Fund Accounting Example

Consider a municipal utility which provides water and wastewater service. The utility has two departments: water and wastewater. Each department must track their finances separately therefore a fund is setup for each department:

- Water (fund 01).

- Wastewater (fund 02).

In addition, with fund accounting, there is always a general fund (fund 99).

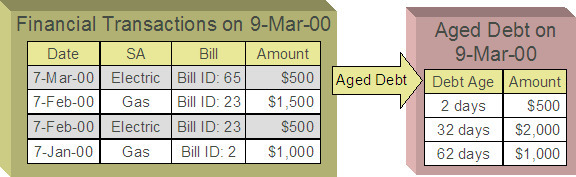

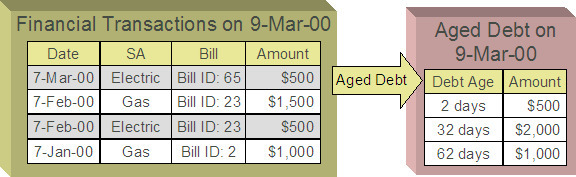

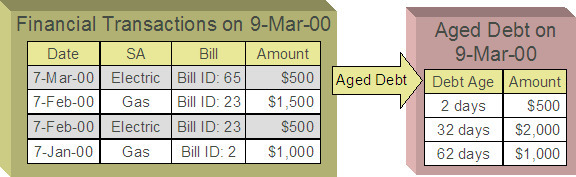

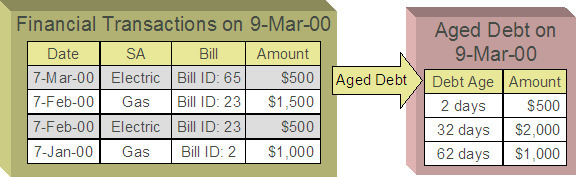

Assume the following bill is generated.

The bill would produce the following GL entries:

For each fund, the GL details of the bill will include a debit to the accounts receivable (A/R) account and credits to the revenue and taxes payable accounts. In organizational terms, each department is owed a portion of the overall bill by the customer, part of which is sales by the department and part of which is owed to the taxing authorities by the department. Each fund is balanced.

Note that the accounting could be identical under corporate accounting if each service is its own division with its own chart of accounts.

The following diagram illustrates the initial GL accounting that would occur when the payment arrives:

The utility's general cash account is debited, and the departmental funds' A/R accounts are credited. In other words, the cash is held by the utility as a whole but the receivables are reduced for the individual departments.

If the accounting were left in this state, the fund accounting principal - that each fund represents an independent entity with a self-balancing chart of accounts - would be violated. This violation is caused due to the fact that cash is recorded on the general fund, not the departmental funds, causing the general fund to have an excess debit and the departmental funds to have an excess credit.

From an organizational viewpoint, to make each department whole, the departments need to note what portion of the cash they own, and correspondingly, the utility needs to note what portion of the cash is owed to each department. The following diagram illustrates this point.

To maintain a balance of debits and credits within each fund, the departmental funds have an "equity in pooled cash" (EPC) account and the general fund has a liability account for each departmental fund. In addition to debiting the general fund's cash account and crediting the departmental funds' A/R accounts, the departmental funds' EPC accounts are debited and the general funds liability accounts are credited.

And so, with the additional GL entries, all funds have matching debits and credits.