Example Use Case

In the example below, you are creating configured deferred movement "PYAutomated" with Tax automation support.

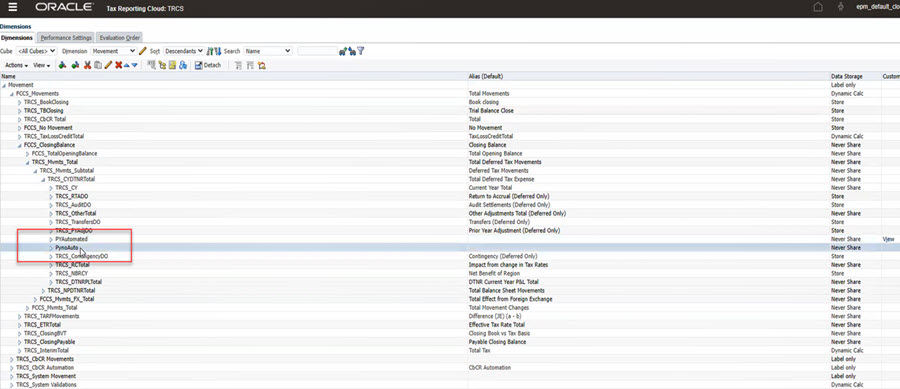

- Go to Navigator→ Create and Manage → Dimension → Movement.

- Create 2 child members under TRCS_CYDTNRTOTAL. Enter Name (PYAutomated (for Tax Automation) and PYnoAuto (for data entry)) and Alias. See Adding or Editing Members in Administering Tax Reporting

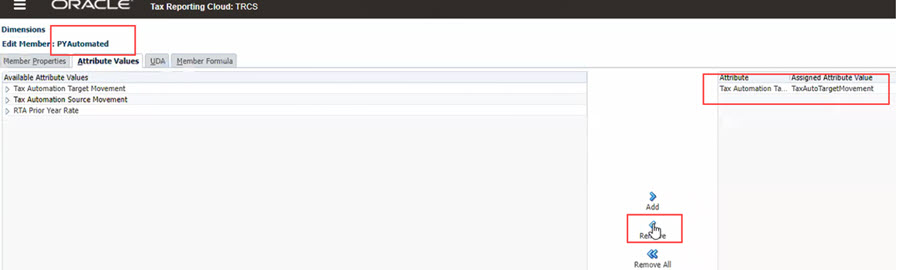

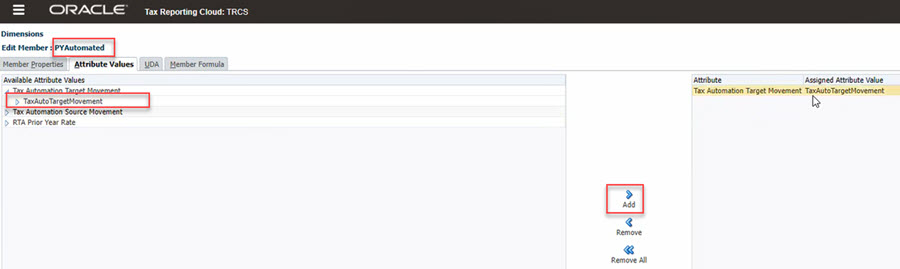

- Switch tab to Attribute Values and notice that a new attribute TaxAutoTargetMovement is created.

- Assign TaxAutoTargetMovement by clicking on the add (>) icon.

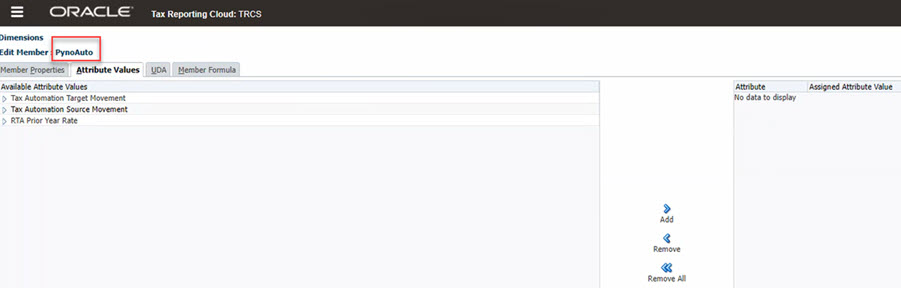

The attribute is assigned to the movement member. Since PYnoAuto is for data entry, no attribute is assigned to it.

Note:

Movement members can be either automated movement or for data entry. - Click Save.

- Continue to refresh database.

- Navigate to Configuration card.

- Click on Tax Automation.

