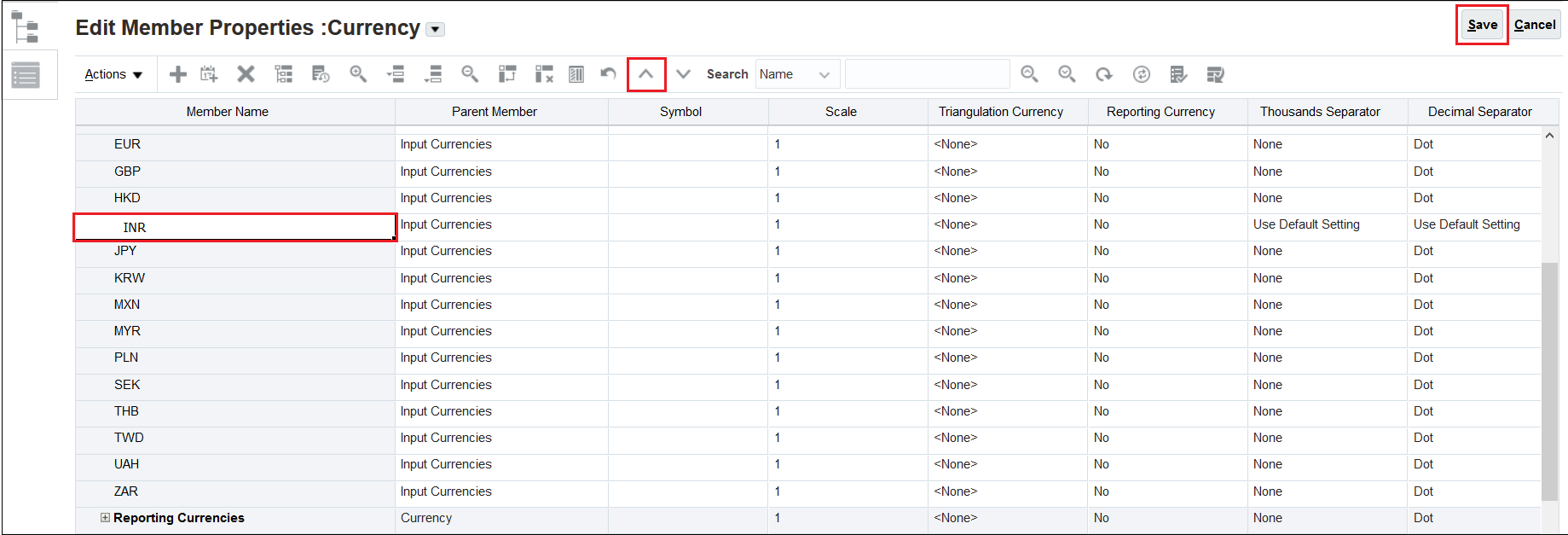

Add the Indian Rupee Currency

Now that we have configured a national jurisdiction for India, we will add the Indian Rupee currency to the Currency dimension.

-

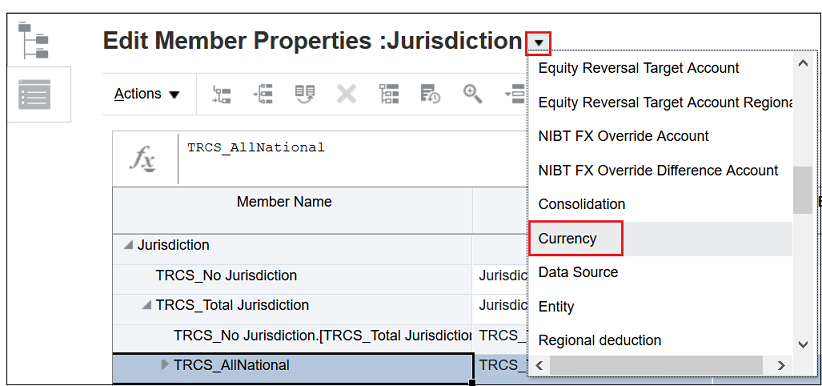

Click the drop-down next to Edit Member Properties: Jurisdiction, and then scroll down and select Currency.

-

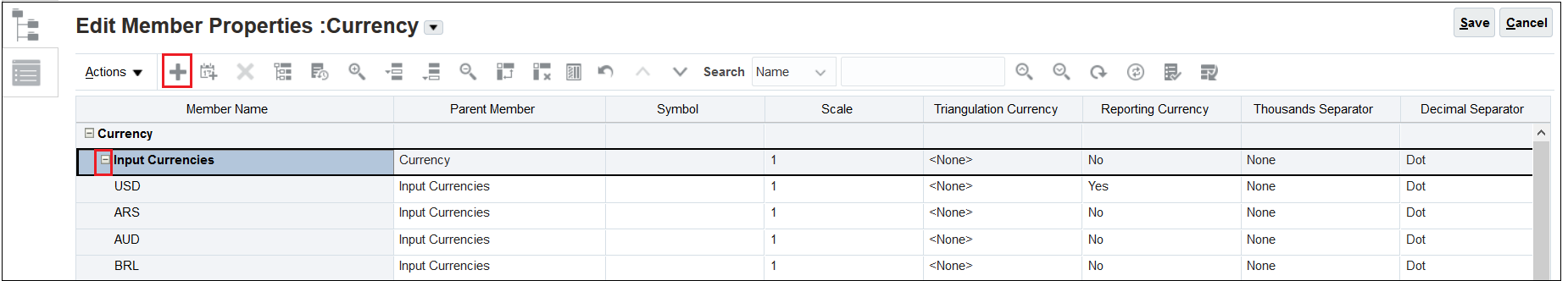

You add new currencies to the Input Currencies member. Expand Input Currencies, and then select

(Add Currency button).

