Working with Configurable Deferred Movement Members

The Movement dimension captures the movement details of an account. By default, the system provides the members in the movement dimension to move data. When you create an application, the movement dimension is created by default with seeded members, and optionally adds system members based on the features that you enabled. See Seeded Dimension Members in Administering Tax Reporting.

You can create additional user-defined members under the movement dimension to run consolidation and translations for these members. For instructions, see Customizing the Movement Dimension Hierarchy.

See the following example to add new columns for the deferred movement members:

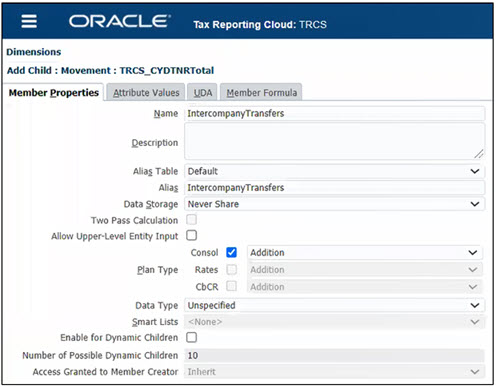

- Go to Navigator→ Create and Manage → Dimension → Movement.

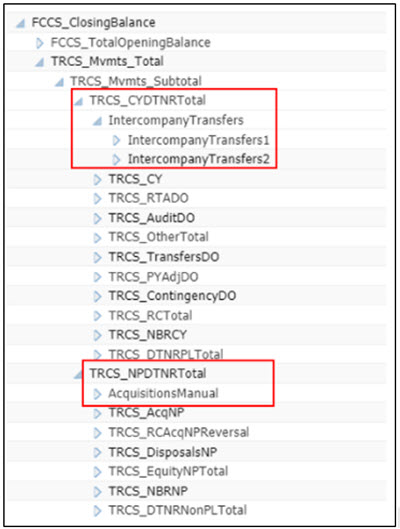

- Create IntercompanyTransfers member under TRCS_CYDTNRTotal(P&L section).

See Adding or Editing Members in Administering Tax Reporting.

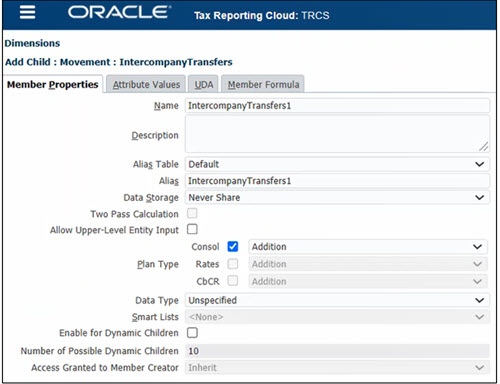

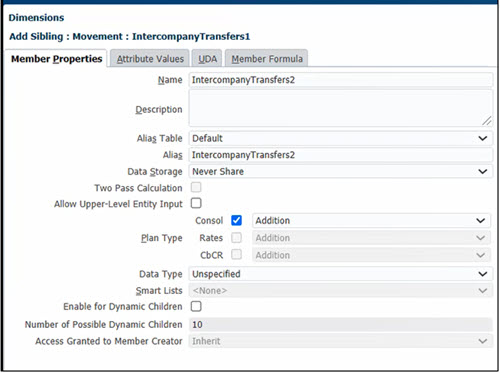

- Create IntercompanyTransfers1 and IntercompanyTransfers2 under

IntercompanyTransfers.

- Create AcquisitionsManual member under TRCS_NPDTNRTotal (Balance sheet total).

- Refresh the database.

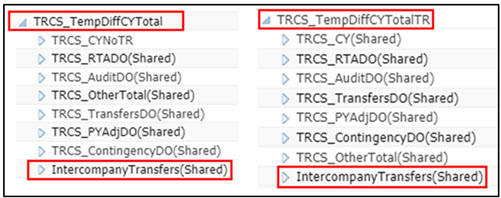

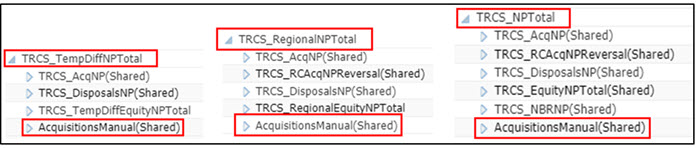

- Verify if the shared member for IntercompanyTransfers are created under

TRCS_TempDiffCYTotal and TRCS_TempDiffCYTotalTR. Similarly, verify

if the shared members for AcquisionsManual are created under

TRCS_TempDiffNPTotal, TRCS_RegionalNPTotal and

TRCS_NPTotal.