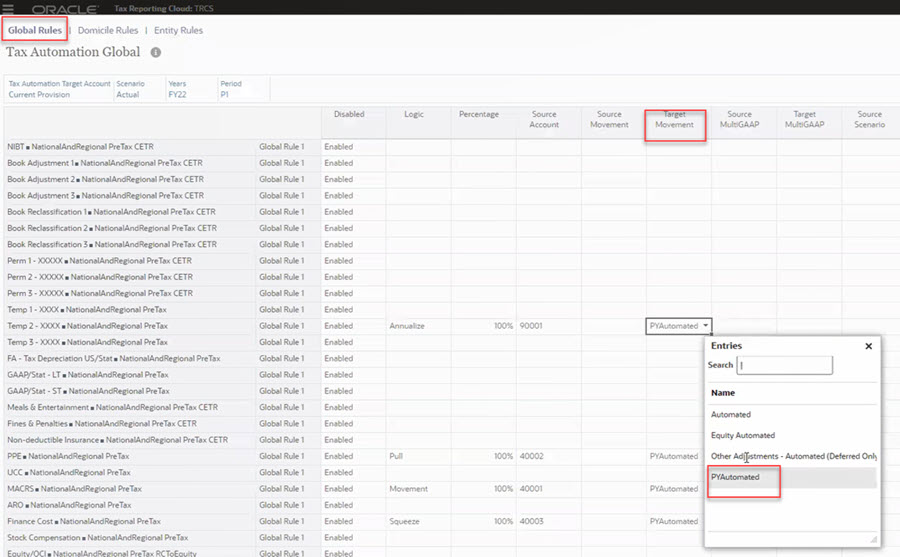

- Click on Global Rules tab. Now Tax Automation form will show "PYAutomated" as a tax automation Target Movement. This is same for also Domicile Rules, Entity Rules, and Regional Tax Automation. Note that the logic applied in the example is "Annualize".

- Save the rule and run the consolidation.

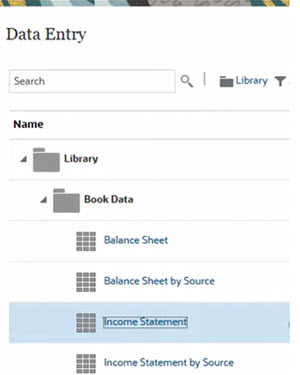

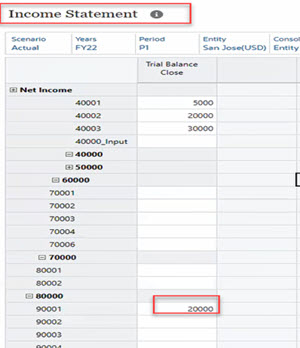

- Open the book forms to see the values. On the Home Page -> Library -> Book Data

The annulalized value is P1value * 12.

So, in the above example, the Annualized value will be 20000*12=240000 in the Temporary Differences form.

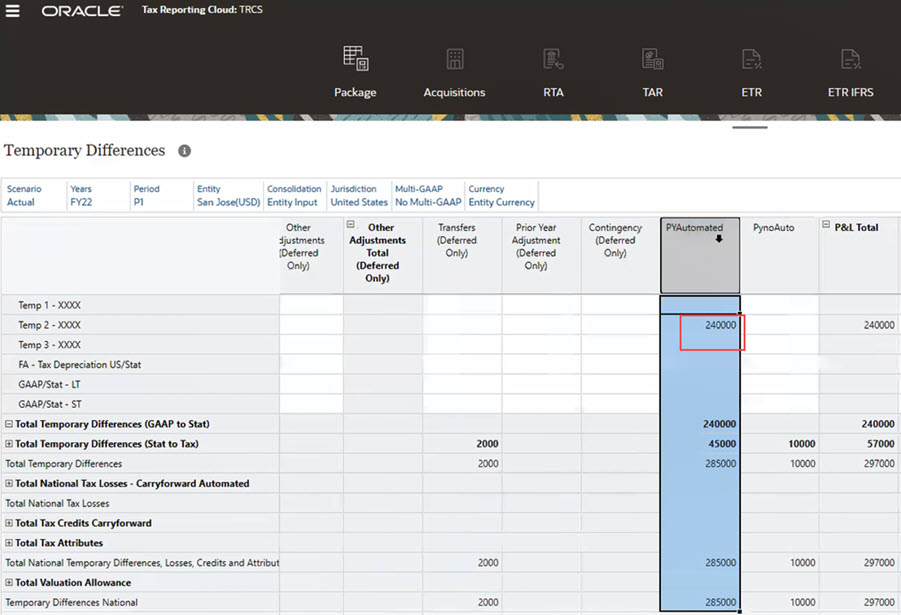

- Open the Temporary Differences form.

- Notice column "PYAutomated" populated with the pull value from the book account. There are two columns – PYAutomated and PYnoAuto (without automation). PYAutomated appears as a read-only column as you have tagged it as automated and is used only for tax automation. However, PYnoAuto is an editable column for the user to adjust any data entry.

In this example, 240000 is the Pull Annualized rule.

Note:

If you remove Tax automation target movement attribute (Dimensions > Movement Members > Select the member > Attribute Values > Remove) for the PYAutomated movement and then run Refresh Database, the rules associated will become invalidated and the data will not be cleared.

You must delete all associated tax automation rules for the movement member before removing the Tax automation target movement attribute from the member.