(Add Currency button).

-

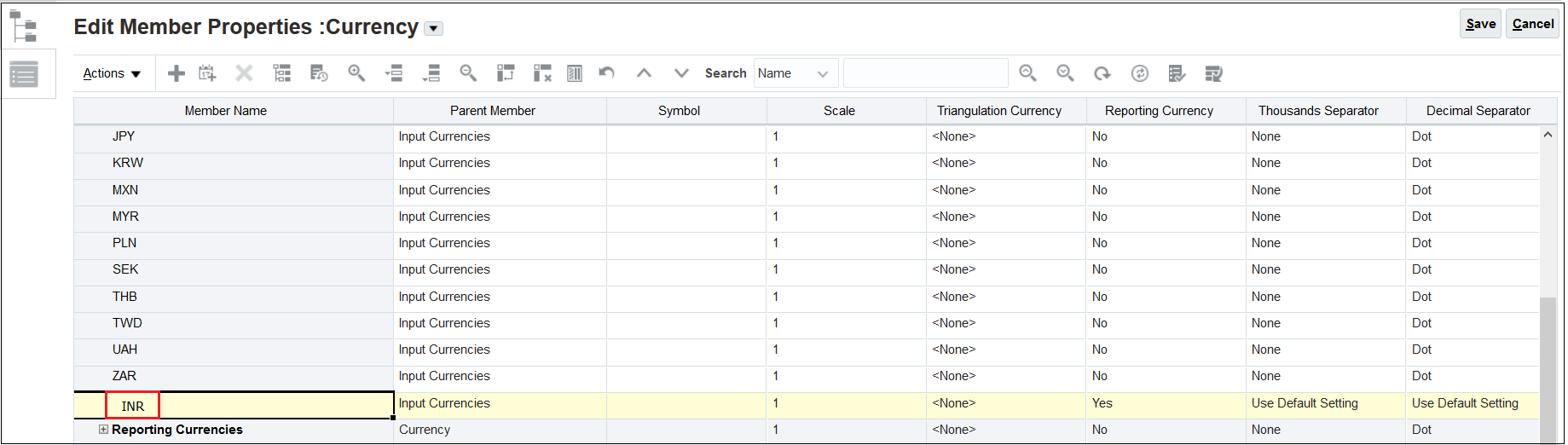

Enter INR for the Member Name.

The Tax Reporting metadata file defines most world currencies using the three-character ISO currency code.

-

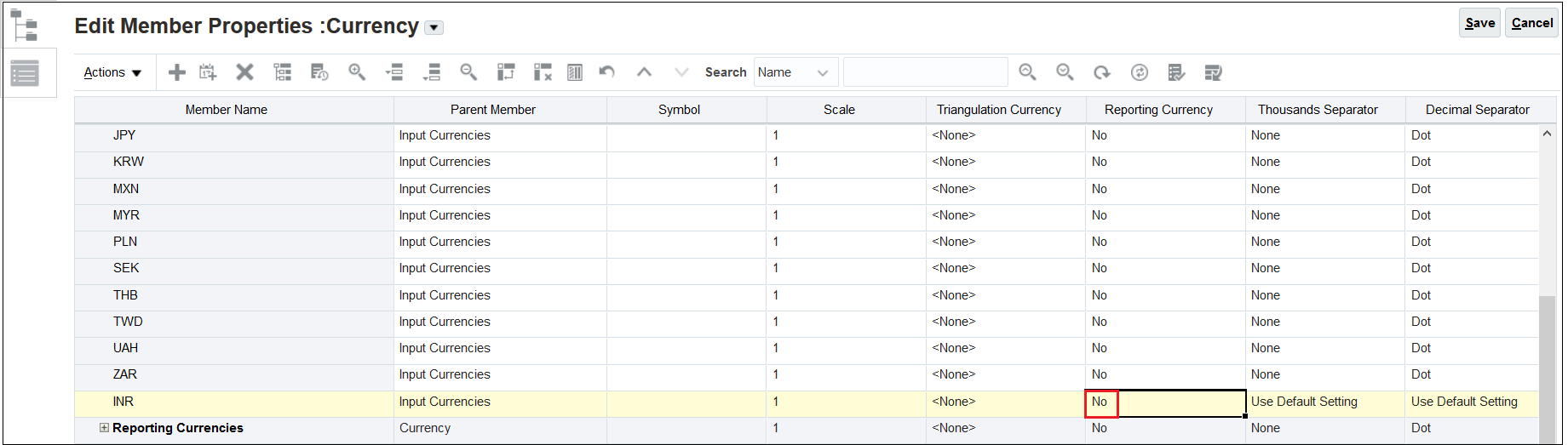

Change the Reporting Currency to No.

Setting the Reporting Currency to Yes, adds the member to the Reporting Currencies hierarchy, so you should do this only if you plan to report in the currency. If you are uncertain, you can change the property to Yes at a later time. For this example, we will set the Reporting Currency to No.

-

Click Save, and then click

(Up Arrow button) to move INR up alphabetically in the list of currencies.

(Up Arrow button) to move INR up alphabetically in the list of currencies.

-

Click Save again to save the currency information.