Shared member for the newly created member under TRCS_CYDTNRTotal

Shared member for the newly created member under TRCS_NPDTNRTotal

Note:

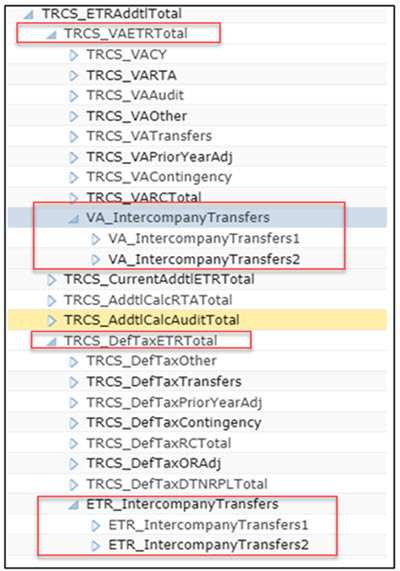

You should not try to move (cut and paste) any member in or out of the TRCS_CYDTNRTotal and TRCS_NPDTNRTotal hierarchies. You can however create/delete (see Deleting Members in Administering Tax Reporting) a newly created configurable deferred movement member. - Verify if the corresponding ETR accounts are created under TRCS_DefTaxETRTotal for intercompany transfers. Similarly corresponding VA accounts are created under TRCS_VAETRTotal.

Note:

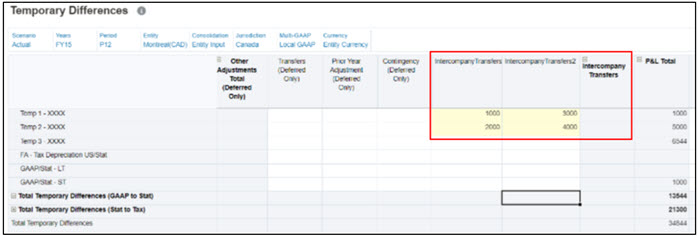

Corresponding ETR and VA accounts are created for movement members under TRCS_CYDTNRTotal only. - Open the Temporary Differences form, expand the IntercompanyTransfers column. Enter data for IntercompanyTransfers1 and IntercompanyTransfers2. Save.

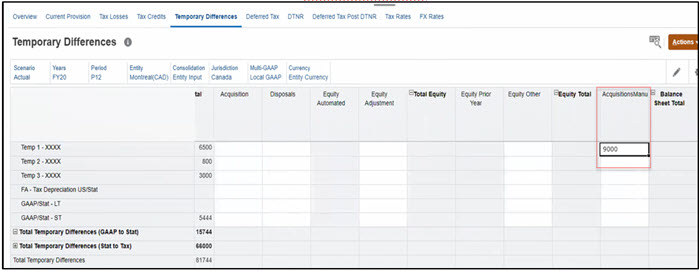

- Enter data in Temporary Difference form against AcquisitionsManual column. Save.

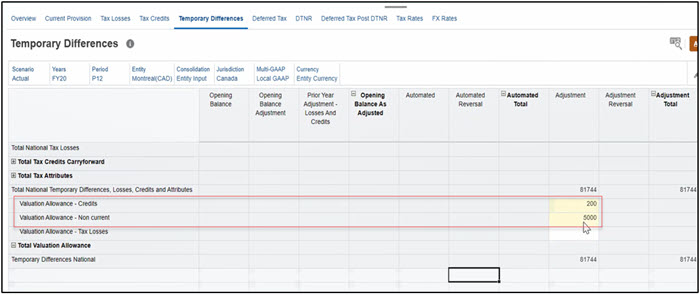

- Enter data in Temporary Difference form against Change in Valuation Allowance. Save.

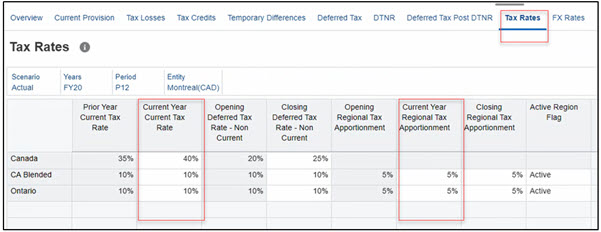

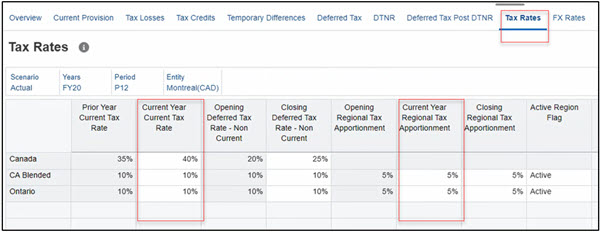

- Check the Tax Rates for example, for Entity Montreal(CAD). Current Year Current Tax

Rate is 40% and Current Year Regional Tax Apportionment is 5%.

