Applying Amount or Rate Override to a Tax Account

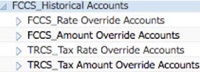

You use this feature to have an amount or rate override entered for tax account(s) by Movement, Jurisdiction, Multi-GAAP and custom dimensions. Following two new hierarchies are created under FCCS_Historical Accounts:

- FCCS_Amount Override Accounts

- FCCS_Rate Override Accounts

When an account exchange rate property is set as Historical Amount Override or Historical Rate Override, the system creates a shared member of the Account under respective hierarchy.

Note:

-

FCCS_Rate Override Accounts and FCCS_Amount Override Accounts hierarchies have a shared member created if the account is a book account.

-

TRCS_Tax Rate Override Accounts and TRCS_Tax Amount Override Accounts hierarchies have a shared member created if the account is a tax account.

Example:

- If an account is setup with tax attributes (Tax Data Type/Tax Type) then it will be treated as a Tax Account and it has "Exchange rate type" as Historical Amount Override, then it will be shared under "TRCS_Tax Amount Override Accounts" hierarchy.

- If an Account is not a Tax Account and it has "Exchange rate type" as Historical Amount Override then it will be shared under "FCCS_Amount Override Accounts" hierarchy.

Related Topics: Working with Forms: FX Rates - Book Override and Tax Override Form