Tax Credits DTNR: Use Case Example

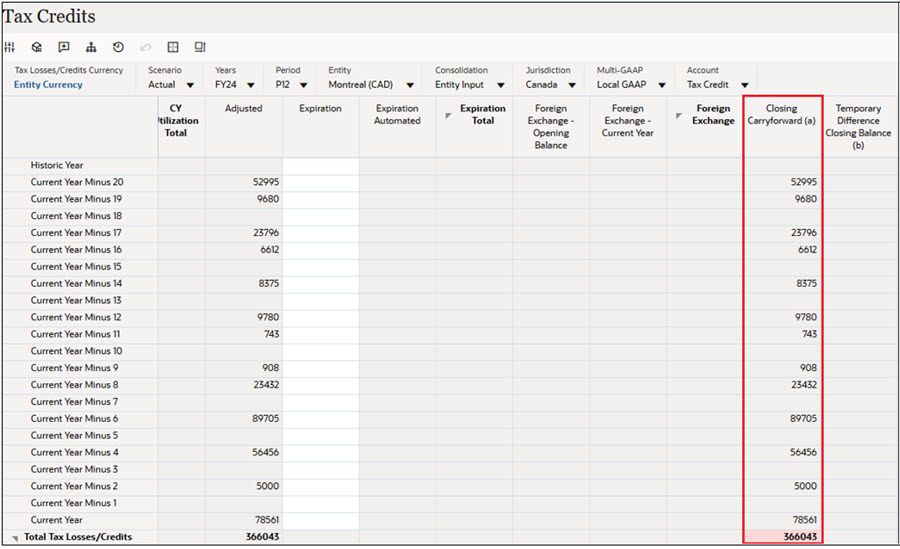

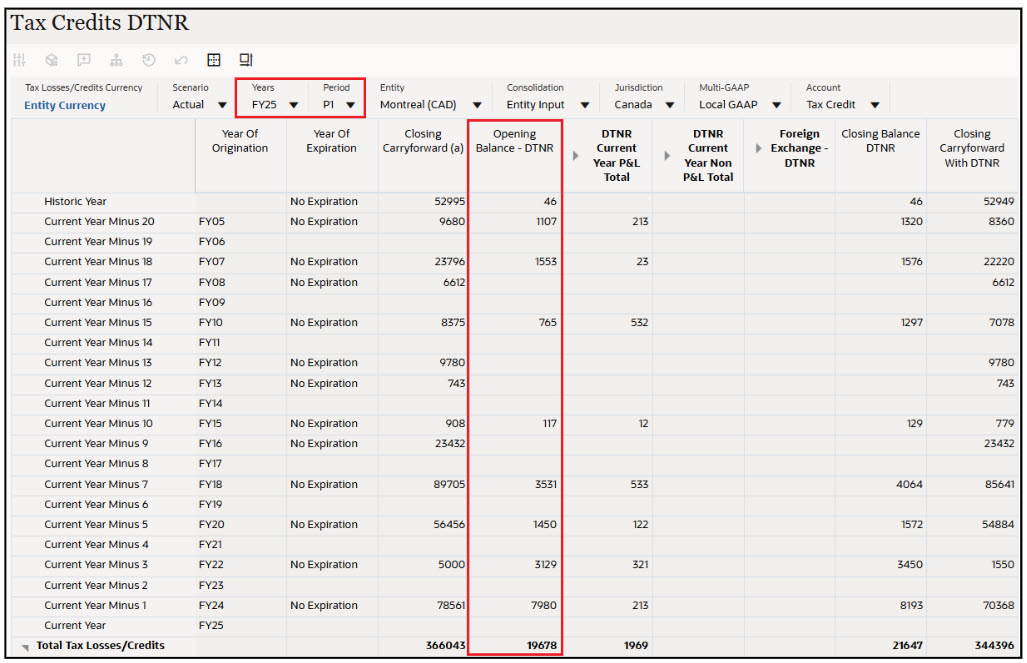

Consider the following values for Closing Carryforward (a) in Tax Credits form for the account Tax Credit.