- Select Temporary Differences and run consolidation (Actions → Consolidate).

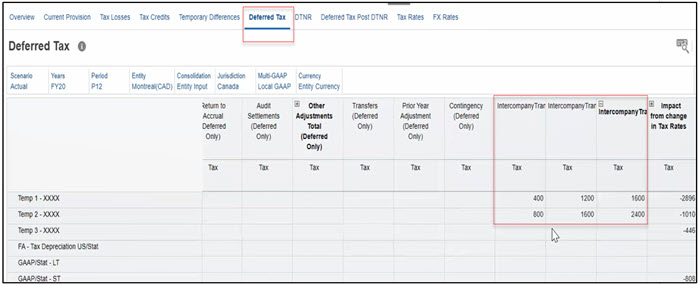

- Click on Deferred Tax. Verify data in Deferred Tax form for

IntercompanyTransfers, AcquisitionManual, and Change in

Valuation Allowance. It shows you the calculated value for

IntercompanyTransfers, AcquisitionManual, and Change in Valuation Allowance. In the

example below, 40% of 1000 is 400 and similarly other values are also calculated.

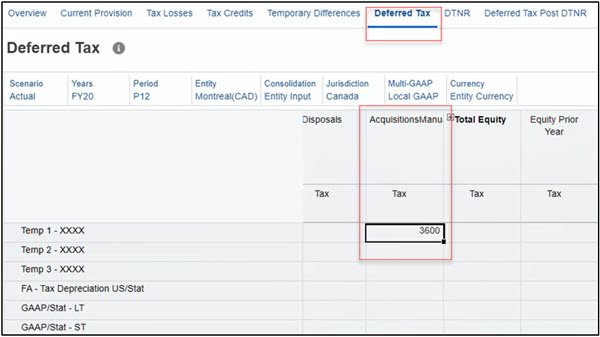

Similarly 40% of 9000 (that you entered for AcquisitionManual) is 3,600.

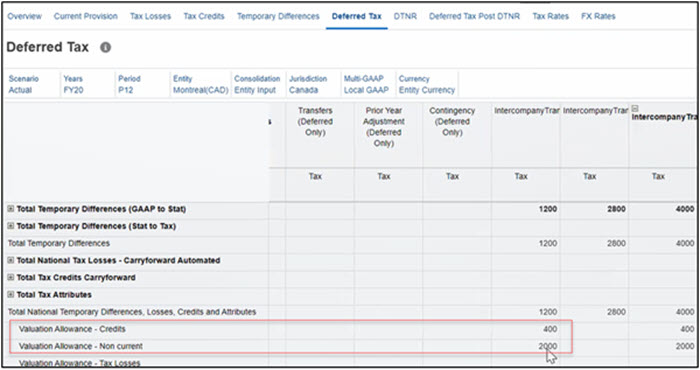

Note that Valuation Allowance for Credits and Tax Losses are non taxable whereas Valuation Allowance – Non current is taxable. Notice the Valuation Allowance – Non current is 40% of 5000, that is 2000.

- Click on ETR to validate data.

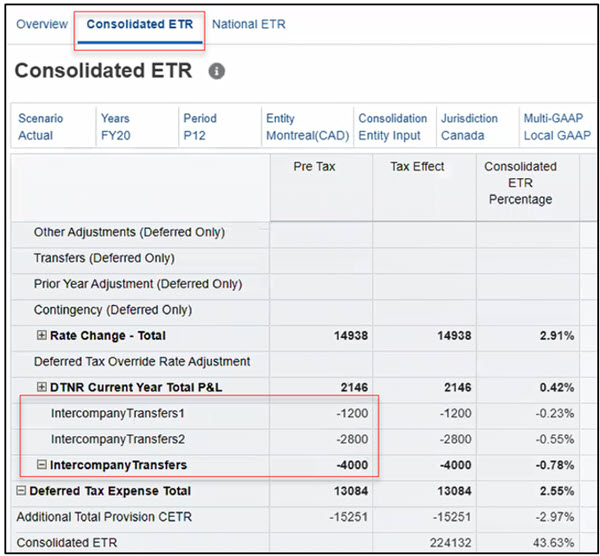

- Verify data in Consolidated ETR and Consolidated ETR IFRS form. See also, Entering the Consolidated EffectiveTax Rate and Consolidated ETR IFRS Overview Dashboard.

