Working with Balance Sheet Approach for Fixed Assets

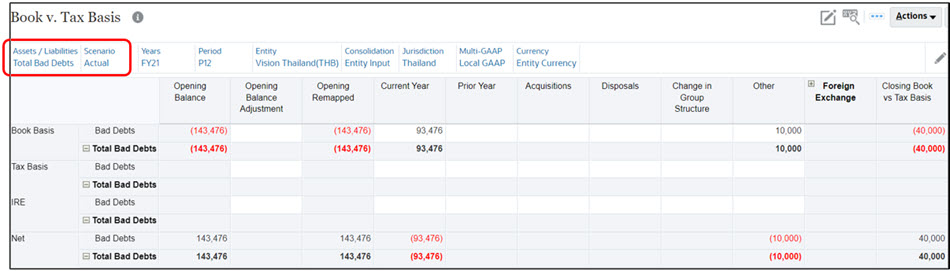

The balance sheet approach requires the comparison of the Book and Tax Basis of Assets and Liabilities at provision and return filing time. The Book versus Tax Basis form in the examples below (figure 1 and 2) can be configured for all assets and liabilities or just the assets and liabilities where there is difference between the Book and Tax Basis (for example, Total Bad Debts, Total Tax Loss Carryforward). The web form is in a continuity format allowing for the reconciliation of the beginning balance, current year movements and ending balance.

Figure 1: Total Bad Debts Account - TRCS_BVTAccounts Total Bad Debts

Figure 2: Total Tax Loss Carryforward - TRCS_BVTAccounts Total Loss Carryforward