Supporting Aggregate Weighted Average Amount Overrides

In Tax Reporting, the weighted average rate amounts at base entities rollsup to parent entity, enabling you to override aggregated weighted average amount at parent entity. You do not need to re-enter the weighted average rate amounts at parent entity to prevent data mismatch.

When you enter Amount Override at parent entity and the Aggregated Amount Override rolls up from base entities, then the amount you entered in Amount Override is considered as priority and is used to calculate the weighted average rate.

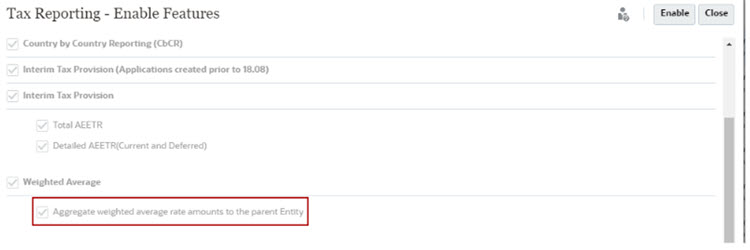

Enabling the Feature

- To enable this feature, navigate to the Configuration card and click

Enable Features. See also: Enabling Application Features in Administering Tax Reporting. Note that, Aggregate weighted average rate amounts to the parent Entity

is a sub feature of the existing Weighted Average feature.

- Select the feature and click Enable. See also: Enabling Weighted Average