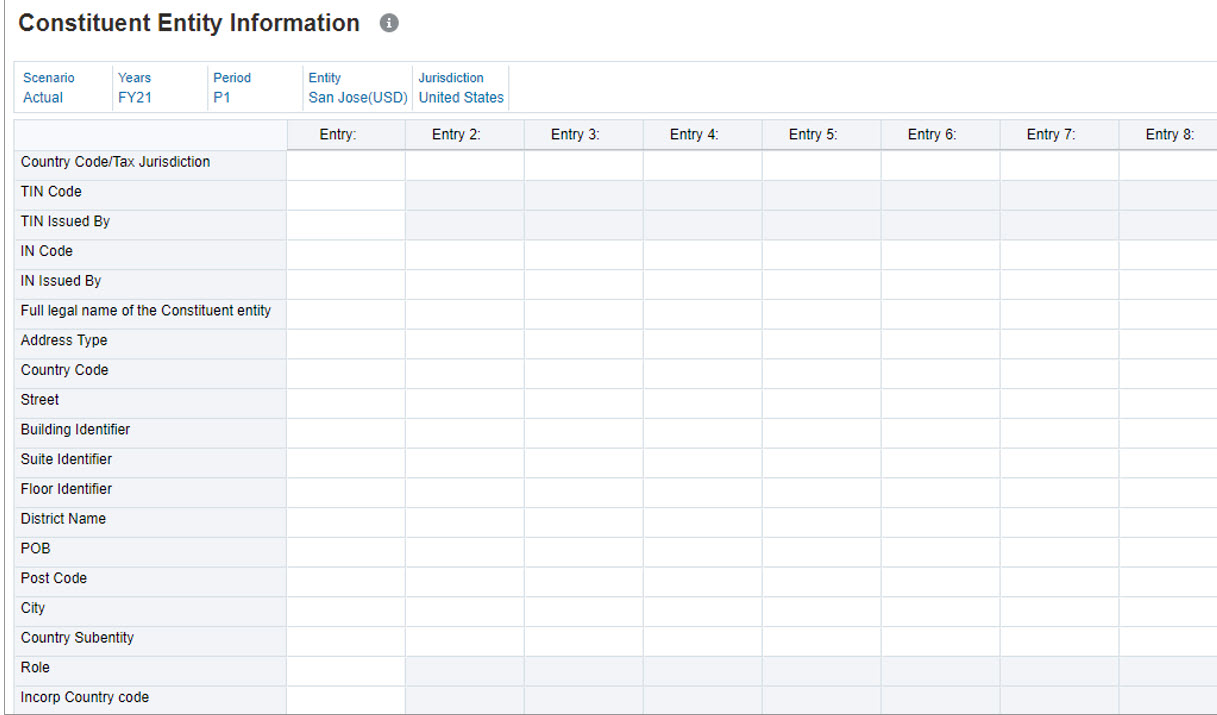

Preparing the Constituent Entity Information

The Constituent Entity Information provides detailed information on the name and address for the constituent entity for the report that is being submitted.

To prepare the Constituent Entity Information report:

- From the Home page, click CbCR, and then Data Entry.

- Select Constituent Entity Information.

- Select the POV for the report.

- Under Country Code/Tax Jurisdiction, select the country code for the tax jurisdiction associated with the selected constituent entity.

- In TIN Code, enter the Taxpayer Identification Number (TIN).

- Under TIN Issued By, select the name of the country or jurisdiction that issued the TIN.

- In IN Code, enter the IN Code (Entity or Organization Identity Number).

This data element can be provided (and repeated) if there are other INs available, such as a company registration number or a Global Entity Identification Number (EIN).

- Under IN Issued By, select the name of the country or jurisdiction that issued the IN.

- In Full Legal Name of the Constituent Entity, enter the full legal name of the constituent entity as indicated in its articles of incorporation.

- Under Address Type, select the type from the drop-down list:

- Residential or Business

- Residential

- Business

- Registered Office

- Unspecified

- Under Country Code, select the country code associated with the business address of the selected entity.

- Under Street, enter the complete street address.

- Optional: In Building Identifier, enter the name of the building.

- Optional: In Suite Identifier, enter the suite number.

- Optional: In Floor Identifier, enter the floor number for the office.

- Optional: In District Name, enter the name of the District, if applicable.

- Optional: In POB, enter a Post Office Box number, if applicable.

- Optional: In Post Code, enter the associated postal code, if applicable.

- In City, enter the name of the city.

- In Country Subentity, enter the name of any associated country subentity, such as a state, county, province, and so on.

- Under Role, select the role from the drop-down list:

- Ultimate Parent Entity

- Reporting Entity

- Both (Ultimate Parent Entity and Reporting Entity)

- In Incorp Country Code, select the country code for the Tax Jurisdiction under whose laws a Constituent Entity of the MNE Group is organized or incorporated, if the Tax Jurisdiction is different from the Tax Jurisdiction of residence of the Constituent Entity.

- Click Save.