An Example Of A Bill Segment That References Multiple Funds

Consider a municipal utility that primarily supplies water service but is also responsible for maintaining the city's fire hydrants. The costs for fire hydrant maintenance are borne by the water customers and make up just a small portion of the overall bill. These costs are simply added to the water bill as a line item. The utility has two departments:

- Water service (fund 01)

- Hydrant maintenance (fund 39).

In addition, there is a general fund (fund 99).

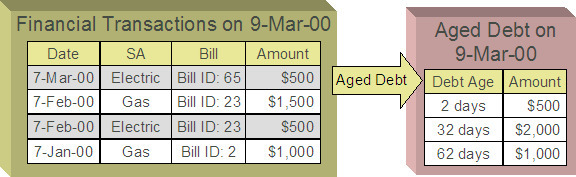

Assume the following bill is generated for water and hydrant services.

The following diagram illustrates the initial GL entries for the bill:

In accounting for the bill, the water fund's A/R is debited, the water and hydrant funds' revenue accounts are credited, and the water's taxes payable account is credited.

If left at this, the funds would be out of balance; the water fund would have an overall excess debit and the hydrant fund would have an equal excess credit. In organizational terms, the hydrant fund has recorded sales but that amount is recorded as being owed to the water department.

To balance each department, the water department accepts the responsibility for collecting the hydrant charges from the customer but immediately remunerates the charges to the hydrant fund.

This transfer is done using the general fund. The water fund's EPC account is credited and the liability to water is debited with the amount of the hydrant revenue. Also, the hydrant fund's EPC account is debited and the general fund's liability to hydrant account is credited by the hydrant revenue. In effect, the water department owes the hydrant charges to the general fund, and the general fund owes the hydrant charges to the hydrant fund.

The following diagram illustrates the initial GL accounting that would occur when the payment arrives:

When the payment arrives, the cash is debited to the general fund's cash account, and the water fund's A/R is relieved. Again, the funds would be unbalanced if left in this condition; the water fund would have an excess of credits and the general fund would have an excess of debits.

To maintain each fund's balance of debits and credits, the general fund's liability to the water fund is credited by the amount of the department's share of the cash, and the water fund's EPC is debited. Note that the payment has no effect on hydrant fund's EPC and the general fund's liability to the hydrant fund. The hydrant department "received" its money from the water department when the bill was created.

And so, all funds have matching debits and credits.