Collection Criteria vs. Severance Criteria vs. Write Off Criteria

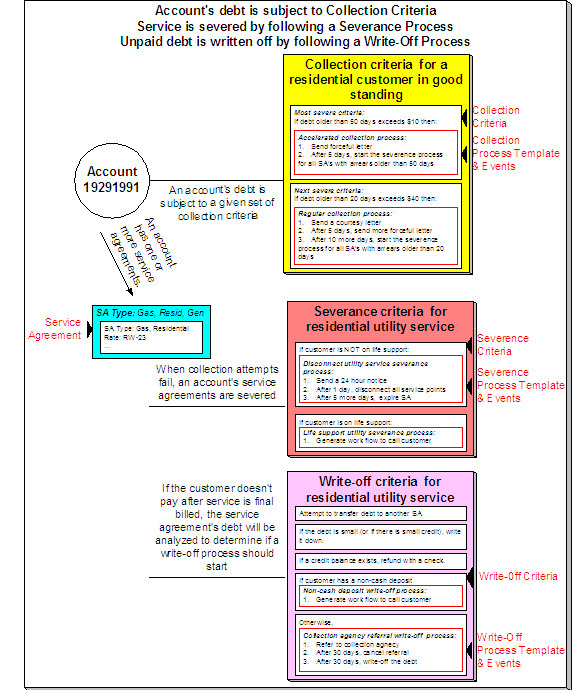

The following diagram introduces important concepts related to the C&C processes:

There are many important concepts illustrated above:

|

An account's debt comes from its service agreements |

An account's debt is managed at the service agreement level, i.e., the system keeps track of how much a customer owes in respect of each service agreement. In order to determine an account's balance, the system must add up the debt on each of the account's service agreements. |

|

Collection criteria define intolerable debt |

Collection criteria are control data that define intolerable debt. Most criteria are defined using a combination of number of days in arrears and a dollar amount. |

|

Collection criteria may be compared to an account's total debt or to subsets of debt |

If your organization has simple collection procedures, you will probably target collection criteria at an account's total debt. However, you have the option of segregating an account's debt into debt classes and targeting the collection criteria at each class. For more information about debt classes, see Different Collection Criteria For Different Customers And Different Debt. |

|

Collection criteria also define what to do when the level of intolerable debt is exceeded |

When you define collection criteria, you also define how the system should respond if an account violates your criteria. These collection events are defined in respect of a "collection process template". |

|

There are usually several collection events that take place when criteria are violated |

A collection process template usually has several collection events. Each event is meant to prod the customer to pay. The initial collection events are typically letters. If payment is not received after several such attempts, the last collection event typically starts a severance process for each service agreement in arrears. |

|

A severance process template defines how to sever a service agreement |

A "severance process template" defines how to sever a given type of service agreement. A severance process template usually contains several severance events. These events are a series of letters and / or disconnection field activities that eventually result in the expiration of a service agreement if payment is not received. |

|

Severance criteria define how to sever service agreements |

Severance criteria define the severance process to be executed for service agreements of a given SA type. The severance process may differ depending on some attribute of the customer (or premise). For example, you may have a different severance process if the customer has life support equipment. |

|

After a service agreement is severed, it will be final billed |

When the last active service agreement linked to an account is stopped, the system changes the account's bill cycle to bill that evening. If only one of many SAs is stopped, the SA will only be final billed as per the account's original bill cycle schedule. |

|

If a customer doesn't pay their final bill, the account's debt will be analyzed to determine if the system can reduce the debt to zero using a variety of mechanisms |

The system will look at an account's finaled debt on its next scheduled credit review date (typically a few days after the bill's due date). The system will attempt to reduce the service agreement's debt to zero using all of the following methods:

|

|

If a customer's finaled debt cannot be reduced via any of the previous methods, the system creates a write-off process |

A write-off process contains one or more write-off events. These events can generate a letter, send a To Do entry to a CSR, send a referral to a collection agency, etc. When you set up the system, you define the type of write-off process to use for every collection class / write-off debt class combination. In addition, you can also indicate when the type of write-off process should differ depending on some attribute of the customer (or premise). For example, you may have a different write-off process if the customer has a non-cash deposit. |

|

The last write-off event typically causes the debt to be written off |

Ultimately, if the write-off events fail, the debt will have to be written off. When debt is written-off, the system creates a write-off service agreement and transfers the outstanding debt to it. This means the debt stays with the account for life and will have to be paid off if the customer ever returns. |

Checkpoint. At this point, you should be familiar with the concept that an account's debt is compared to user-defined collection criteria. If the account violates the criteria, a series of events will ensue that prod the customer to pay. If the customer doesn't respond, every service agreement in arrears will be severed (i.e., disconnected). If lack of service doesn't inspire payment, the service agreement will be expired and a write-off process will be created to manage the write-off activities.