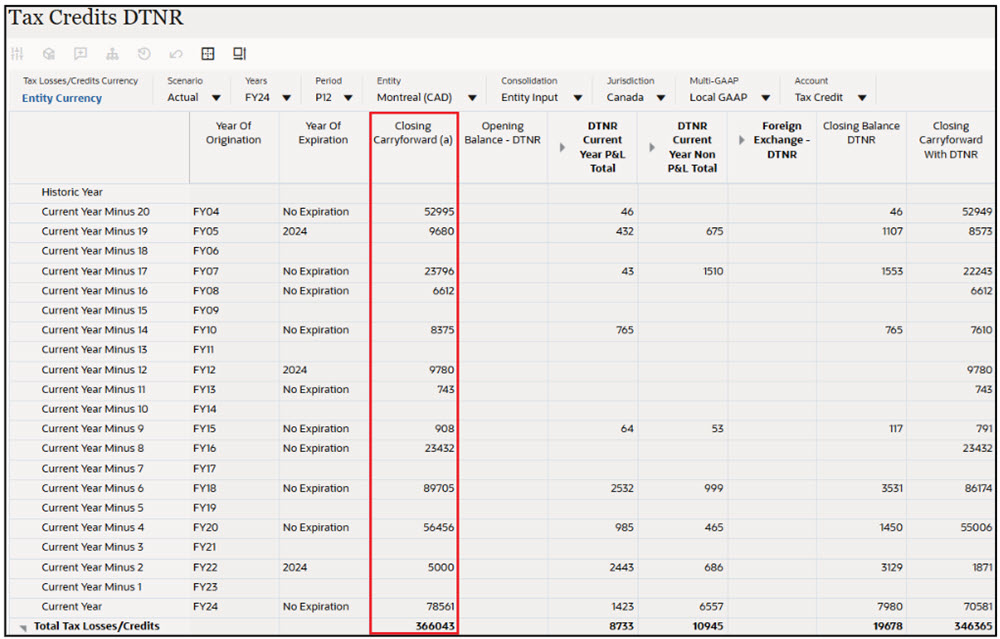

Closing Carryforward values are populated in Tax Credits DTNR form.

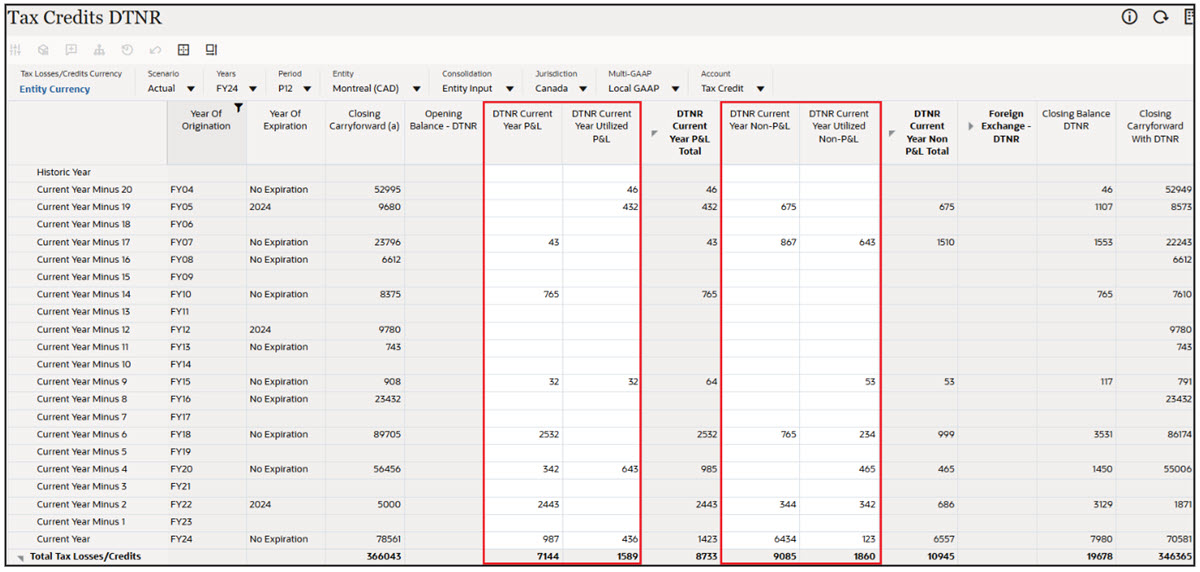

You can derecognize P&L and Non P&L amounts from any year using the DTNR Current Year P&L, DTNR Current Year Utilized P&L, DTNR Current Year Non-P&L, and DTNR Current Year Utilized Non-P&L columns.

For example, for Year FY24, refer the screenshot below. The values for DTNR Current Year P&L is 987, DTNR Current Year Utilized P&L is 436, DTNR Current Year Non-P&L is 6434 and DTNR Current Year Utilized Non-P&L is 123.

The Closing CarryForward with DTNR column holds the Closing Carryforward with the derecognized amounts.

