National Tax Losses

National tax losses are captured under Carryforward Automated for these categories:

- Tax Losses—used to record the utilization of any Net Operating Loss carryforward against the current year taxable income

- Capital Losses

- Charitable Contributions

- National Tax Losses—used to bring taxable income up to 0 for an entity with a loss in the current year, which should be carried forward

- Total National Tax Losses

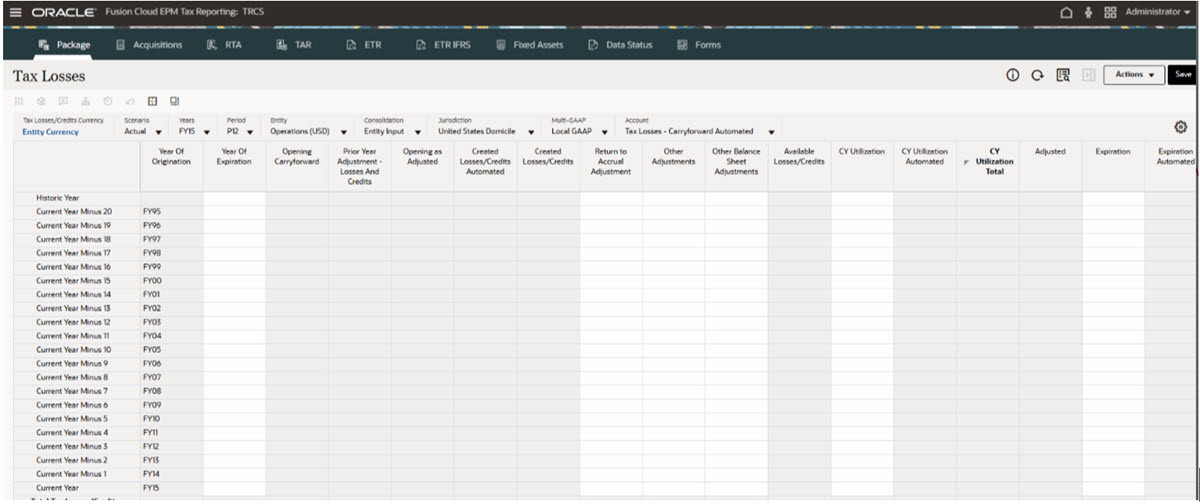

The Tax Losses form is used to track Tax Losses. If you are deferring a loss to a future period, enter the data on the Current Provision report. After Consolidation, the deferred amount is moved to the Tax Losses detail schedule.

To defer a loss to a future period:

-

From the Home page, click Tax Provision National, and then Package.

- On the Current Provision form, in Tax Losses - Carryforward Automated, in the Adjustment column, enter the value of the deferred loss.

- Click Save.

- Under Actions, select Consolidate.

- From the Current Provision report, click the Tax Losses tab.

On the Tax Losses detailed schedule, the deferred amount is displayed under Opening Carryforward. Any other adjustments made on the Tax Losses form are moved to the Temporary Differences form after Consolidation. See Entering National Temporary Differences.

- Enter tax losses for the selected year, as required. For a description of all columns on the Tax Losses form, see "Tax Losses and Tax Credits Detailed Schedule" in National Detailed Tax Losses and Credits to complete data entry. Some columns are automatically populated using details from the Current Provision form.

- Click Save.

- Under Actions, select Consolidation.