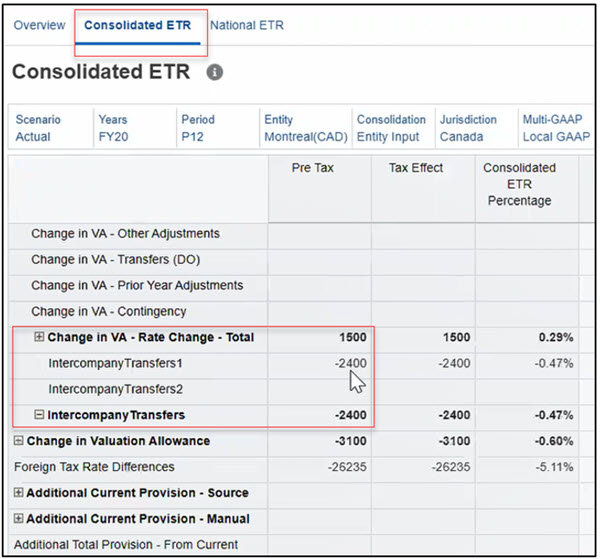

Consolidated ETR Form

See the calculated value of -4000 (negative value of 40% of 10,000) for IntercompanyTransfers.

Similarly for Change in Valuation, notice the negative value of -2400 (400+40% of 5000).

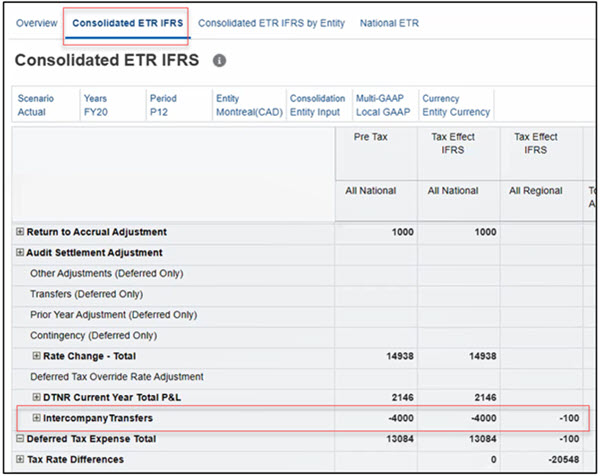

Consolidated ETR IFRS Form

Notice the calculated value of -4000 for All National and -100 for All Regional

Current Year Tax Rate for CA_Blended is 10%, Current Year Regional Apportionment Tax Rates is 5%, hence calculation is 10,000*10%*5%=50

Since it is for All Regional, it will be 50+50=100

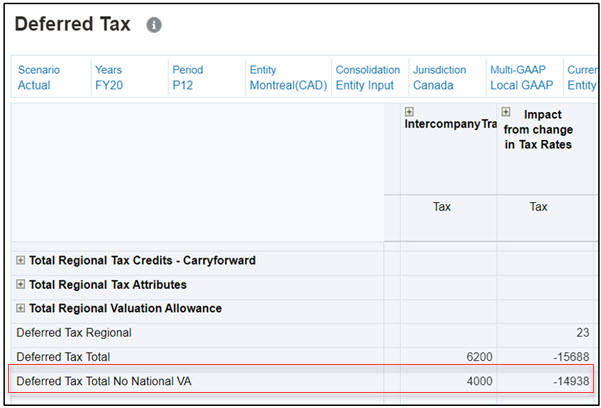

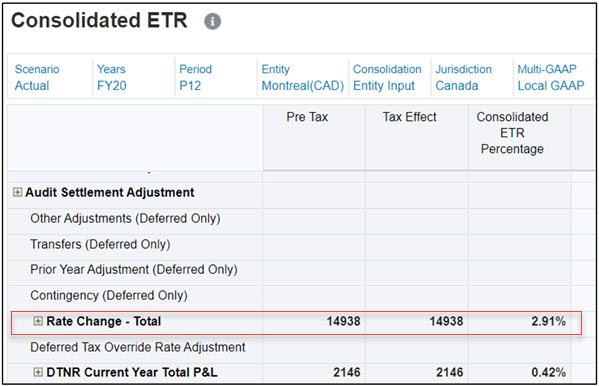

- Verify Rate change Total. Note that Impact from change in Tax Rates - Current Year Total for Deferred Tax Total No National VA account in Deferred Tax form should match Rate Change Total in Consolidated ETR form. In the example below, notice the calculated value (14398) on Deferred Tax and Consolidated ETR form. See also, Working with National Deferred Tax and Entering the Consolidated EffectiveTax Rate.

