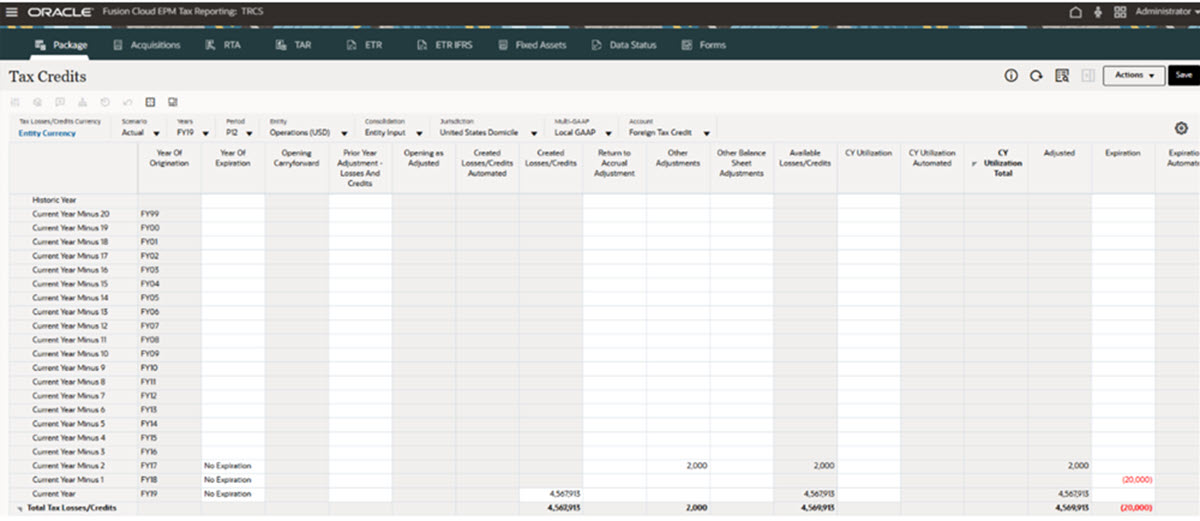

National Tax Credits

The system tracks the impact of tax credits for the Total Tax Credits, including the following categories:

- Total Tax Credit Current Year, including the Foreign Tax Credit - Current Year

- Total Tax Credits Carryforward

- Foreign Tax Credit

- General Business Credit

- Jobs Credit

Note:

If Tax Losses/Credits accounts are not available, the Tax Losses and Tax Credits forms will not be displayed.If you are deferring a credit to a future period, you must enter the data on the Tax Credits form. After Consolidation, the deferred amount is moved to the Temporary Differences form, under the Other Adjustment - Automated - Deferred Only column. The system tracks Tax Credit carryforwards in the Temporary Difference rollforward.

To defer a credit to a future period:

-

From the Home page, click Tax Provision National, and then Package.

- On the Tax Credits form, under the Created

Losses/Credits column for the Current Year, enter the value of the

deferred credit . This value is not populated from the Current Provision

report.

- On the Tax Credits form, enter the values in the following columns:

- Year of Expiration

- Created Losses/Credits

- Other Adjustments

Note:

Based on the selected year in the POV, the actual Financial year is displayed under Year of Origination, such as FY19. - Click Save.

- Under Actions, select Consolidate.

The sum of the following columns are displayed in the Temporary Differences form, under Other Adjustments - Automated (Deferred Only) for the corresponding tax credit account:

- Created Losses/Credits

- Other Adjustments

- Expiration