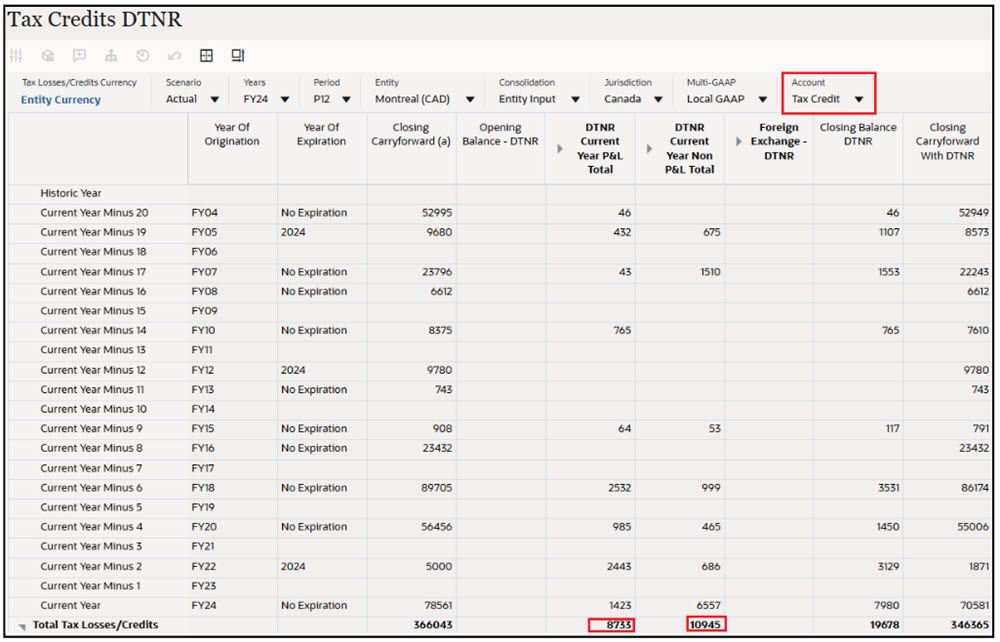

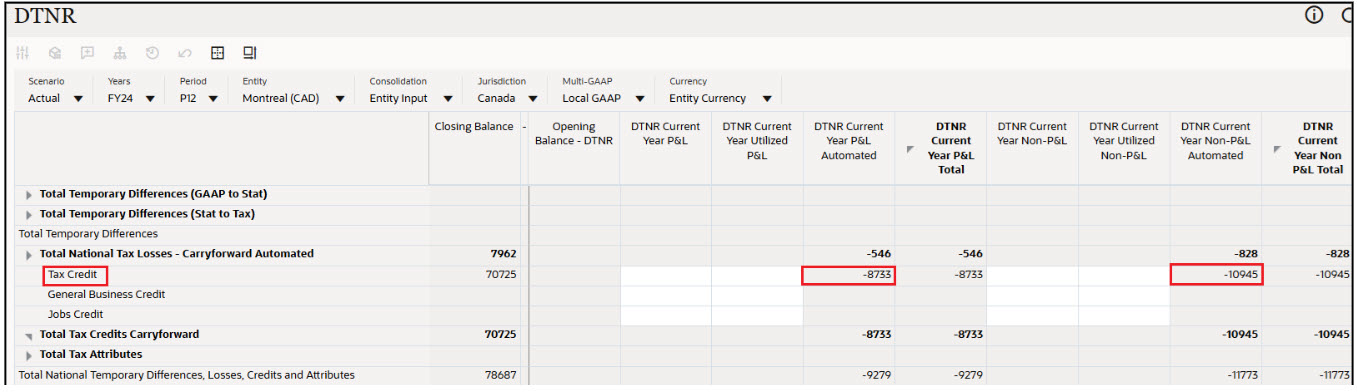

Post Consolidating FY24 P12, the values are populated in the DTNR form as follows:

- DTNR Current Year P&L Automated = - DTNR Current Year P&L Total (8733)

- DTNR Current Year Non-P&L Automated = - DTNR Current Year Non-P&L Total (10945)

Post consolidation, DTNR Current Year P&L Automated and the DTNR Current Year Non-P&L Automated values are populated as below:

Post consolidating FY25, P1, in Tax Credits DTNR, the values from Closing Balance DTNR flows to Opening Balance - DTNR column.

Note:

- By default, the amounts for the account "Total National Temporary Differences, Losses, Credits and Attributes" in the DTNR Current Year P&L Automated and DTNR Current Year Non-P&L Automated columns are reflected in TAR form.

- The amount for the account "Total National Temporary Differences, Losses, Credits and Attributes" in the DTNR Current Year P&L Automated column is reflected in the ETR forms.