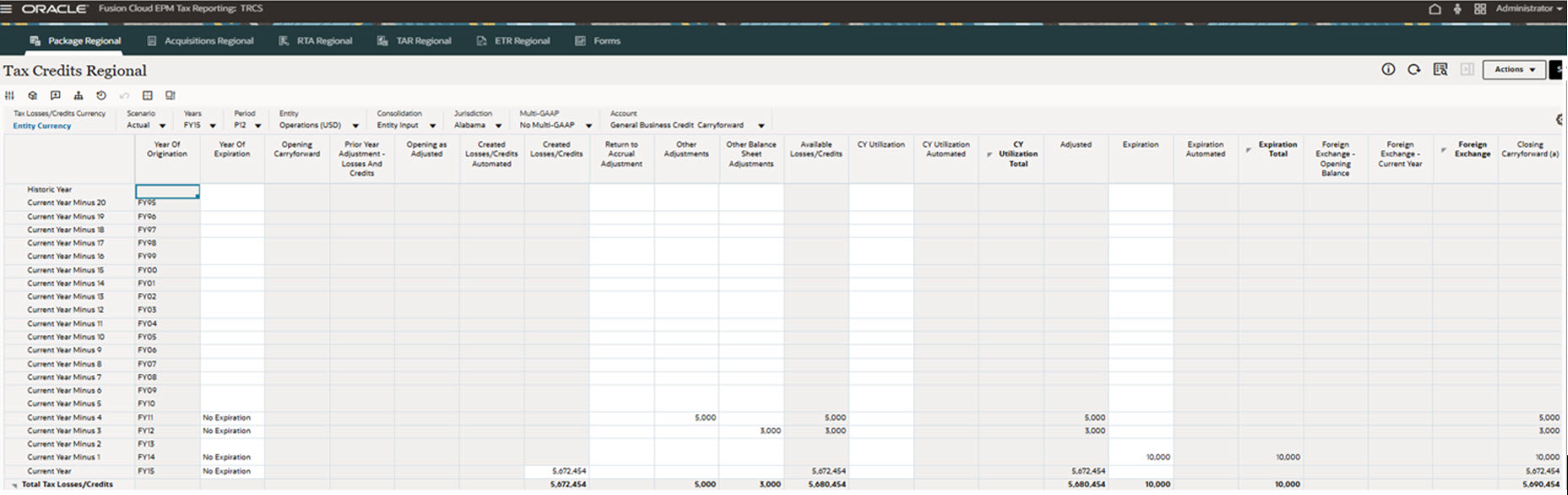

Regional Tax Credits

The system tracks the effect of regional tax credits.

Regional tax credits utilized in the current year are input in the Tax Credits Regional form and automatically flow to the Temporary Differences Regional form. The detailed composition of individual tax credits (for example, year, expiration) can be tracked in the Tax Credits Regional form.

If you are deferring a credit to a future period, you must enter the data on the Tax Credits Regional report. The system tracks Tax Credit carryforwards in the Temporary Difference rollforward.

Note:

If Regional Tax Losses and Credits accounts are not available, the Tax Losses Regional and Tax Credits Regional forms will not be displayed.To defer a credit to a future period:

-

From the Home page, click Tax Provision Regional , and then Package Regional.

- On the Tax Credits Regional form, under the Created Losses/Credits column for the Current Year, enter the value of the deferred credit. This value is not populated from the Current Provision report.

- On the Tax Credits tab, enter the values in the following

columns:

- Year of Expiration

- Created Losses/Credits

- Other Adjustments

Note:

Based on the selected year in the POV, the actual Financial year is displayed under Year of Origination, such as FY19.

- Click Save.

- Under Actions, select Consolidate.

The sum of the following columns are displayed in the Temporary Differences Regional form, under Other Adjustments - Automated (Deferred Only) for the corresponding tax credit account:

- Created Losses/Credits

- Other Adjustments

- Expiration