Working with FX Rates – Global Account Override Forms

To work on the form:

- Navigate to the Foreign Exchange (FX) Rates folder (see, Accessing Override Forms).

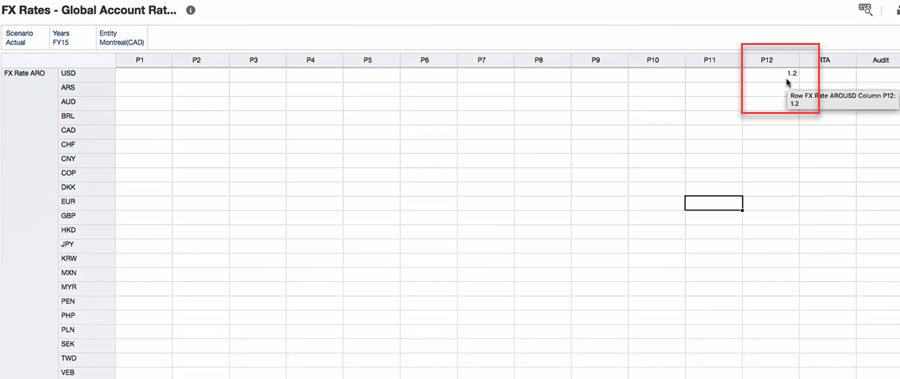

- Select FX Rates – Global Account Rate Override.

- The FX Rates – Global Account Rate Override form opens. You use this form to enter FX override rates by Scenario/Year/Period and Entity.

Here you can see that for FX Rate ARO Account P12 period the rate is 1.2. So the accounts which use this custom FX Rate ARO will all have the rate as 1.2.

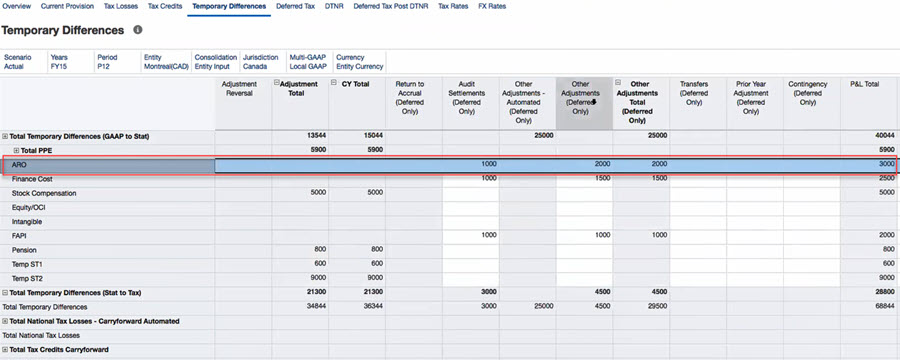

- Notice the translated data for the ARO account under Temporary Differences. The screenshot below shows Audit Settlements (Deferred only) as 1000 and Other Adjustments (Deferred only) as 2000.

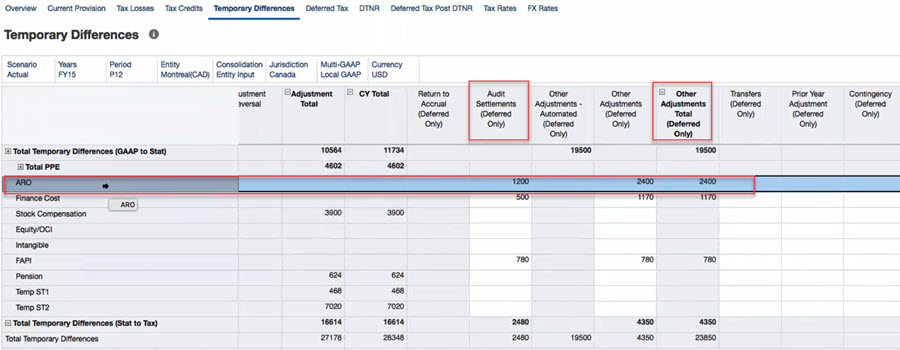

- However, after applying the 1.2 rate, the Audit Settlements (Deferred only) appear as 1000 * 1.2 = 1200 and Other Adjustments (Deferred only) appear as 2000 * 1.2 = 2400.