Deferred Tax Form

Consolidated ETR Form

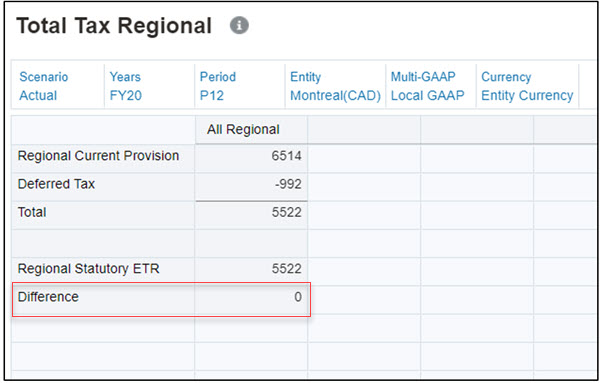

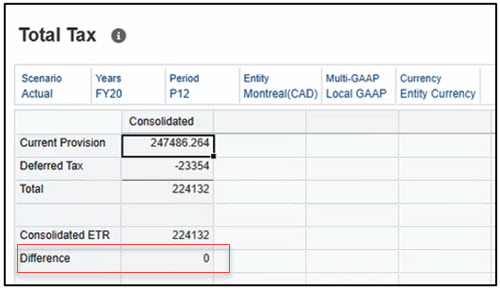

- Check Total Tax Validation form. Go to Library→ Validation→ Total

Tax. Notice that the difference value is 0.

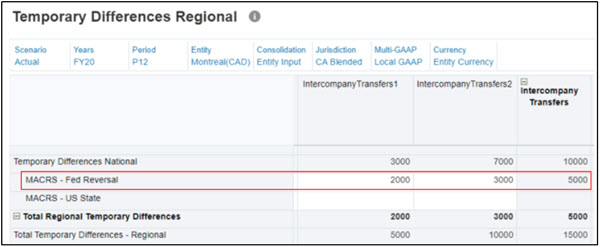

- Now, for the regional form, enter data in Temporary Difference Regional form against IntercompanyTransfers1 (MACRS – Fed Reversal account). Save. See also, Entering Regional Temporary Differences.

- Check the Tax Rates for example, for Entity Montreal(CAD). Notice that the Current Year tax rate for CA Blended is 10% and Current Year Regional Tax Apportionment is 5%. See also, Working with Regional Tax Rates.

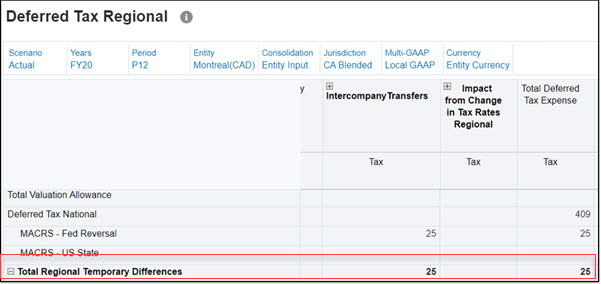

- Verify Deferred Tax Regional Form. Notice that calculated value is 5000*10%*5% which is 25. See also, Working with Regional Deferred Tax.

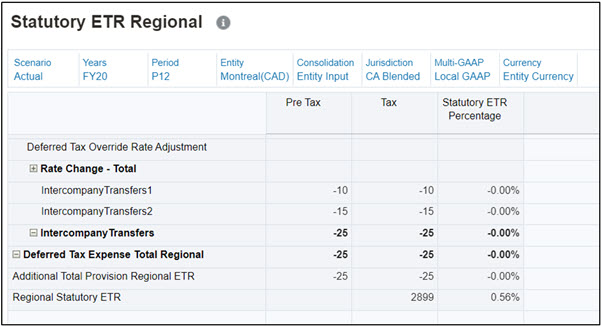

- Verify Regional ETR form. See also, Working with the Regional Statutory Effective Tax Rate.

- Check Total Tax Regional validation form. Go to Library→ Validation→ Total Tax Regional. Notice that the difference value is 0.